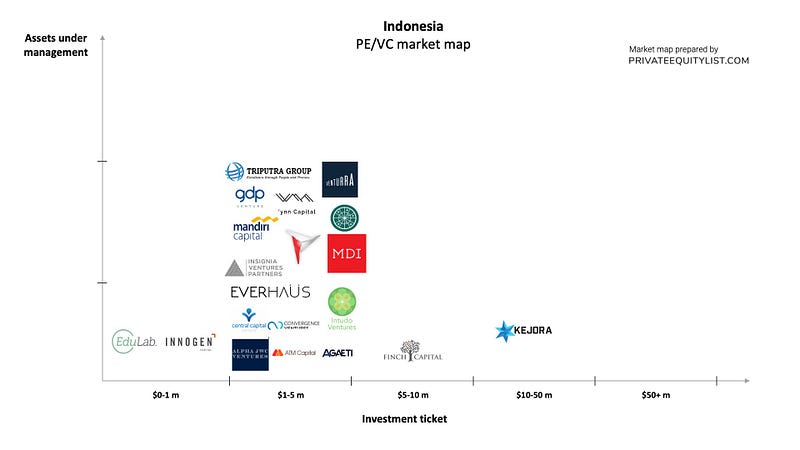

Indonesia private equity and venture capital (PE & VC) market map

We compiled an extensive Indonesia private equity (PE) and venture capital (VC) market map that shows key Indonesia investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Indonesia has the world’s fourth-largest population and rising middle-class makes it an important investment target. A more stable political environment and developing infrastructure and reduced restrictions on foreign direct investments also helped international private equity and venture capital investors access into the south Asian country. In terms of the numbers of fund managers and investors, Indonesia is behind its smaller neighbors Singapore and Malaysia. However, in terms of startups and entrepreneurs, Indonesia leads the entire region. Jakarta is the main hub for startups. Digital payment service OVO became the latest unicorn after ride-hailing app Go-jek, online booking platform Traveloka, e-commerce platforms Tokopedia and Bukalapak. Startup funding increased to $3 billion in 2018 from $44 million in 2012. Venture capitals mostly focus on Fintech, e-commerce, logistics, and agritech. East Ventures, GDP Ventures, Venturra Capital, Sinar Mars Digital Ventures are actively investing in Indonesian startups. Angin is the most important angel investor network in the country. There are several accelerators as well such as Digitaraya, Plug, and Play Accelerator, GnB Accelerator among others. CVC Capital Partners, KKR, Warburg Pincus, Sequoia Capital, and Hillhouse Capital Partners are among the most active private equity investors in the country. Government-backed Creative Economy Agency (Bekraf) acts as an incubator for startups and supports the creative economy ecosystem. Indonesia Investment Coordinating Board (BKPM) is a governmental body that coordinates and supports foreign investments.

The funds present on the market maps are:

- Agaeti Ventures

- Alpha JWC Ventures

- ATM Capital

- Central Capital Ventura

- Convergence Ventures

- EduLab Group

- Everhaus

- Finch Capital

- GDP Venture

- Inoogen Capital

- Insignia Venture Partners

- Intudo Ventures

- Kejora

- Mandiri Capital

- MDI Ventures

- Prasetia

- Skystar Capital

- Triputra Group

- Venturra Capital

- Vynn Capital

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Indonesia go to Indonesia PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team