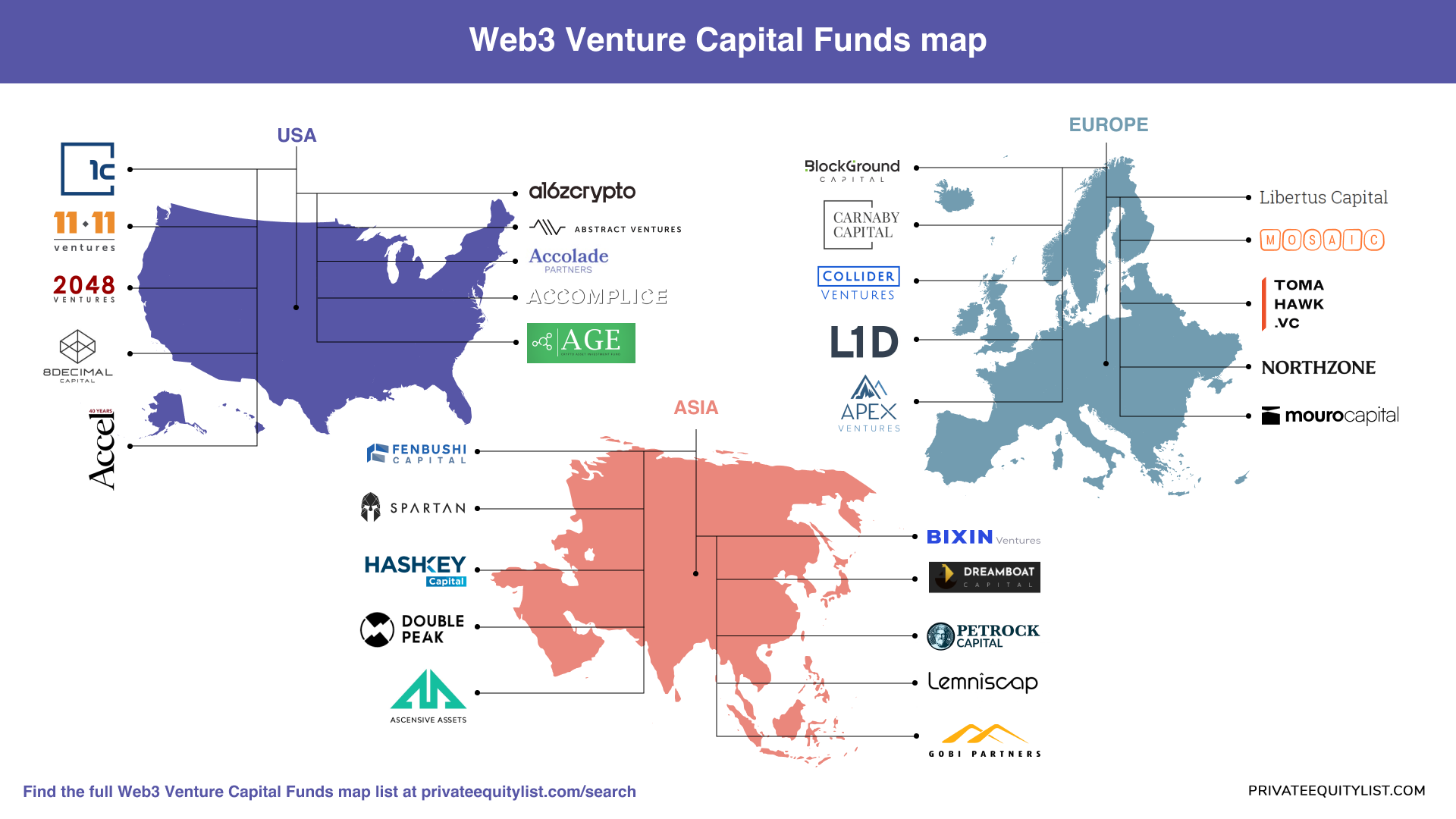

Web3 Venture Capital Funds in the US, Europe and Asia: Overview

The venture capital world has undergone a significant transformation in recent years, thanks to the rise of Web3 technologies. These technologies, which include blockchain, decentralized finance (DeFi), non-fungible tokens (NFTs), and more, are reshaping the way we think about finance, ownership, and digital assets. As a result, a new breed of venture capital funds has emerged, focusing on Web3 and its myriad opportunities. In this blog post, we will explore the landscape of Web3 venture capital funds in the United States, Asia and Europe including statistics, ticket sizes, and the list of such funds. We'll also provide insights on how startups can secure investments from these funds.

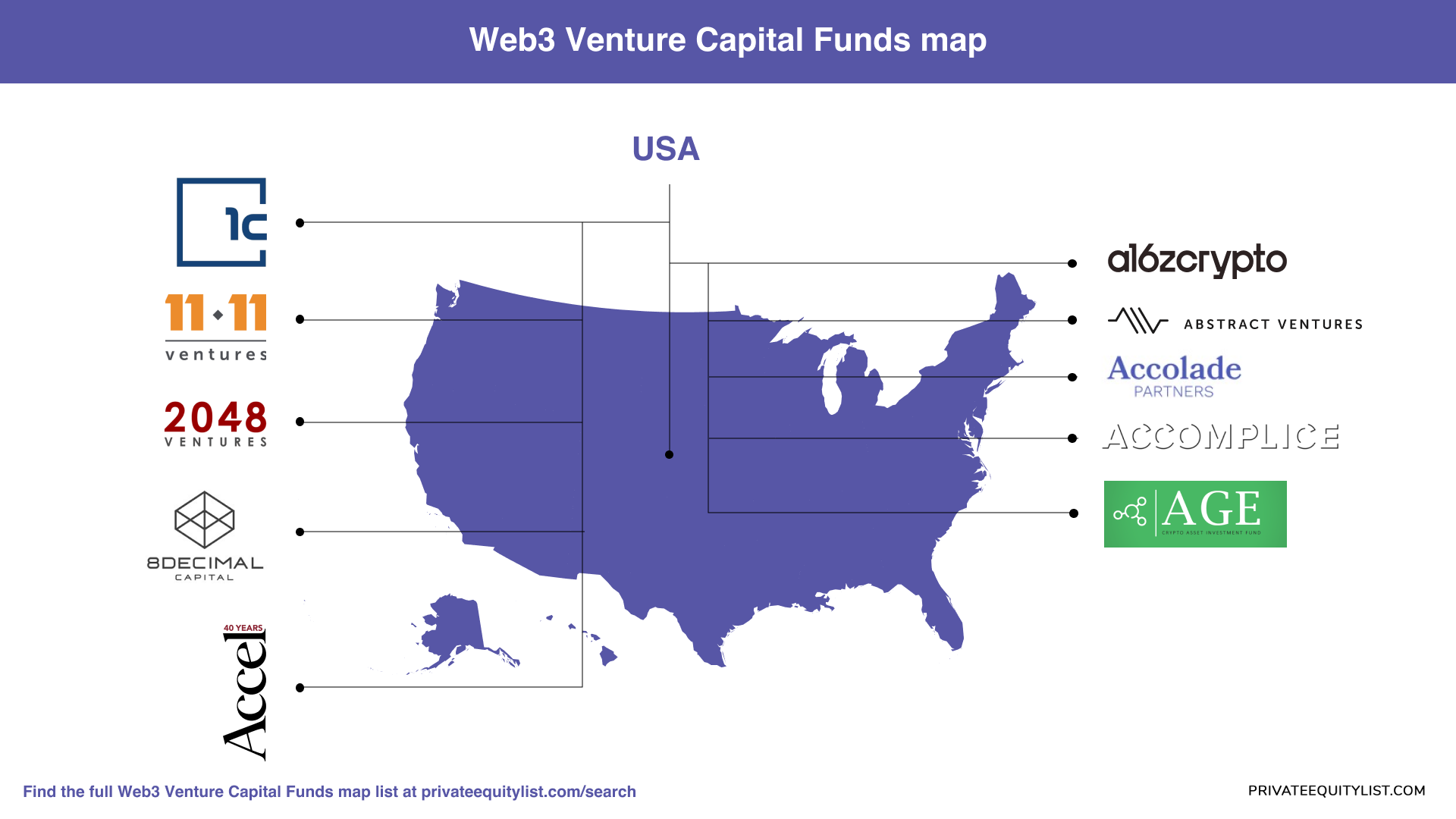

The Web3 Venture Capital Landscape in the United States

Web3 venture capital funds are on the rise, reflecting the growing interest in blockchain and decentralized technologies. According to recent data, there are over 100 active Web3-focused venture capital funds in the United States, with a total estimated capitalization of more than $5 billion. These funds vary in size, focus, and investment strategies, making it essential for startups to understand their options when seeking funding in the Web3 space.

The ticket sizes for Web3 venture capital funds can vary widely, depending on the fund's focus and stage of investment. According to Web3 Investment Trends Report 2022, early-stage rounds were:

- below $500,000 (86.7% of surveyed VCs answered so)

- 6.7% of deals were from $500,000 to $1,000,000

- 6.7% of deals were between $3,000,000 and $5,000,000

Top 5 Most Popular Web3 Venture Capital Funds in the United States

Now, let's take a closer look at the top 5 most popular Web3 venture capital funds in the United States, along with links to their websites for further exploration:

a16z, founded by Marc Andreessen and Ben Horowitz, is a prominent venture capital firm that has made significant investments in Web3 and blockchain projects. They have a strong track record of supporting startups in various Web3 sectors, including DeFi, NFTs, and blockchain infrastructure.

Blockchain Capital is a dedicated venture capital firm focused exclusively on blockchain and cryptocurrency projects. They are known for their deep expertise in the space and have invested in numerous successful Web3 startups.

Pantera Capital is a leading blockchain investment firm with a global presence. They have a strong portfolio of investments in Web3 startups, including those in the cryptocurrency, DeFi, and blockchain infrastructure sectors.

Paradigm is a venture capital firm founded by Fred Ehrsam (co-founder of Coinbase) and Matt Huang. They focus on investing in early-stage blockchain and cryptocurrency projects, providing strategic guidance along with capital.

Coinbase Ventures is the investment arm of Coinbase, one of the largest cryptocurrency exchanges in the world. They actively invest in innovative Web3 startups and provide them with access to resources within the Coinbase ecosystem.

You can find more web3 funds in the US here.

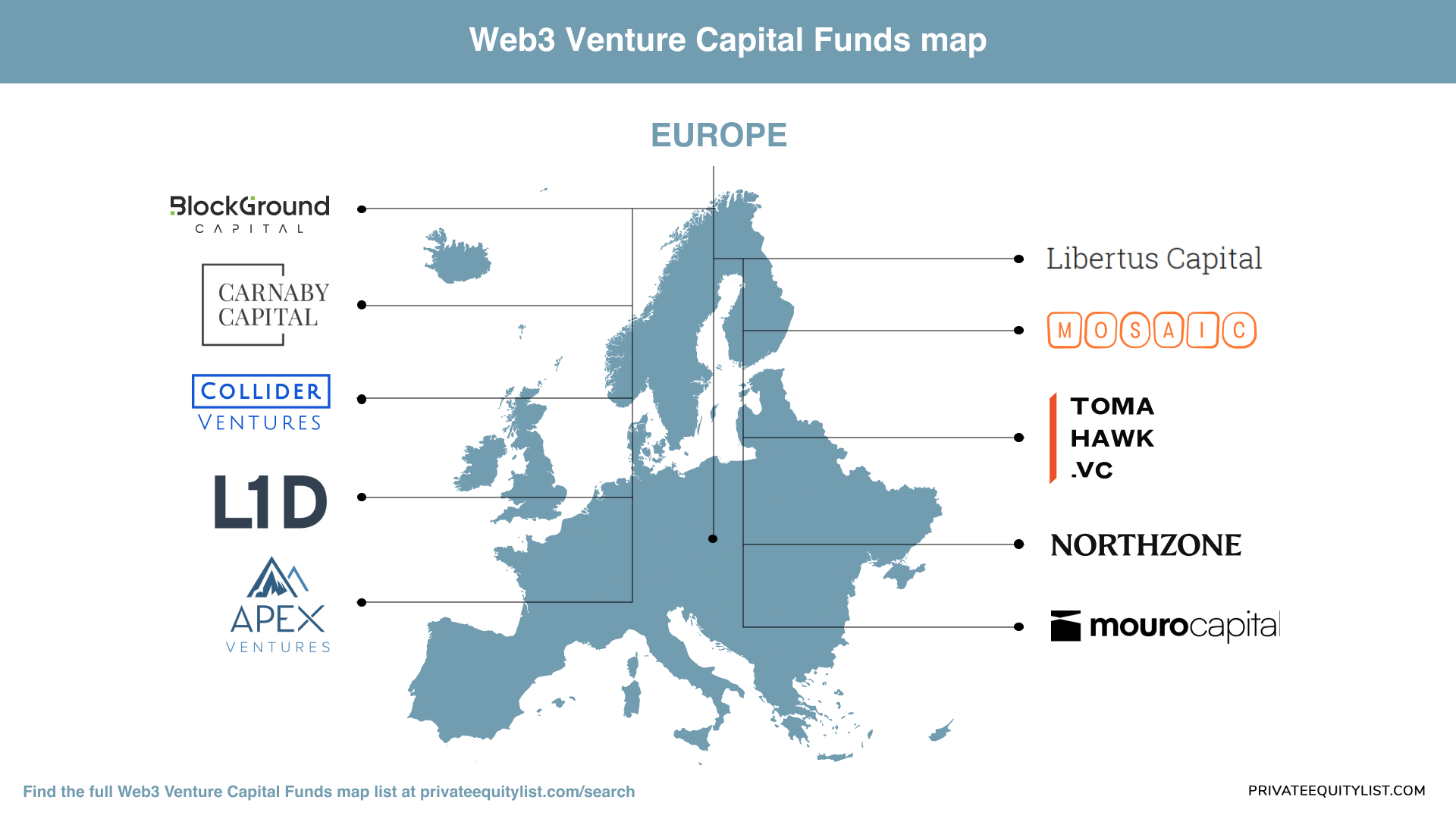

The Web3 Venture Capital Landscape in Europe

According to State of European Crypto Startups 2023, in 2022 European venture capital investment in cryptocurrency startups achieved a record-breaking milestone, surging to an unprecedented $5.7 billion. This notable achievement stands in stark contrast to the global and U.S. venture funding trends within the crypto space, which experienced a contraction in the previous year.

European companies played a pivotal role, contributing significantly to the global landscape by accounting for a substantial 20% of the total funding allocated to early-stage crypto startups worldwide. While Europe has established itself as a formidable player in the realm of early-stage company funding, it's worth noting that U.S. companies continued to assert their dominance in funding rounds that exceeded the $100 million mark, showcasing their stronghold on the larger investment landscape.

Top 5 Most Popular Web3 Venture Capital Funds in Europe

Fabric Ventures, based in London, specializes in Web3 investments. They actively support early-stage Web3 startups across Europe, providing both capital and strategic guidance.

Libertus Capital, based in the United Kingdom, invests in companies and protocols that enhance and protect freedom, privacy and trust.

Northzone is an early-stage venture capital firm backing the entrepreneurs building tomorrow's global companies.

Northzone is a technology investment partnership. With four offices, Northzone’s focus is on disruptive companies in attractive markets. Since its inception in 1996, Northzone has invested in over 130 companies, injecting some 200 years of collective operational and investment experience into businesses that truly make a difference.

Founded in 2018, Collider Ventures is a venture capital fund focused on digital assets and the digital economy. The firm actively invests in digital assets and early-stage startups to support the next generation of companies, protocols, and products that are building the digital native economy.

Carnaby Capital is a successful private investment and digital asset management organisation who provide expertise in helping clients make investments in emerging and existing blockchain and cryptocurrency opportunities.

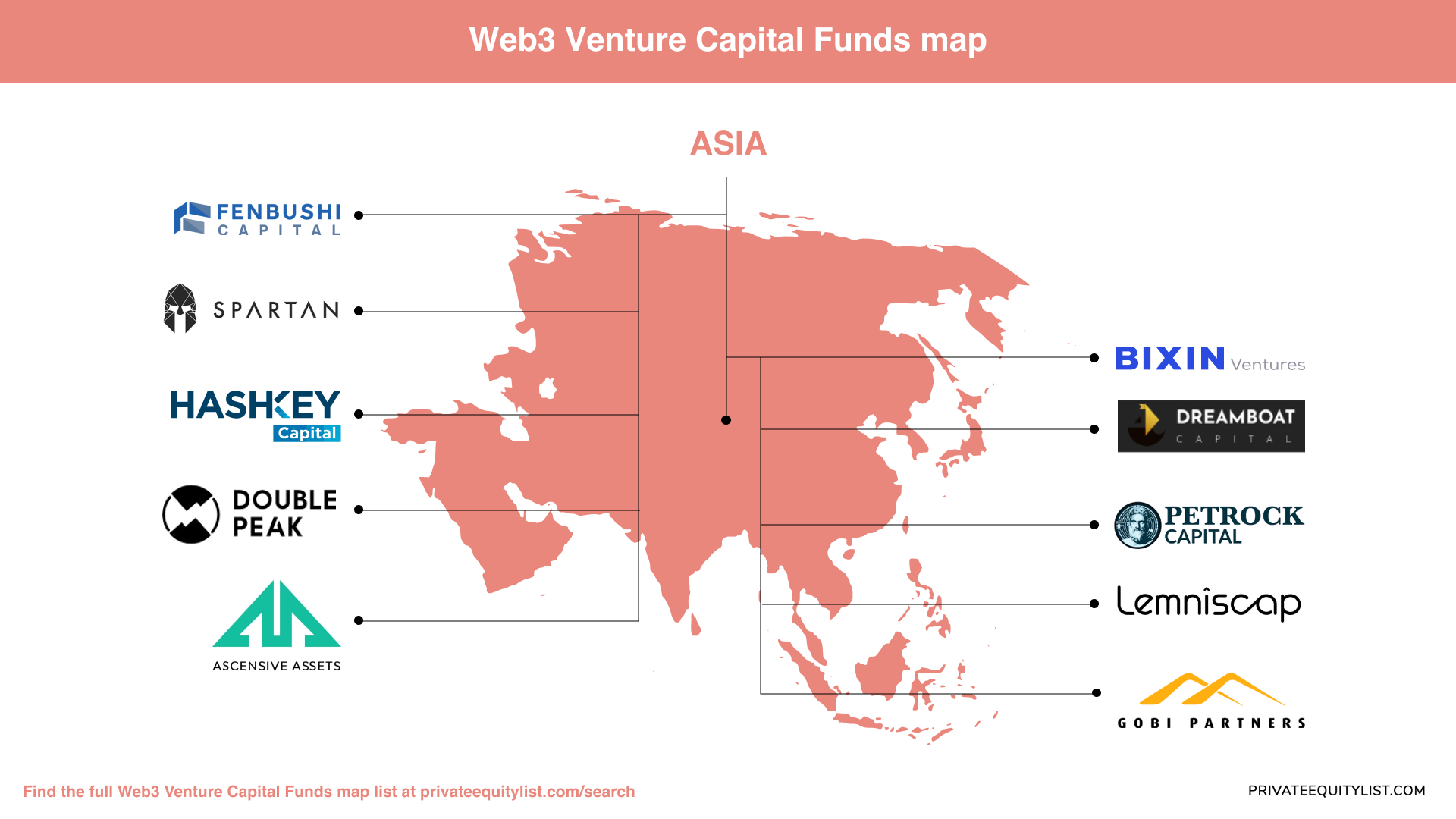

The Web3 Venture Capital Landscape in Asia

Asia has consistently been at the forefront of tech innovation, and its momentum continues to surge. According to recent reports, tech investment in the region soared to an astonishing $146 billion in the past year, encompassing China, India, and Southeast Asia. Of particular interest to investors has been the burgeoning landscape of seed-stage investments. Notably, Southeast Asia witnessed a remarkable 73% surge in seed-stage investments in the year 2022 alone.

This remarkable growth underscores Asia's pivotal role in shaping the global tech ecosystem, with substantial investments and a pronounced focus on nurturing early-stage ventures. The robust expansion of seed-stage funding, especially in Southeast Asia, reflects the region's increasing attractiveness to tech investors, fueling innovation and entrepreneurship across the continent.

Top 5 Most Popular Web3 Venture Capital Funds in Asia

HashKey Capital is a prominent blockchain-focused venture capital firm based in Asia. With a strong portfolio spanning blockchain infrastructure and DeFi, they actively invest in cutting-edge Web3 projects.

Fenbushi Capital is the first and most active blockchain-focused venture capital firm in Asia. Founded in Shanghai in 2015 by veterans across both blockchain and traditional financial industries, it has to date supported over 60 leading projects across 4 continents leveraging blockchain technology to reshape myriad industries such as finance, healthcare, supply chain, and consumer goods.

Bixin Ventures’ mission is to invest in and build crucial infrastructure that enables the future of open finance through permissionless and decentralized networks. Our investment team works alongside founders to provide guidance and expertise for growth in Asia. These actions reflect our priority to transform open finance into a truly global ecosystem.

Founded in 2017, Spartan Group is a leading player in the Web3 space. It’s one of the most active venture investors and have backed some of the leading crypto companies and networks.

PetRock Capital is a venture firm that invests in breakthrough blockchain technologies, ranging from ground-breaking Web 3.0 infrastructure to degenerately unorthodox concepts.

Securing Investments from Web3 Venture Capital Funds

For startups looking to secure investments from Web3 venture capital funds, here are some key steps to consider:

- Understand Your Niche: Identify the specific niche within the Web3 ecosystem that your startup operates in, whether it's DeFi, NFTs, blockchain infrastructure, or another area. Different funds may have different areas of focus.

- Build a Strong Team: Investors in the Web3 space often look for teams with deep expertise in blockchain and decentralized technologies. Ensure that your team has the necessary skills and experience to execute your vision.

- Develop a Compelling Product: Your product or service should address a real problem within the Web3 ecosystem and offer a unique value proposition. A well-defined and well-executed product is more likely to attract investment.

- Network and Attend Conferences: Building relationships in the Web3 community is crucial. Attend blockchain and Web3 conferences, participate in hackathons, and engage with potential investors to gain visibility.

- Prepare a Solid Pitch: Craft a compelling pitch that clearly communicates your startup's mission, vision, and potential impact in the Web3 space. Highlight your team's expertise and your product's unique features.

- Research and Target the Right Funds: Take the time to research Web3 venture capital funds and understand their investment criteria. Target funds that align with your startup's goals and values.

- Seek Warm Introductions: Whenever possible, try to secure introductions to investors through mutual connections or mentors. Warm introductions often carry more weight than cold outreach.

- Be Prepared for Due Diligence: Once you have investor interest, be prepared for a thorough due diligence process. Investors will want to examine your financials, technology, and legal aspects.

- Negotiate Terms Carefully: When you receive offers, review the terms carefully and consider seeking legal advice. Ensure that the terms align with your long-term goals.

- Execute and Deliver: After securing funding, focus on executing your business plan and delivering results. Build a strong relationship with your investors, providing them with regular updates on your progress.

Web3 funds you can contact to get investment

Find all funds from the map here.

In conclusion, the Web3 venture capital landscape in the US, Asia and Europe is teeming with opportunities for innovative startups. By understanding the unique dynamics of each region, building a strong case for your project, and effectively navigating the fundraising process, startups can position themselves for success in the dynamic and ever-evolving world of Web3 technologies.