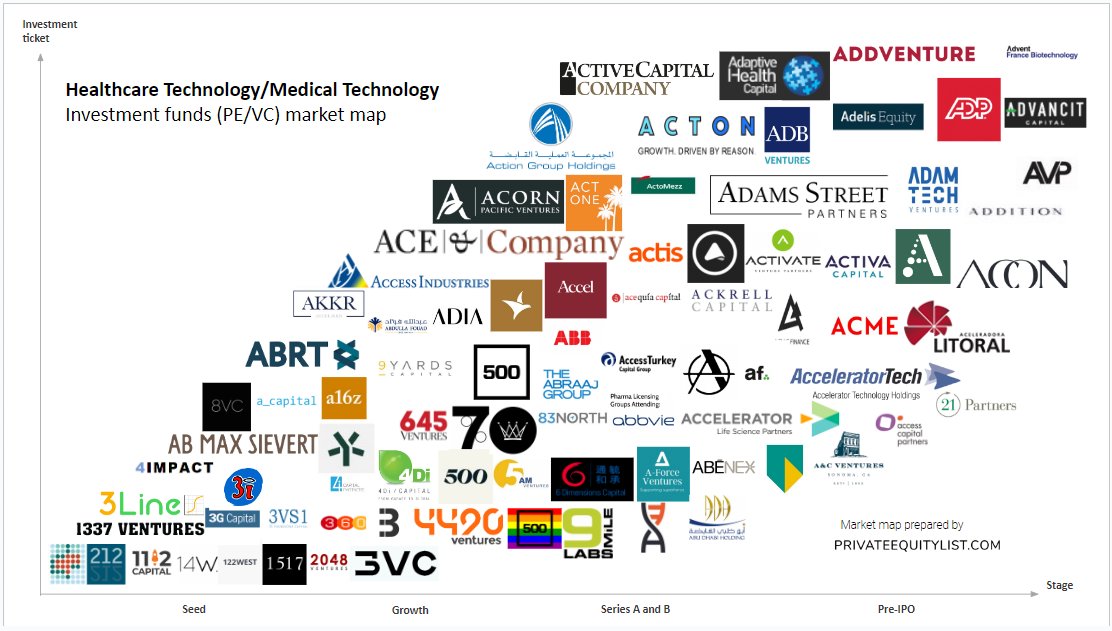

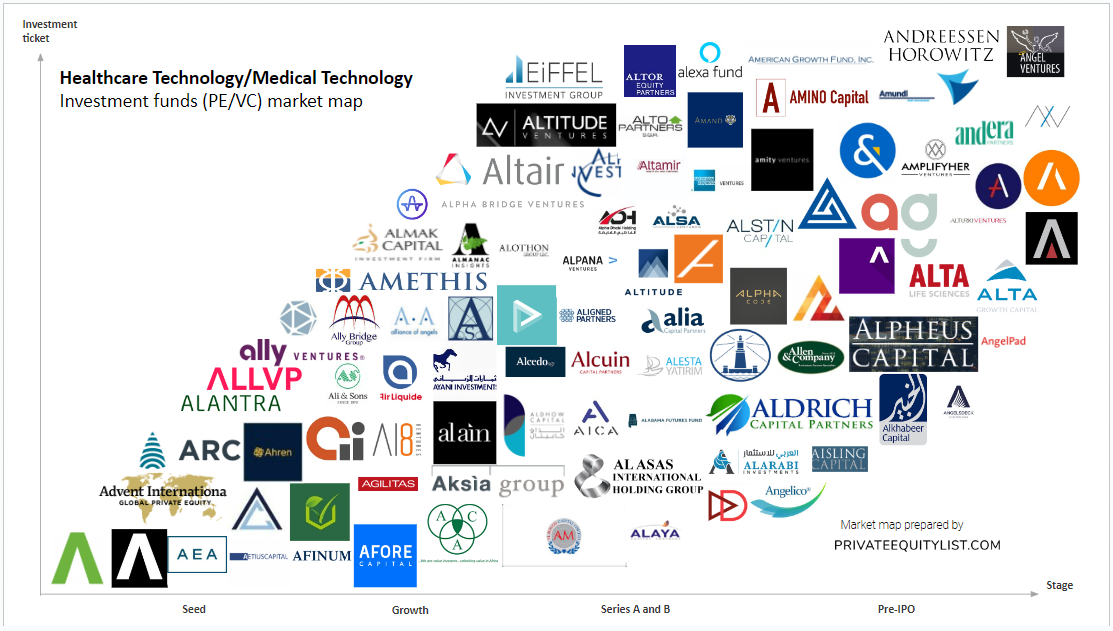

We compiled an extensive HealthTech/MedTech private equity (PE) and venture capital (VC) market map that shows key HealthTech/MedTech investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

HealthTech/MedTech market overview (market map is below it):

HealthTech and MedTech are two of the most exciting and rapidly growing sectors in the world of venture capital (VC) and private equity (PE) funds. With the rise of innovative technologies and increasing demand for healthcare solutions, there has been a surge in investment in these sectors across different regions. Let's take a closer look at some of the key HealthTech/MedTech market trends in each region.

North America:

- North America has the largest share of HealthTech/MedTech VC/PE funds, accounting for over 60% of the global market.

- The region has a strong focus on digital health, with startups leveraging technologies such as artificial intelligence (AI), telemedicine, and wearables to improve patient outcomes.

- Valuations for HealthTech/MedTech startups have been steadily increasing, with Series A funding rounds often exceeding $10 million.

- Accelerators and incubators are becoming increasingly popular in North America, offering startups access to resources, mentorship, and funding.

Europe:

- Europe has a growing HealthTech/MedTech market, with a particular focus on medical devices and diagnostics.

- The region is home to several notable HealthTech/MedTech accelerators, including Startupbootcamp and Healthbox.

- Valuations for HealthTech/MedTech startups in Europe tend to be lower than in North America, with Series A funding rounds averaging around $5 million.

- There is a growing interest in HealthTech/MedTech among traditional VC/PE funds, as they recognize the potential for significant returns in these sectors.

Asia:

- Asia is a rapidly growing market for HealthTech/MedTech, with a focus on digital health and medical devices.

- China is the largest market for HealthTech/MedTech in Asia, with a number of notable startups such as Ping An Good Doctor and WeDoctor.

- Valuations for HealthTech/MedTech startups in Asia vary widely, with some startups receiving significant funding at early stages.

- There is a growing interest in HealthTech/MedTech among Asian VC/PE funds, with several dedicated funds emerging in recent years.

In conclusion, HealthTech/MedTech is a rapidly growing sector with significant potential for investors. While North America remains the largest market, Europe and Asia are quickly catching up, with a focus on different sub-sectors and investment strategies. As valuations continue to rise and startups seek larger funding rounds, it will be interesting to see how the market evolves and which regions emerge as the dominant players.

The funds present on the market maps are:

- 406 Ventures

- 11.2 Capital

- 122-West-Ventures

- 1337 Ventures

- 14W Ventures

- 1517 Fund

- 2048 Ventures

- 21 Invest

- 212 Venture

- 24Haymarket

- 360 Capital Partners

- 3B Ventures

- 3g capital

- 3i Group

- 3Lines

- 3V SourceOne Capital

- 3vc

- 4490 Ventures

- 4Di Capital

- 4i Capital Partners

- 4impact

- 500 Istanbul

- 500 LGBT Syndicate

- 500 Mena

- 500 Startups

- 5AM Ventures

- 5Y Capital (Morningside Venture Capital)

- 6 Dimensions Capital

- 645 Ventures

- 7percent Ventures

- 83North

- 8VC

- 9 Mile Labs

- 9Yards Capital

- A Plus Finance

- A-Force Ventures

- A.Capital

- a16z

- AAF Management

- AB Max Sievert

- ABB Technology Ventures

- Abbvie Biotech Ventures

- Abdullah Fouad Holding

- Abénex

- Abingworth

- ABN AMRO Ventures

- Abraaj

- ABRT

- ABRY Partners

- ABS Capital Partners

- Abu Dhabi Holding

- Abu Dhabi Investment Authority (ADIA)

- Abu Dhabi Investment Office

- AC Ventures

- Accel

- Accel London

- Accel Partners

- Accel-KKR

- Accelerator Life Science Partners

- Accelerator Technology Holdings

- AccelFoods

- Access Capital Partners

- Access Industries

- AccessTurkey Capital Group

- Accomplice

- ACE and Company

- Aceleradora Litoral

- Acequia Capital

- Ackrell Capital

- ACME

- Acon

- ACON Investment

- Acorn Pacific Ventures

- ACrew Capital

- Act One Ventures

- ACT Venture Capital

- Action Group Holdings

- Action Hero Ventures

- Actis Capital

- Activa Capital

- Activate Venture Partners

- Active Capital

- Active Capital Company B.V.

- Active Venture Partners

- ActoMezz

- Acton Capital Partners

- Adage Capital

- Adams Street Partners LLC

- AdamTech Ventures

- Adaptive Health Capital

- ADB Ventures

- Addition VC

- AddVenture

- Adelis Equity Partners

- Adobe Capital

- ADP Invest

- Advance Venture Partners

- Advancit Capital

- Advent France Biotechnology

- Advent International Corporation

- Advent Life Sciences

- Advent Venture Partners

- AEA Investors

- Aetius Capital

- AFINUM Management GmbH

- Afore Capital

- African Capital Alliance

- African Rainbow Capital

- Agent Capital

- Agilitas Private Equity

- Aglae Ventures

- Agronomics

- Ahren Innovation Capital

- AI Capital

- AI Seed Fund

- AI8 Ventures

- AICA

- Air Liquide Venture Capital (ALIAD)

- Aisling Capital

- Aksìa Group SGR S.p.A.

- Al Ain Holding

- Al Dhow Capital

- Al Masah Capital Limited

- Al Zayani Investments

- Al-Asas International Holding Group

- Alabama Futures Fund

- Alantra Private Equity

- Alarabi Investemnts

- Alaya Capital Partners

- AlbionVC

- Alcedo SGR S.p.A.

- Alcuin Capital Partners

- Aldrich Capital Partners

- Alesta Yatirim

- Alexandria Real Estate Equities

- Alfvén and Didrikson AB

- Ali & Sons Holding LLC

- Alia Capital Partners

- Aligned Partners

- Alkhabeer Capital

- All Iron Ventures

- Allen & Company

- Alliance Entreprendre

- Alliance of Angels

- ALLVP

- Ally Bridge Group

- Ally Ventures

- Alma Mundi Fund

- Almak Capital

- Almanac Insights

- Alothon Group LLC

- Alpana Ventures

- Alpha Bridge Ventures

- Alpha Dhabi Holding

- Alpha Intelligence Capital Fund

- AlphaCode

- Alpheus Capital Limited

- AlpInvest Partners

- Alrai Capital

- Alsa Ventures

- Alstin Capital

- Alta Growth Capital

- Alta Life Sciences

- Altair

- Altamir

- Altergate

- Altitude Investment Management

- Altitude Partners LLP

- Altitude Ventures

- Alto Invest

- Alto Partners SGR S.p.A.

- Altor Equity Partners

- AlTouq Group

- Alturki Ventures

- Alumni Ventures Group

- Amand Ventures

- Amasia

- Amazon Alexa Fund

- Amereus

- American Express Ventures

- American Growth Fund

- American Securities

- Amethis Finance Luxembourg Sarl

- Amino Capital

- Amity Ventures

- aMoon Fund

- Ampersand Capital Partners

- Amplifyher Ventures

- Amplo

- Amundi Private Equity

- Ananda Impact Ventures

- Andera Partners

- Andreessen Horowitz

- Angel CoFund

- Angel Ventures Mexico

- AngelHub Ventures

- Angelico Ventures

- AngelPad

- Angels Deck Investor Club

For more information on HealthTech/MedTech investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC HealthTech/MedTech funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team