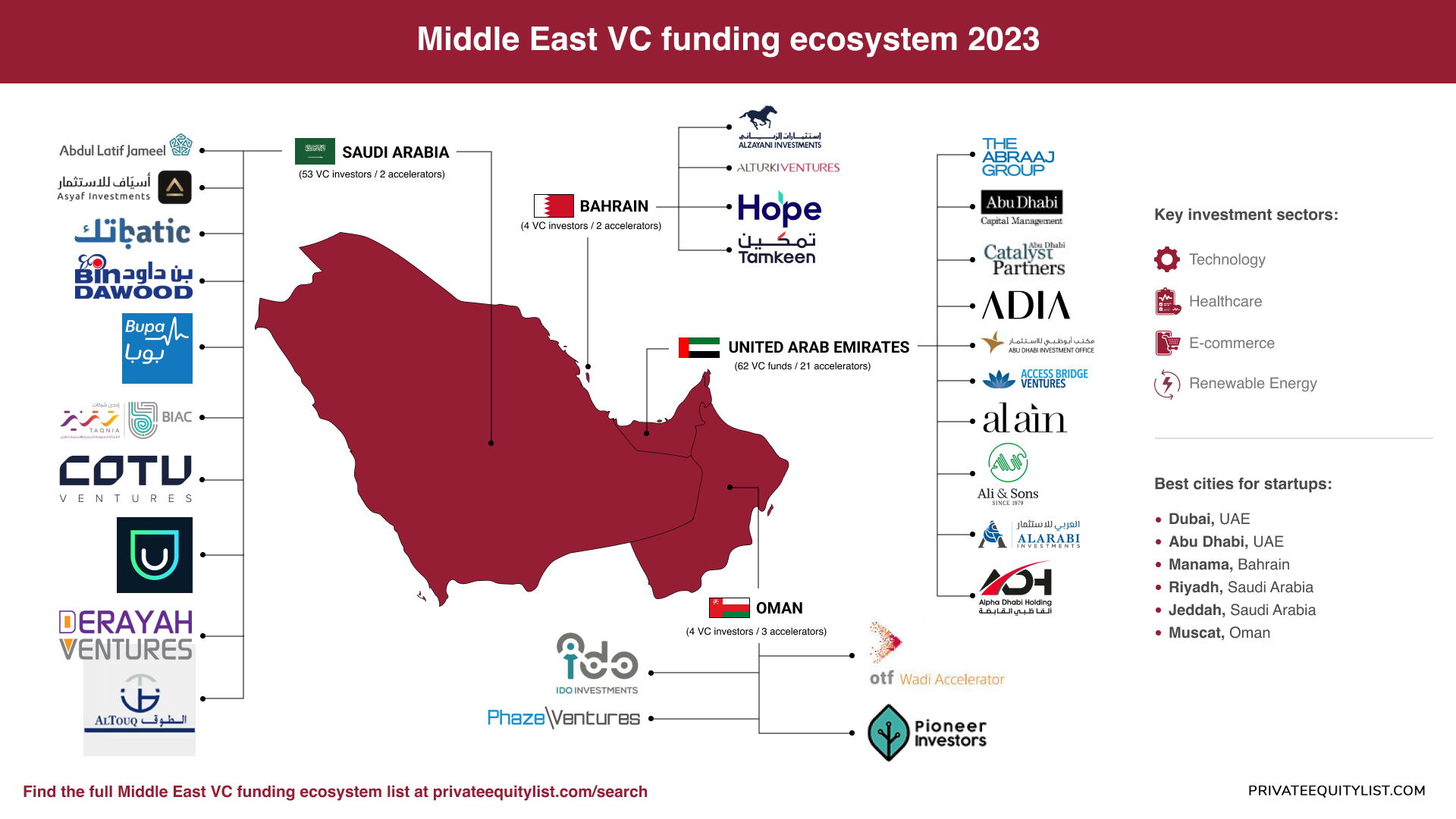

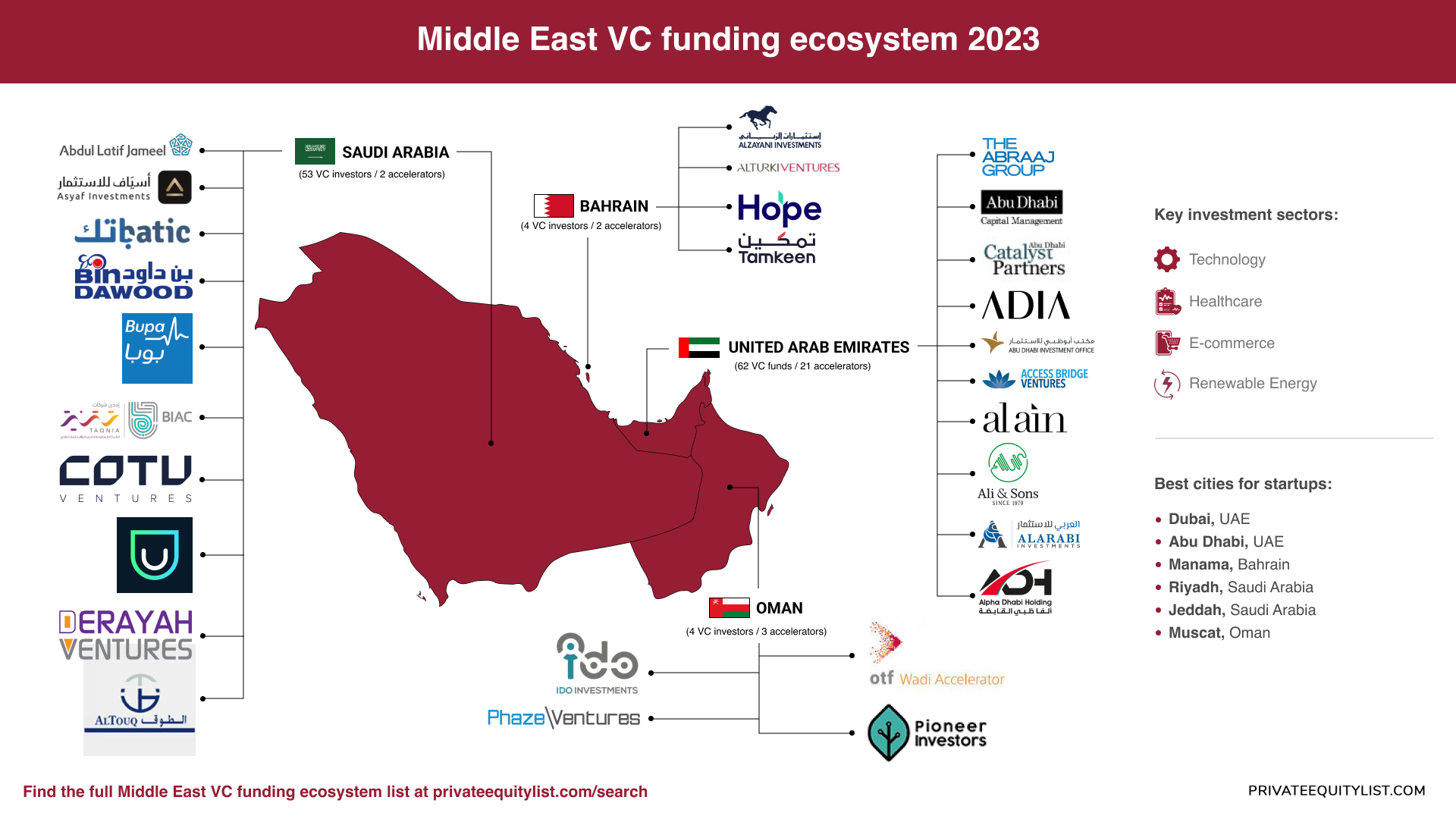

Unveiling the Middle East Venture Capital Landscape: A Deep Dive into UAE, Bahrain, Saudi Arabia, and Oman

In the dynamic landscape of the Middle East, the venture capital (VC) scene has experienced a remarkable surge in recent years. With a burgeoning entrepreneurial spirit and government initiatives supporting innovation, countries like the United Arab Emirates (UAE), Bahrain, Saudi Arabia, and Oman have become hotbeds for startups seeking funding and growth. In this comprehensive guide, we'll explore the funding statistics, average investment sizes, key sectors, and dive into each country's unique VC ecosystem.

Navigating the Middle East VC Ecosystem

According to Wamda, in March 2022, startups in the Middle East and North Africa (MENA) region secured $299 million through 79 deals. Although this marked a 22% decrease compared to the previous month, it reflected a significant 71% increase year-on-year. The cumulative funding for the first quarter of 2022 reached $934 million, demonstrating a notable 38% surge compared to the corresponding period in the previous year.

The distribution of deal value in March was prominently led by the UAE, Saudi Arabia, and Egypt, collectively contributing to 93% of the total amount raised during the month.

Key Investment Sectors

- Technology: With a focus on digitization, AI, and blockchain, the technology sector attracts a substantial portion of VC investments.

- Healthcare: Innovative solutions in healthcare and biotechnology have garnered significant interest from investors looking to support advancements in the region's healthcare ecosystem.

- E-commerce: The booming e-commerce sector, fueled by a tech-savvy population, has become a magnet for VC funds.

- Renewable Energy: In line with global sustainability trends, VC investments in renewable energy startups are on the rise.

Now let’s look at each country individually.

🇦🇪United Arab Emirates (62 VC funds / 21 accelerators)

- Abraaj

- Abu Dhabi Capital Management

- Abu Dhabi Catalyst Partners

- Abu Dhabi Investment Authority (ADIA)

- Abu Dhabi Investment Office

- Access Bridge Ventures

- Al Ain Holding

- Alarabi Investemnts

- Ali & Sons Holding LLC

- Alpha Dhabi Holding

Find the full list here. Local accelerators are INVESTORS YACHT EVENT IN DUBAI, UAE GLOBAL ONLINE WEB3 COMPETITION and Thursday Pitches.

Best Cities for Startups

- Dubai: A global business hub, Dubai offers a thriving ecosystem, attracting startups with its strategic location, government support, and diverse talent pool.

- Abu Dhabi: The capital city, Abu Dhabi, provides a conducive environment for startups, supported by initiatives like Hub71 and strategic partnerships.

🇧🇭Bahrain (4 VC investors / 2 accelerators)

Learn more about them via the link. Local accelerators are Tenmou and Al Jebra Foundation.

Best Cities for Startups

- Manama: The capital city, Manama, serves as a vibrant hub for startups, offering a supportive regulatory environment and a strategic location for regional expansion.

🇸🇦Saudi Arabia (53 VC investors / 2 accelerators)

- Abdul Latif Jameel Fintech Fund

- AlTouq Group

- Asyaf Investment

- Batic Investment

- BinDawood Holdings

- Bupa Arabian Ventures

- Business Incubators and Accelerators Company (BIAC)

- Cotu Ventures

- Daal

- Derayah VC

Find the full list here. Local accelerators are KAUST and WMV - VC Program.

Best Cities for Startups

- Riyadh: The capital city, Riyadh, stands as a key player in the Middle East's startup ecosystem, boasting a thriving community, government support, and strategic partnerships.

- Jeddah: Known for its strategic location and entrepreneurial spirit, Jeddah provides a dynamic environment for startups to flourish.

🇴🇲Oman (4 VC investors / 3 accelerators)

Learn more about these funds here. Local accelerators are otf Wadi Accelerator Cohort IV, OTF Techween Open Application and Global Zakat Platform.

Best Cities for Startups:

- Muscat: As the capital and economic center, Muscat offers startups a strategic location, government support, and a growing network of investors and mentors.

Key Trends Shaping the Middle East VC Landscape

- Increased Government Support: Governments across the Middle East are actively supporting entrepreneurship through initiatives, grants, and regulatory frameworks.

- Rise of Sustainability-Focused Startups: With a global shift towards sustainability, VC investments in renewable energy and eco-friendly solutions are gaining momentum.

- Tech-driven Innovation: The region is witnessing a surge in tech-driven startups, leveraging AI, blockchain, and IoT to address local and global challenges.

- Cross-border Collaborations: Startups in the Middle East are increasingly engaging in cross-border collaborations, expanding their reach and accessing diverse markets.

- Diversity and Inclusion: There is a growing emphasis on fostering diversity and inclusion within the startup ecosystem, with initiatives promoting gender equality and representation.

As the Middle East continues to emerge as a dynamic hub for startups and venture capital, the landscape is evolving at a rapid pace. With supportive ecosystems, diverse investment opportunities, and a commitment to innovation, the UAE, Bahrain, Saudi Arabia, and Oman are positioning themselves as key players in the global startup scene. As the journey unfolds, the region is set to witness even more groundbreaking developments, making it an exciting time for entrepreneurs, investors, and enthusiasts alike.