Unveiling the European Impact VC Funds Ecosystem: A Comprehensive Overview

In recent years, the global investment landscape has witnessed a notable shift towards impact investing. Investors are no longer solely focused on financial returns; they are increasingly looking to make a positive difference in the world. This shift has given rise to Impact Venture Capital (VC) Funds, a subset of venture capital firms that focus on backing startups dedicated to addressing social, environmental, and ethical challenges.

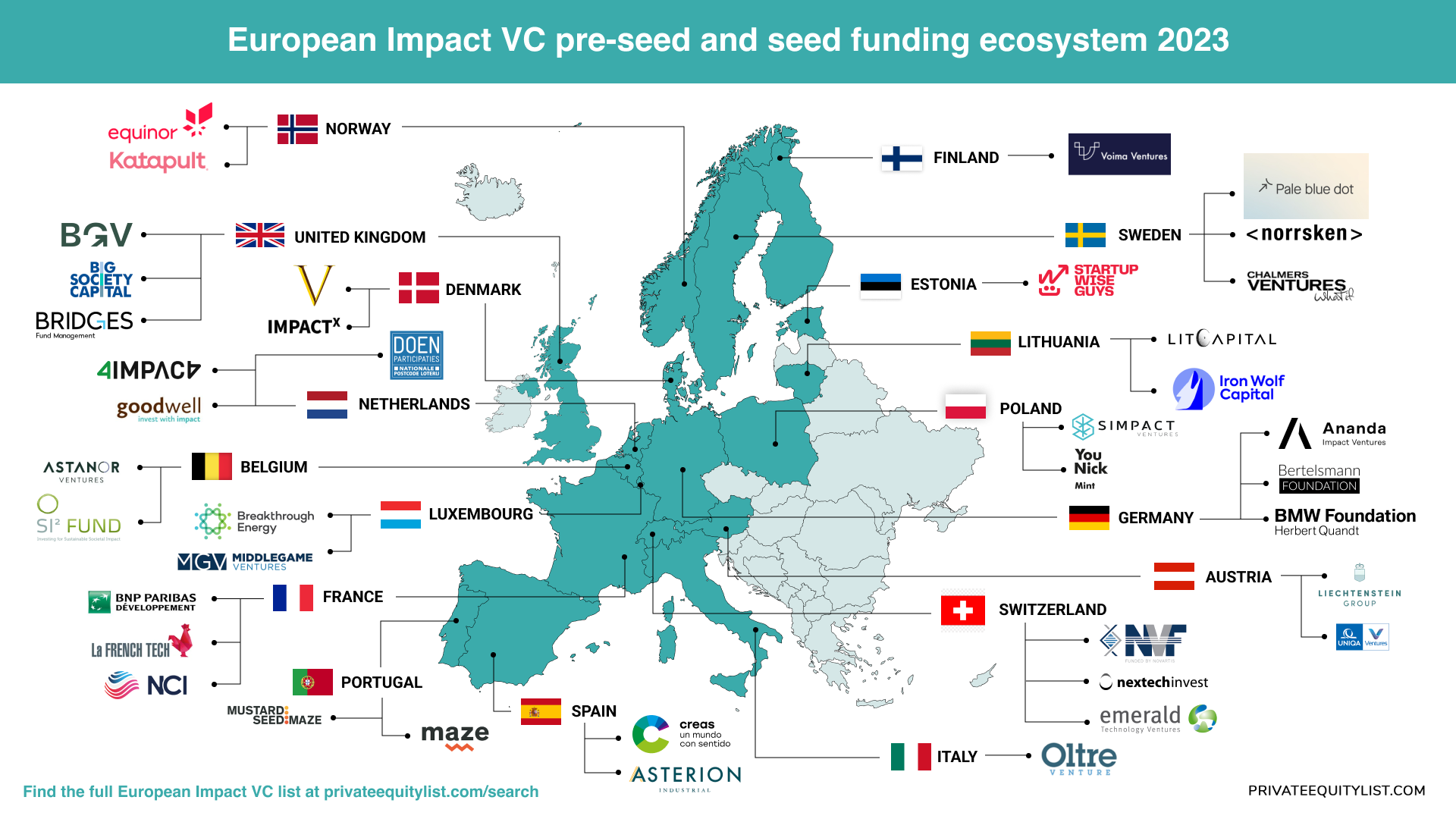

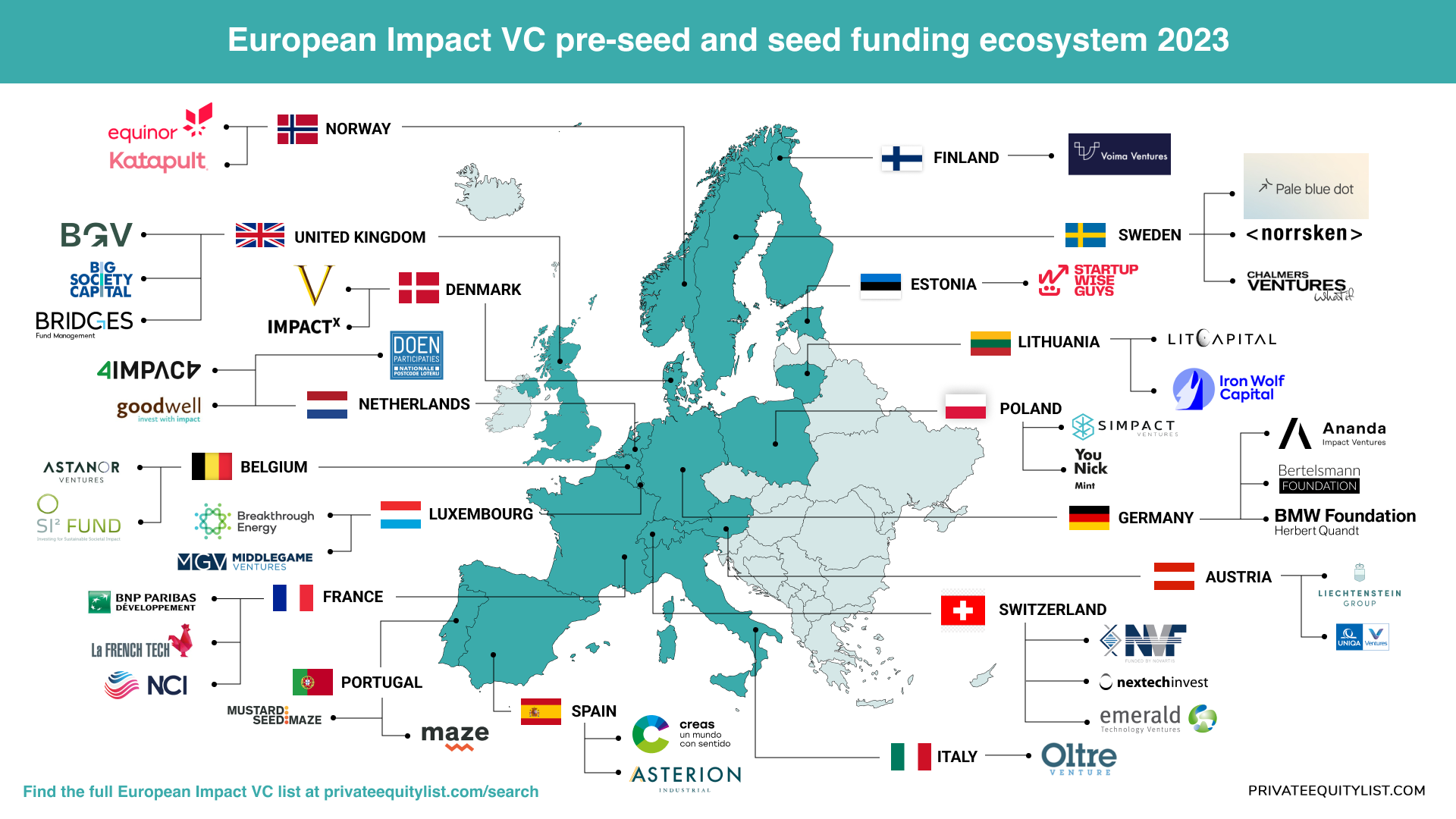

In this extensive blog post, we will dive deep into the European Impact VC Funds ecosystem. We will begin by defining what impact investing means, explore the sectors in which these VC funds are actively involved, discuss the types of startups that seek investments from these firms, and provide insightful statistics on the number of deals impact investors have in various European countries. We’ve analysed 18 European countries, and there are about 100 funds there.

Understanding Impact Investing

Impact investing can be defined as the practice of making investments in companies, organizations, and funds with the intention of generating measurable social or environmental impact alongside a financial return. It's about aligning capital with values, striving to address critical issues, and creating positive change in the world. Impact investors consider both the financial performance of their investments and their contributions to a better society or planet.

Impact VC Sectors in Europe

Impact VC Funds in Europe are active in a wide range of sectors, with the goal of supporting startups that tackle pressing societal and environmental challenges. Some of the prominent sectors in which these funds operate include:

- Clean Energy and Sustainability: Many European impact VC funds focus on clean energy solutions, sustainable agriculture, and waste reduction technologies. These investments aim to combat climate change and promote resource efficiency.

- Healthcare and Life Sciences: Impact investors in Europe are also heavily involved in healthcare startups, especially those addressing issues like access to healthcare, medical technology innovations, and affordable healthcare solutions.

- Education and EdTech: Startups dedicated to improving educational access, quality, and technology-driven innovations are often backed by impact VC funds.

- Social Enterprises: Social enterprises that have a clear mission to drive social change while generating revenue are a prime target for impact investors.

- Financial Inclusion: Supporting startups that provide access to financial services for underserved populations, such as microfinance institutions and fintech companies, is another key area for impact funds.

Startups in Search of Impact Investments

Startups seeking investments from European Impact VC Funds should demonstrate a strong commitment to social or environmental impact. Here are some characteristics that make startups appealing to impact investors:

a. Clear Mission and Impact Focus: Impact startups should have a well-defined mission and a clear strategy for achieving positive outcomes. The impact should be central to the company's mission, not just an add-on.

b. Scalability: Impact investors typically seek startups with the potential for significant growth and scalability, as this allows for a broader and more substantial impact.

c. Innovative Solutions: Startups offering innovative solutions to critical issues are attractive to impact investors. They should have a unique value proposition that differentiates them from competitors.

d. Track Record and Evidence: Having a track record of impact and evidence of effectiveness in addressing social or environmental challenges can significantly enhance a startup's appeal to impact investors.

Impact VC funds in Europe

Below you can see a list of impact VC funds in several European countries.

🇦🇹Austria

🇧🇪Belgium

🇩🇰Denmark

🇪🇪Estonia

🇫🇮Finland

🇫🇷France

🇩🇪Germany

🇮🇹Italy

🇱🇹Lithuania

🇱🇺Luxembourg

🇳🇱Netherlands

🇳🇴Norway

🇵🇱Poland

🇵🇹Portugal

🇪🇸Spain

🇸🇪Sweden

🇨🇭Switzerland

🇬🇧United Kingdom

Find the full list here.

The European Impact VC Funds ecosystem is thriving, with investors and startups alike recognizing the importance of addressing social and environmental challenges. Impact investing is no longer a niche practice but a significant force for positive change in Europe and beyond.

As we move forward, it's crucial to keep an eye on evolving trends and emerging impact sectors. The statistics provided here offer a snapshot of the impact investing landscape in various European countries, but the field continues to evolve rapidly. Startups with a clear mission and innovative solutions will find a wealth of opportunities within this dynamic ecosystem, as they partner with impact VC funds to create a better future for all.