Unlocking the Dragon's Den: A Deep Dive into VC Investors in China and Hong Kong

Venture capital (VC) investment is a driving force behind the entrepreneurial ecosystems in China and Hong Kong. As these regions continue to flourish, it's crucial for startup founders and investors to understand the funding landscape, key players, and emerging trends. In this comprehensive guide, we'll explore the current state of VC investments in both China and Hong Kong. We'll start with the funding statistics, average investment size for pre-seed and seed rounds, and key investment sectors. Then, we'll delve into each region, showcasing local pre-seed and seed VC funds, the number of VC funds, key accelerators, and the count of accelerators. Finally, we'll highlight the best cities for startups in each country and discuss the most prominent trends in the VC landscape.

Funding Statistics

As PitchBook says, venture capital firms in China invested $26.7 billion in 3,072 deals in the first half of 2023.

According to Statista, Total Capital Raised in the Venture Capital market is projected to reach US$3.0bn in 2023. Early Stage dominates the market with a projected market volume of US$1.6bn in 2023.

Chinese investors usually have from $200,000 to $2,000,000 ticket sizes in pre-seed and seed stages. In Hong Kong, the same rounds state from $100,000 to $1,500,000.

Key Investment Sectors

China and Hong Kong show interest in financial and tech sectors.

- China:

- Artificial Intelligence (AI)

- E-commerce and Retail Tech

- Healthcare and Biotech

- Fintech

- Edtech

- Hong Kong:

- Fintech

- Proptech

- Healthtech

- E-commerce and Retail Tech

- AI and Machine Learning

Let’s now look at each country's investment players.

China (39 VC investors / 8 accelerators)

- 5Y Capital (Morningside Venture Capital)

- 6 Dimensions Capital

- AMP Capital Investors Limited

- AngelVest

- ANMI OECD

- Binance Labs

- Bixin Capital

- Bixin Ventures

- Blockchain Founders Fund

- Blockox Fund

Find the full list of funds here. Local accelerators are Tuspark Jiangsu China, IMPACT CHINA 2019 and Z-Innoway.

Best Cities for Startups in China

- Beijing: China's capital is a startup hub, with a thriving tech scene, top universities, and numerous investment opportunities.

- Shanghai: A global financial center with a rapidly growing tech ecosystem.

- Shenzhen: Known as China's Silicon Valley, it's home to numerous tech giants and startups.

- Hangzhou: Alibaba's hometown, a hotspot for e-commerce and tech innovation.

- Guangzhou: A rising startup destination, with a focus on AI, biotech, and fintech.

Key Trends in China's VC Landscape

- Cross-border investments are growing, strengthening China's ties with global markets.

- The government's support for emerging technologies like AI and biotech is driving innovation.

- Corporate venture capital is becoming more prevalent, as established companies seek strategic investments.

- Sustainability and green tech are gaining momentum as investors focus on ESG (Environmental, Social, and Governance) initiatives.

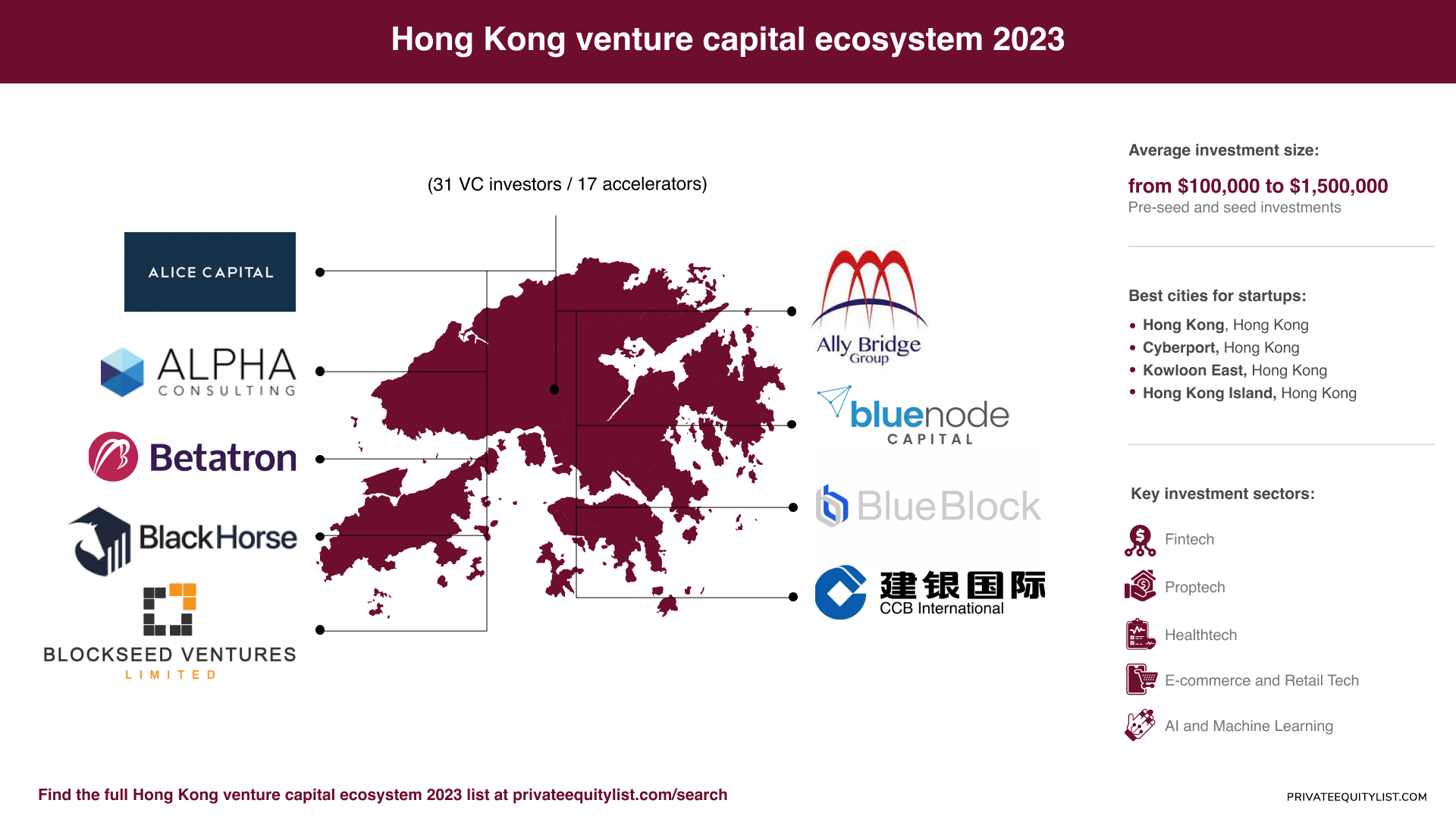

Hong Kong (31 VC investors / 17 accelerators)

- Alice Capital

- All in One Coin

- Ally Bridge Group

- Alpha Blockchain

- Betatron

- BlackHorse Group

- BlockSeed Ventures

- Blue Node Capital

- BlueBlock

- CCB International

Use the link to take a look at the full list. Such accelerators as Brinc Health Innovation Spring 2024, Venturetec Accelerator and Pre-Accelerator Course are working here.

Best Cities for Startups in Hong Kong

- Hong Kong: The bustling financial hub is also a growing tech and startup center.

- Cyberport: A dedicated tech park fostering innovation in fintech, AI, and more.

- Kowloon East: An emerging tech district attracting startups and entrepreneurs.

- Hong Kong Island: A hub for fintech and professional services startups.

Key Trends in Hong Kong's VC Landscape

- Fintech remains a focal point for investments in Hong Kong, driven by the region's status as a global financial hub.

- Greater emphasis on sustainability and green initiatives, in line with global ESG trends.

- Collaboration with mainland China and international investors is on the rise, expanding Hong Kong's reach.

- The government's initiatives like the Greater Bay Area development plan are boosting innovation and entrepreneurship in the region.

The VC landscape in both China and Hong Kong is vibrant, with robust funding statistics and a multitude of investment sectors. While China boasts a massive number of VC funds and accelerators, Hong Kong offers its own unique advantages, including a growing fintech ecosystem and strong government support.

Entrepreneurs and investors should carefully consider their options, from key VC funds and accelerators to the best cities for startups in each region. As trends continue to evolve, staying up-to-date with the latest developments in China and Hong Kong's VC ecosystems is essential for those looking to embark on their entrepreneurial journey in these dynamic markets.

By understanding the distinct characteristics of each region, you can make informed decisions and leverage the abundant opportunities for growth and innovation in this ever-evolving landscape.