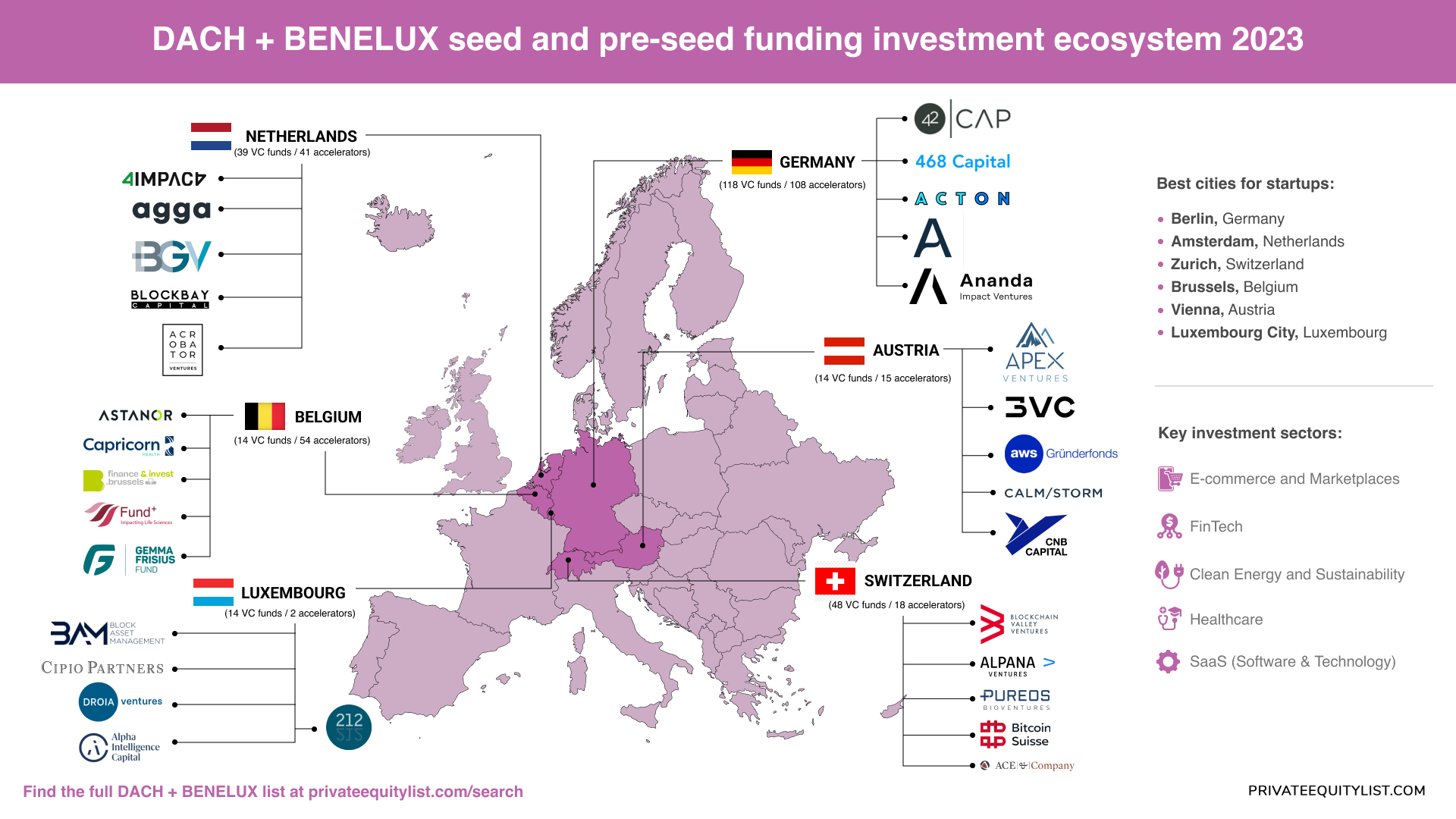

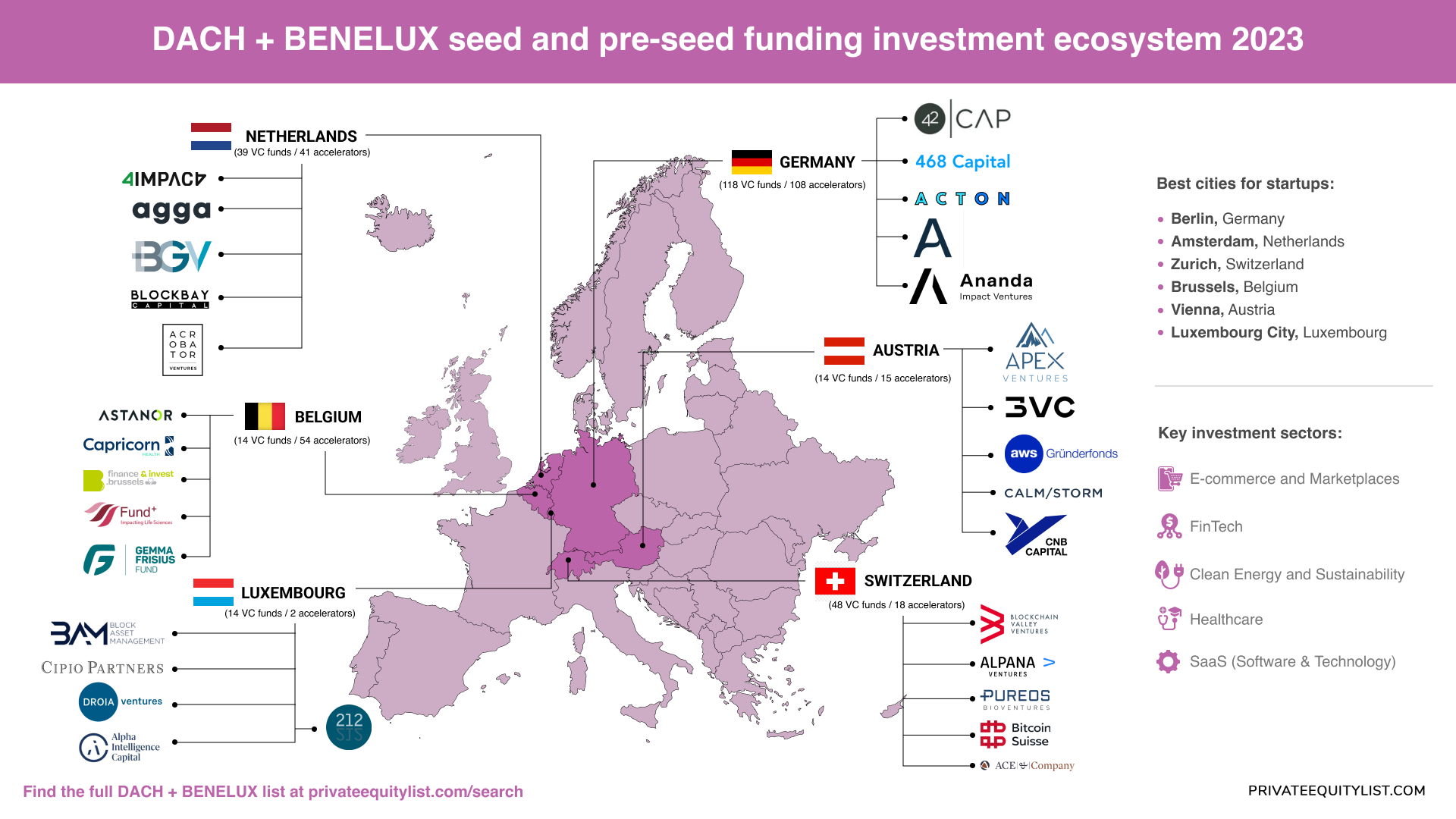

Unlocking Pre-Seed and Seed Funding Potential: A Deep Dive into DACH + BENELUX 🚀

When it comes to nurturing startups, the DACH (Germany, Austria, Switzerland) and BENELUX (Belgium, Netherlands, Luxembourg) regions have been making waves in the European startup ecosystem. With their robust economies, innovative ecosystems, and access to capital, these countries have become hotbeds for entrepreneurial talent. In this blog post, we'll dive deep into the world of pre-seed and seed funding in these regions, providing you with key insights and a breakdown of each country's landscape.

Key Investment Sectors

While the startup ecosystem is diverse, some key sectors consistently attract investment:

- Fintech: With the rise of digital banking and payment solutions, fintech startups have been receiving substantial funding.

- HealthTech: The healthcare and biotechnology sectors have seen significant investment due to the growing demand for innovative solutions.

- SaaS (Software as a Service): Software startups, especially those offering B2B solutions, have been thriving in the region.

- E-commerce and Marketplaces: The e-commerce boom has led to increased investments in online retail and marketplace platforms.

- Clean Energy and Sustainability: As sustainability gains importance, startups focused on clean energy and sustainable technologies are attracting attention.

Now, let's take a closer look at each country in the DACH and BENELUX regions.

🇦🇹Austria (14 VC funds / 15 accelerators):

Look for more VC funds in Austria via the link.

There are about 15 accelerators in Austria including Female Founders Global, Salzburg AG and VERBUND AG.

🇩🇪Germany (118 VC funds / 108 accelerators)

Germany has about 118 venture capital funds investing on pre-seed and seed stages, here are some of them:

Find more here.

108 accelerators are working in Germany, some of them are BFG Adrenaline, Avant Now Accelerator - Cohort 2 and Connected Germany.

🇧🇪Belgium (14 VC funds / 54 accelerators)

More VC funds in Belgium are available via the link. You can also contact one of 54 accelerators in Belgium, some of them are XR2Learn - Open Call 1, biotope I Basecamp and NGI Enrichers - Challenges #2

🇳🇱Netherlands (39 VC funds / 41 accelerators)

To find more funds in the Netherlands, follow the link. There are 41 accelerators in this region, for example, SBC Inclusive Fintech & DeFi 2024, StartLife Wageningen and Provincie Zuid-Holland.

🇱🇺Luxembourg (14 VC funds / 2 accelerators)

- 212 Venture

- Alpha Intelligence Capital Fund

- Block Asset Management

- Cipio Partners

- Droia Oncology Ventures

More VC funds in Luxembourg are here. Pitch Deck and Founder Institute Luxembourg are accelerators working in the region.

🇨🇭Switzerland (48 VC funds / 18 accelerators)

Find more VC investors in Switzerland via the link. Such accelerators as MIRAHI 3.0, Tenity and SBB Startup are open for you here.

The best cities for startups

Berlin, Germany. Berlin shines as a startup haven in Germany and Europe due to its diverse industries, especially in fintech, SaaS, and e-commerce. Its universities attract global talent, offering a skilled workforce, while its affordable living costs make it ideal for startups. The city's vibrant ecosystem, co-working spaces, and accelerators like Techstars Berlin foster collaboration and innovation, solidifying its position as a top startup city.

Amsterdam, Netherlands. Amsterdam's rapid rise as a startup hub is attributed to its global connectivity and strategic location for European markets. Its tech scene is booming, particularly in fintech, AI, and creative industries. Initiatives like StartupAmsterdam offer essential resources, mentorship, and access to capital. Amsterdam's high quality of life, international atmosphere, and English-speaking population make it an appealing place to live and work, making it one of the region's best startup cities.

Zurich, Switzerland. Zurich, a global financial hub, attracts fintech startups seeking proximity to investors. Switzerland's political stability and strong legal framework provide a safe environment. Zurich is a research hub for biotech and AI, while its high standard of living is a draw for talent. These factors establish Zurich as a top city for startups.

Brussels, Belgium. Brussels offers unmatched access to EU institutions and markets, making it attractive for navigating Europe's complexities. Its diverse startup scene covers sectors from biotech to fashion tech. Government support via Startup.be and LeanSquare aids early-stage startups. Brussels' multilingual population and international outlook facilitate cross-border scaling.

Vienna, Austria. Vienna's exceptional quality of life is complemented by government grants and incentives for startups. Emphasis on research and development benefits biotech, AI, and clean energy startups. Vienna's central European location offers access to multiple markets, solidifying its position as a top startup city.

Luxembourg City, Luxembourg. Luxembourg City is a global financial player, attracting fintech and investment management startups. Favourable regulations support financial services startups. The city's multilingual and skilled workforce ensures access to talent. Its central European location provides a launchpad for EU market access, making it a top startup city in the region.

Key Trends

As we look ahead, several key trends are shaping the pre-seed and seed funding landscape in DACH and BENELUX:

- Evolving Ecosystems: These regions continue to foster vibrant startup ecosystems, attracting talent and capital from around the world.

- Sustainability Focus: Startups addressing environmental and sustainability challenges are gaining traction, driven by increasing awareness and investor interest.

- Corporate Engagement: Corporates are actively engaging with startups through accelerators and corporate venture arms, providing startups with resources and market access.

- Cross-Border Collaboration: Startups are increasingly expanding across borders within the DACH and BENELUX regions, creating opportunities for international investment.

- Government Support: Governments are rolling out initiatives to support startups, offering grants, tax incentives, and infrastructure support.

In conclusion, DACH and BENELUX countries offer a fertile ground for pre-seed and seed-stage startups. With a plethora of venture capital funds, accelerators, and a focus on innovation, these regions are ideal places to launch and grow your startup. Keep an eye on the emerging trends and opportunities, and you could be the next success story in this dynamic part of the world. 🌍