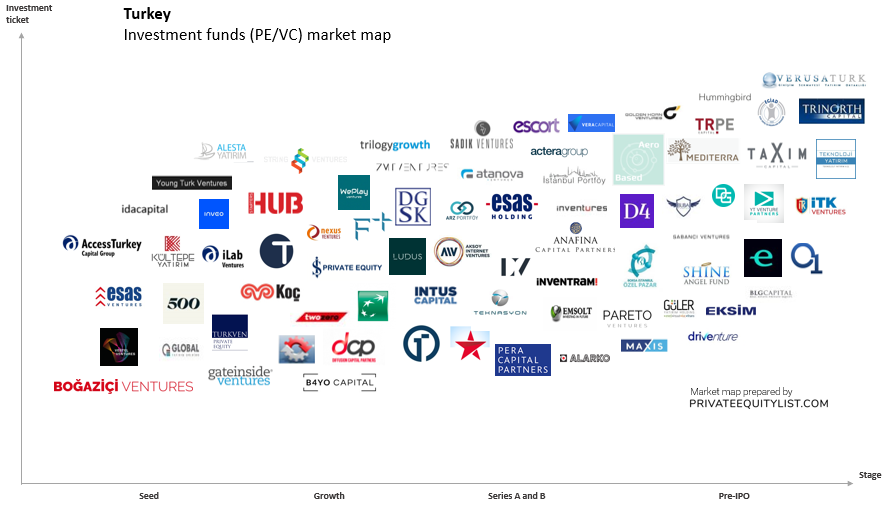

Turkey private equity and venture capital (PE & VC) market map

We compiled an extensive Turkey private equity (PE) and venture capital (VC) market map that shows key Turkey investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Turkey is an important economic hub and has strong ties with Europe and the Middle East. Its large domestic market makes it an attractive investment base. Due to the recent economic downturn and political tensions international investors tend to reduce their exposure. However, investment appetite seems to be picking up again. Startups received $59,2 million from angels and venture capital funds. Top 3 funded startups were online marketing management platform Insider, online accounting services provider Foriba and online furniture store Vivense. Trendyol, OpsGenie, and Gram Games made the biggest exits in 2018 Earlybird, Hummingbird, and 3TS have Turkey dedicated funds. Revo Capital, Bogazici Ventures and ACT Capital Partners are among the most active local venture capital firms. Aslanoba is the country’s first super angel with $60 million seed and early-stage investments in startups. Galata Business Angels also established the first angel network. European Investment Fund, European Bank of Reconstruction and Development and International Finance Corporation have a strong presence in Turkey and invest in startups directly or indirectly. Turkey’s most active private equity firms Turkven and Actera are both seeking to raise new funds of over $1 billion each.

The funds present on the market maps are:

- 500 Istanbul

- AccessTurkey Capital Group

- Actera Group

- AeroBased

- Aksoy Internet Ventures

- Alarko Ventures

- Alesta Yatirim

- Anafina

- Arz Portfolio

- Atanova Venture

- B4YO Capital

- BIST Private Market

- BLG Capital

- Boğaziçi Ventures

- BUBA Campus

- D4 Ventures

- DGSK

- Diffusion Capital Partners

- Doga Girisi

- Driventure

- EGIAD Angels

- Eksim

- Emsolt Investment Holding

- Endeavor Türkiye

- Esas Holding

- Esas Ventures

- Escort Teknoloji Yatirim

- F+ Ventures

- Gate Inside Ventures

- Global MD Portfolio Management

- Golden Horn Ventures

- Güler Holding

- Hummingbird

- Idacapital

- iLab Ventures

- Intus Capital

- Inventram

- Inveo Yatirim Holding

- Invetures

- Isgirisim

- İstanbul Portföy Yönetimi

- İTK Ventures

- Koç Holding

- Kültepe Investment

- Lima Ventures

- Ludus Venture Studio

- Maxis

- Mediterra

- Nexus Ventures

- OpenOne

- Pareto Ventures

- Pera Capital Partners

- Sabanci Ventures

- Sadık Ventures

- Sanayi Bakanliğı

- Shine Angel Fund

- StartersHub

- String Ventures

- Tarvenn Ventures

- Taxim Capital

- TEB Private Investor Society

- TechOne VC

- Teknasyon

- Teknoloji Yatirim

- TrilogyGrowth

- TriNorth Capital

- TRPE Capital

- TURKVEN

- twozero Ventures

- VERA CAPITAL

- Verusaturk GSYO

- Vestel Ventures

- WePlay Ventures

- Yildiz Ventures

- Young Turk Ventures

- YT Venture Partners

- ZMT Ventures

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Turkey go to Turkey PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team