Banks can be brutal to their clients including long-term ones and especially small ones like startups. This article is mainly focused on early stage founders who are non-US/EU residents and/or come from underrepresented countries. Or anyone who feels that their current bank is unsecure.

If you don’t want to read all this text, just press here and go to the table of banks below.

Early stage founders usually don’t have more than 1 or 2 banks as they focus on other more important things. And we guess it was a complete surprise that 2 years ago Brex, the Silicon Valley lender for many startups, cancelled the service for tens of thousands of small businesses and asked them to withdraw funds and find new providers.

In August 2024 Mercury bank, one of the leading startup providers for banking services and USD accounts, had an announcement that Mercury Bank dropped African founders in 13 countries as well as founders from other countries by August 2024.

You can find the full list here - https://app.mercury.com/help/prohibited-countries (even Croatia is on the list…).

This way, two leading banks for startups essentially cut off access to accounts for founders who either have nationality of certain countries and/or don’t have professional (read VC) funding.

Why is this important? Simple answer - revenue needs to go somewhere.

Even if you have good product, found your GTM strategy, have customers willing to pay - all of this is useless if you don’t have a bank account where all this revenue or investments can go in. A pure technicality now turned into a potential problem for founders.

Let us give you an example with details for understanding. Let’s take the usual combo for early stage Saas startups/projects - Wyoming LLC + Stripe + Mercury regardless of nationality of the founders (Delaware C-Corp is also a popular choice). Let’s call it “company infrastructure”.

So there are 4 main aspects to look for when deciding on how your company would receive revenue at least:

- founders passport/nationality

- company jurisdiction (US/EU/UK/etc.)

- payment system (like Stripe/Paddle/etc.)

- bank and its country / jurisdiction

You have to understand that all 4 components have their own KYC-like standards and may reject you before or after your “company infrastructure” is complete.

The ideal situation is when all these 4 aspects are in the same country and this country is the US or EU. A perfect fit and it all works. But that holds if you are a US/EU/UK citizen. Things become harder if you are not from these countries, especially for founders from Mercury list above.

The problems arise when all the jurisdictions are different and even worse if one of the jurisdictions is under sanctions. For example, let’s have the wildest mix: African passport, UK company, Paddle payment system and Mercury Bank — high probability that founders just can’t get the “company infrastructure” or will get banned over time.

Additionally some countries are under sanctions or perceived as high risk, so even if you reside outside of these territories banks can just say NO to you without a reason (again see Mercury list and recent outrage on LinkedIn regarding this).

Our research: many alternatives divided by regions

We actually advise early stage founders to have 2-3 find alternatives to continue working upon your major bank provider failure or ban.

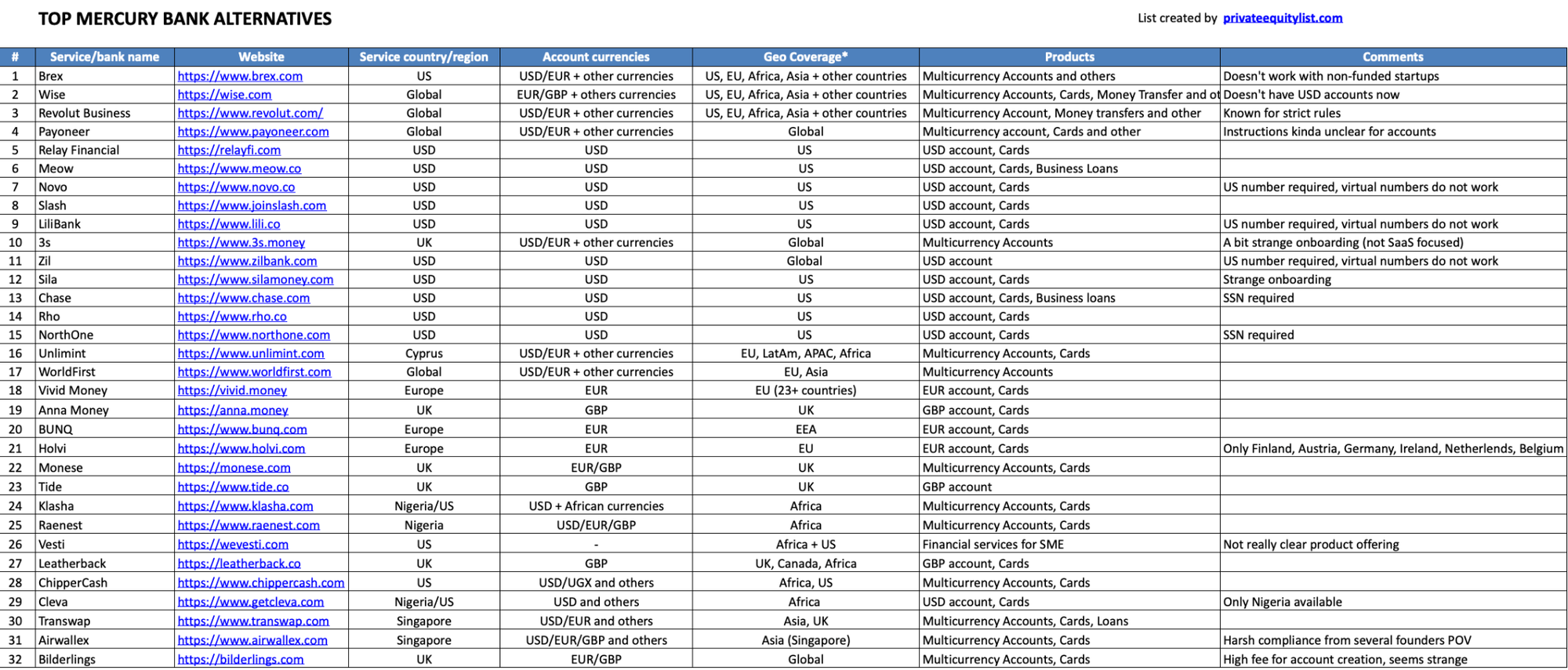

Below is a handpicked list of key alternative banks that can replace Mercury and Brex (though Brex is on the list too as it is still an alternative to Mercury if company is professionally funded). The list can be longer and fintech is an everchanging segment with new players arising.

Link to the table

Disclaimer:

* excluding specific countries for each bank / services based on their info

** we may have written some things incorrect/not fully, but the table overall gives the feel, all these services can be opened remotely

*** we didn't include all services as there can be others we missed

Write to privateequitylist@gmail.com if you want to be featured in this list too.

Our region-based thoughts: Global neobanks and fintech startup-like services provide better experience overall

1. Global players (Brex, Wise, but not Payoneer): Nice support teams and easy onboarding, if you have issues though you have to be very detailed. Best choice for fast change from Mercury. Out of these - Wise looks like the best choice as Brex doesn’t support non-funded companies.

2. US: Meow, Novo and Lili are perceived as the most common alternatives. See below for some comments on some issues with US banks. But overall US banks only offer USD accounts, so choosing Global players is a better option. Also there is a nice video on US banks here

3. EU / UK: Only heard good things about Unlimint as well as Vivid Money and Anna.Money. Others services seem a bit more limited and less tech advanced.

4. Africa: services mentioned in the list have options to open USD accounts and some of them even have nice reputable investors like Klasha. Worth trying but maybe higher risk profile.

5. Middle East: expensive, hard, non-remote, not worth mentioning

Our insights and advice: some services have bad onboarding, cliche answers from support teams, KYC / verification is automated and dumb to non-standard cases

Even though fintech is regarded as one of the most technologically advanced sector, there are several issues with some services from the list:

- Onboarding: song services have strange or bad onboarding, sometimes it lags and doesn’t allow to go forward and in this case you have to write to support like crazy. Or for example you enter all info in onboarding form to understand that your company can’t be supported - just a waste of time.

- Phone numbers: even valid phone numbers are not accepted. Some services allow only non-virtual phone numbers when the startup/SaaS world is global (mostly US)

- Support team issues: some support teams may outreach to you personally and you are near finish, but then disappear and your progress will be stalled, so just spam them with requests to update and write via e-mail/online bot/whatever, otherwise you can just wait forever. Write about your issues in many details with screenshots - otherwise you will get cliche answers from FAQs

- Dumb automated KYC software: some IDs are non-standard form (no photo or A4 format), software like SumSub sometimes can’t get it right, though your ID is valid

- UK Ltd + EU banks scheme: it is worth trying with many services in EU

Good luck in finding your bank partner!

About Private Equity List

Private Equity List is a top choice for finding investment opportunities in new markets. It's a straightforward and detailed site for people looking for private equity, venture capital, and angel investors. You don't have to sign up or subscribe to use it.

With global perspective (incl. US, EU and UK) and special focus on regions like the Middle East, Africa, Pan-Asia, and Central and Eastern Europe, Private Equity List provides vital info on investors, such as how much they invest, what regions and industries they're interested in, and how to contact key team members. This means you get everything you need to find, check out, and reach out to potential investors for your project. We also pay attention to early stage founders.