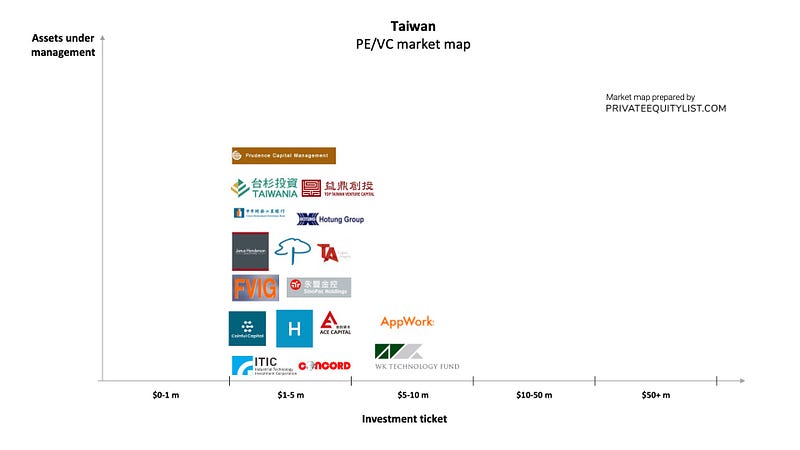

Taiwan private equity and venture capital (PE & VC) market map

We compiled an extensive Taiwan private equity (PE) and venture capital (VC) market map that shows key Taiwan investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Taiwan’s business-friendly political environment and its proximity to China make it an important target for investments. In terms of venture capital, it is not as mature as Japan, Hong Kong, and Singapore but its advanced electronics background makes it a hot spot for tech start-ups, especially in AI, IoT, and big data. Highly skilled labor market and its strong links to the US market, the Silicon Valley in particular, also makes it an attractive ecosystem. Although it is an important electronics manufacturing base Venture Capital and Private Equity industry started to develop relatively late after the 2010s. The number of startup programs, accelerators, co-working spaces has increased significantly in the last few years. Investors tend to fund Taiwanese startups at early stages such as seed, Series A and Series B rounds. Angel investors like National Chiao Tung University (NCTU) Angel Club and National Development Fund’s (NDF) Business Angel Investment Program is very active in the market. Taipei-based Appworks is another major incubator in the country Appier, KKday, Shopline, Viscovery, Kloudless, and Bitmark are among the prominent startups that received venture capital funding locally and globally.

The funds present on the market maps are:

- ACE Capital

- AppWorks

- China Development Industrial Bank

- Coinful Capital

- Concord Venture Capital Group

- Forutne Venture Investment Group

- Hive Ventures

- Hotung Venture Capital Corp.

- ITIC

- Janus Henderson Investors

- MediaTek

- Pinehurst Advisor

- Prudence Capital Management

- PTI Ventures

- Sinopac Venture

- Taipei Angels

- Taiwania Capital

- Top Taiwan Venture Capital

- Trans Pacific Technology Fund

- Translink Capital

- WK Technology Fund

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Taiwan go to Taiwan PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team