Supporting Women-Led Startups: VC Investors Across the Globe

Venture capital (VC) investment is a vital driver of innovation and economic growth worldwide. However, a persistent gender gap in VC funding has been a long-standing issue. Women-led startups have historically faced challenges in securing adequate funding. In recent years, there has been a shift towards supporting women entrepreneurs, and VC investors have played a crucial role in bridging this gender gap. In this blog post, we will explore VC investors supporting women-led startups across America, the European Union (EU), Asia, and the Middle East and North Africa (MENA). We will provide funding statistics, average investment sizes for pre-seed and seed rounds, key investment sectors, and highlight the key players in each region.

Funding Statistics and Investment Sizes

In 2022, a TechCrunch report revealed that startups with all-women teams secured a mere 1.9% of the total venture capital investments, which amounted to approximately $4.5 billion out of the $238.3 billion raised by the venture capital industry.

As Leila Oliveira, Investment Manager at Birchal says: “Men often present overly optimistic business plans when pitching, while women tend to be more realistic. A venture capitalist mentioned adjusting forecasts by reducing men's projections by 50% and women-led businesses by 15%.

Additionally, Research shows the correlation between firms with a female VC partner and the number of investments into female-led startups. For change to occur at the grassroots level, it must be initiated from the top of the organization.”

“According to the Polish report by PSIK, Abris Capital Partners, and Level20 from 2021, women constitute 9% of the management staff in VC and PE funds in Poland. 21% of the funds surveyed had no women in their teams. In Europe and the USA, the numbers are slightly higher, but the differences are not statistically significant – in Europe, it's 16%, and in the United States – 15% of fund management staff (Reports by IDC and Pitchbook from 2022). "Female" VCs also have access to smaller funds – 4-6% of the total amount of European investments (IDC). VC funds with women on board are nearly twice as likely to invest in startups founded or co-founded by women – and this translates to the earnings of the fund. Funds that invest in companies with female founders bring 63% more profits to the funds (Report “Funding in CEE, 2022”).” - says Katarzyna Matuszak, Analityk at CMT Advisory

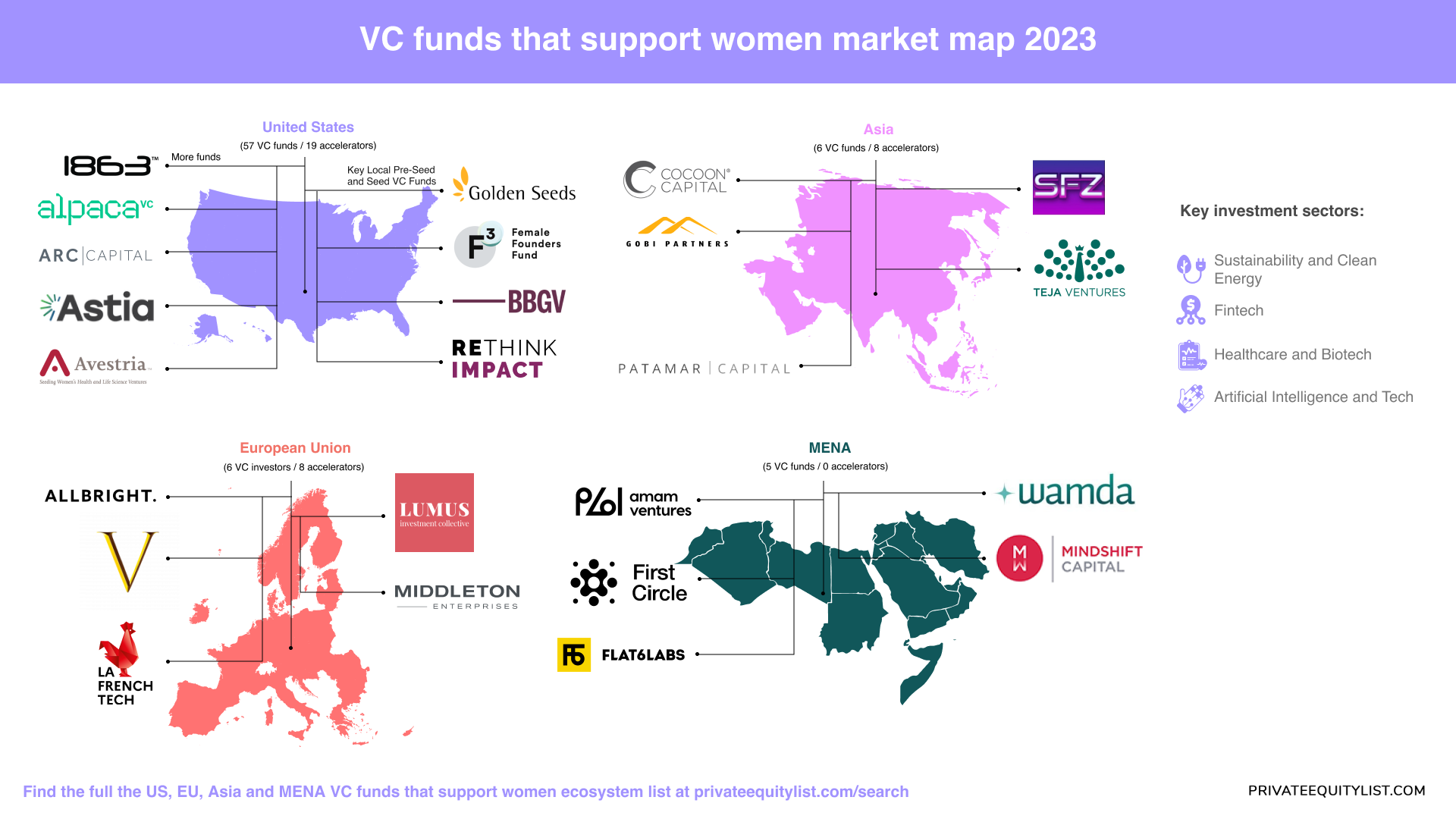

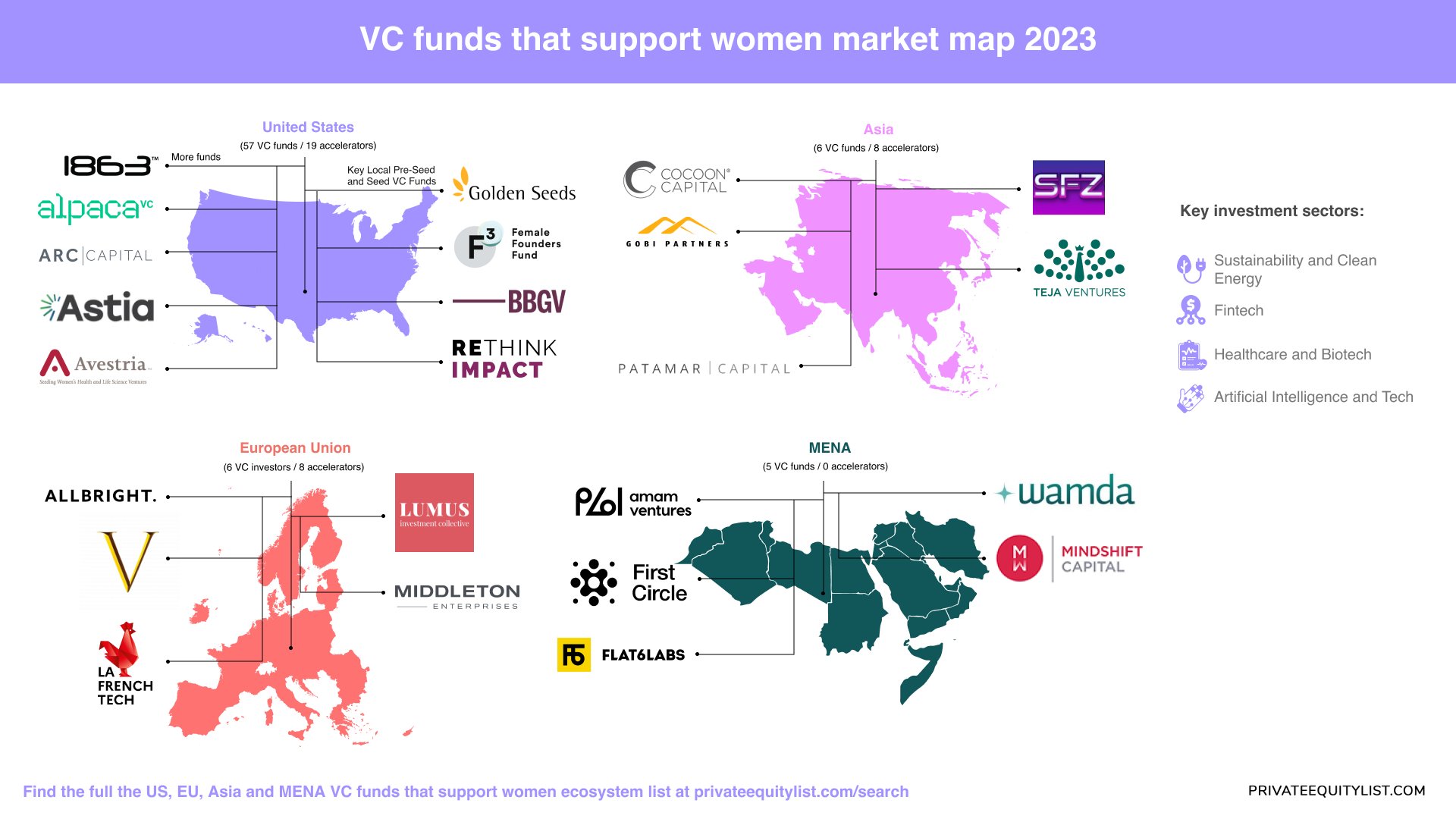

Key Investment Sectors

Investment sectors for women-led startups have diversified over the years. While traditionally, sectors such as e-commerce, health tech, and education received substantial funding, new areas have emerged. These include:

- Sustainability and Clean Energy: Women entrepreneurs in all regions are making strides in sustainable and clean energy solutions, reflecting the global focus on environmental sustainability.

- Fintech: The financial technology sector has seen significant investments, with women-led fintech startups disrupting the financial industry.

- Healthcare and Biotech: Advances in healthcare and biotechnology have attracted substantial VC investments, especially in the wake of the COVID-19 pandemic.

- Artificial Intelligence and Tech: Women-led startups are innovating in AI, machine learning, and tech, contributing to technological advancements.

Lorde Astor West, Managing Member at RadHash.ai, added: “Women are hardly a niche market anymore with $31.8T in spending power worldwide and holding 85% of the buying power, investing in women-led startups is just simple math”.

Now, let's explore the support for women-led startups in each of the mentioned regions.

United States (57 VC funds / 19 accelerators)

The United States has been at the forefront of efforts to support women-led startups. The VC landscape in the U.S. is dynamic and offers numerous opportunities for female entrepreneurs.

Key Local Pre-Seed and Seed VC Funds

- Golden Seeds: Golden Seeds is one of the largest and most active early-stage investment firms dedicated to women-led companies. They invest in a wide range of sectors, including technology, healthcare, and consumer products.

- Female Founders Fund: FFF focuses on investing in consumer and enterprise technology companies led by women. They have made significant contributions to promoting diversity in tech.

- BBG Ventures: BBG Ventures primarily invests in consumer tech and media companies founded by women. They are known for their support in building female-led consumer brands.

- Rethink Impact: Rethink Impact is a female-led venture capital fund that focuses on impact investing in tech companies. They seek to invest in ventures with social and environmental goals.

More funds:

You can find the full list following the link. Such accelerators as Healthtech Women Charlotte, Women & Minority Business Mentorship and Women’s Leadership Accelerator are working here.

European Union (6 VC investors / 8 accelerators)

The European Union is also taking significant strides in promoting gender diversity in the startup ecosystem. Various countries within the EU have seen an increase in VC funding for women-led businesses.

You can search for more funds here. Local accelerators are 4th Women Startup Competition, JFD | Digital Women's Day and Women in AI.

Asia (6 VC funds / 8 accelerators)

Asia has become a thriving hub for startups and investments, and women entrepreneurs are an essential part of this ecosystem. VC investors are recognizing the potential of women-led startups in the region.

Find the full list here. Local accelerators are JAIN Elevate WomEN Incubation Program, Women Faces 2019 and CWE -Tech Enabled Women's Incubator.

MENA (5 VC funds / 0 accelerators)

The MENA region is experiencing a startup boom, with a growing number of female entrepreneurs taking the lead. VC investors in the region are recognizing the potential of women-led startups.

Learn more about these funds via the link.

Key Trends

- Gender Diversity Initiatives: Across all regions, we see a growing number of gender-focused initiatives, funds, and programs aimed at supporting women entrepreneurs.

- Global Collaboration: VC investors are increasingly collaborating on a global scale to support women-led startups. Cross-border investments and mentorship opportunities are on the rise.

- Impact Investing: Many investors are placing emphasis on impact investing, seeking to fund startups that tackle societal and environmental challenges.

- Remote and Hybrid Work: The shift to remote and hybrid work models has opened up opportunities for women entrepreneurs, enabling greater flexibility and access to global markets.

- Technology and Digital Transformation: The COVID-19 pandemic accelerated digital transformation, and women-led startups are actively participating in shaping the future of tech.

In conclusion, VC investors are playing a vital role in supporting women-led startups across the Americas, Europe, Asia, and the MENA region. The funding landscape is evolving, with increasing investments, diverse sectors, and a commitment to narrowing the gender gap in entrepreneurship. As we move forward, it is crucial to continue fostering diversity and inclusivity in the startup ecosystem, empowering women to drive innovation and economic growth worldwide.