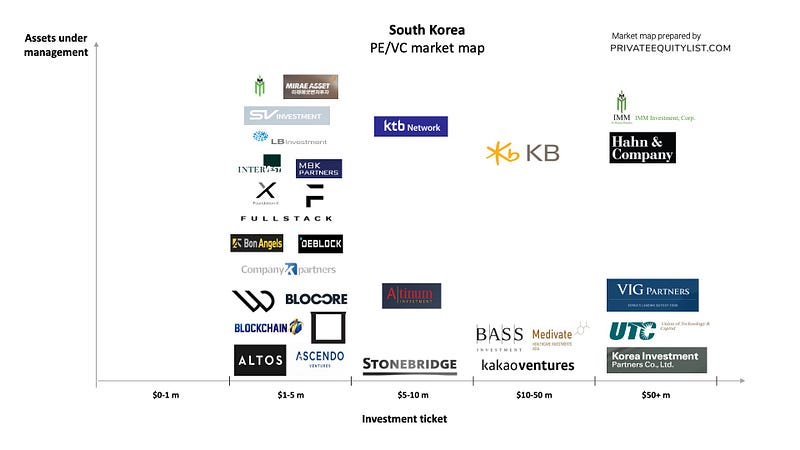

We compiled an extensive South Korea private equity (PE) and venture capital (VC) market map that shows key South Korea investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

South Korea is the first country to commercially launch 5G networks. This allows South Korean start-ups upper hand in 5G-based ventures. Mobile technologies, AI and Blockchain are main areas that could benefit from this head start Having a strong technologic background and a tech-savvy consumer base South Korean start-up investments topped $3 billion in 2018. South Korea has a versatile Venture Capital market with POSCO Venture Capital, Korea Investment Markets, Altos Venture and Stonebridge Ventures among others. South Korean government also created a venture fund of $3 billion in 2015 and pledged a further $9 billion in 2017. SK Telecom is also another major investor in tech start-ups Seoul is the major hub both for venture capital funds, angel investors and naturally for entrepreneurs. It is home for 6 unicorns namely Coupang, Bluehole, Yello Mobile, Woowa Brothers, L&P Cosmetics and Viva Republica with a total market value of $23.5 billion.

The funds present on the market maps are:

- Altos Ventures

- Ascendo Ventures

- Atinum Investment

- Bass Investments

- Blockchain i

- Blockmon

- Blockwater Capital

- Blocore

- Bon Angels

- Deblock

- Foundation X

- Full Stack Capital

- Future Money Venture

- Hahn & Company

- IMM Investment

- IMM Private Equity, Inc.

- InterVest

- Kakao Ventures

- KB Investment Co. Ltd.

- KTB Network

- LB Investment

- MBK Partners

- Medivate Partners LLC

- Mirae Asset Venture

- Stonebridge Capital

- SV Investment

- UTC Investment Co., Ltd.

- VIG Partners

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in South Korea go to South Korea PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team