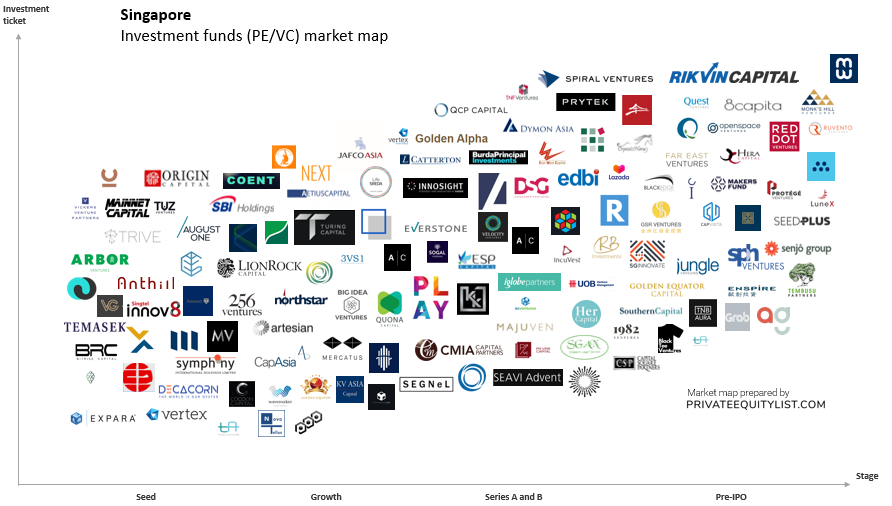

We compiled an extensive Singapore private equity (PE) and venture capital (VC) market map that shows key Singapore investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Despite being geographically small, Singapore is a major financial hub. Due to its high-rankings in global connectivity, tax incentives and ease of doing business, it is one of the top foreign investment destinations in Southeast Asia. It also hosted more than half of the Southeast Asian PE/VC deals in 2018. Private Equity and Venture Capital funds based in Singapore have more than $19.2 billion in assets under management. Start-ups in Singapore secured $7.5 billion in funds consisting of three-quarters of all start-up funding deals in Southeast Asia in 2018. The capital city of Singapore is one of the most technologically integrated smart city and a natural hotbed for tech start-ups and tech-focused Venture Capital funds. It is home for five unicorns, namely Grab, Lazada, Razer, Sea, and Trax, with a combined valuation of around $12 billion. In terms of Private Equity Investments, most of the recent deals focused on financial services, insurance, and real estate. Private Equity industry is mostly driven by giant sovereign wealth funds GIC Private Limited and Temasek Holdings.

The funds present on the market maps are:

- 1982 Ventures

- 256 Venture

- 3V SourceOne Capital

- 8Capita

- Aetius Capital

- Amand Ventures

- Amereus

- Anthill Ventures

- Arbor Ventures

- Artesian

- Astronaut Capital

- Atlas Ventures

- August One

- B Capital Group

- BEENEXT

- Big Idea Ventures

- Bitrise Capital

- Black Edge Capital

- Black Tee Ventures

- Block Asset Ventures

- Block X Ventures

- BlockOrigin Capital

- Burda Principal Investment

- Cap Vista

- CapAsia

- Capital Square Partners

- Cento Ventures

- CMIA Capital Partners Pte Ltd.

- Cocoon Capital

- Coent Venture Partners

- Crystal Horse Investment

- Decacorn Capital

- DSG Consumer Partners

- Dymon Asia

- East West Capital Partners

- EDBI

- Enspire Capital

- ESP Capital

- Everstone Group

- Expara Ventures

- Far East Ventures

- First Crypto ETF

- Genesis Alternative Ventures

- GIC

- Golden Alpha

- Golden Equator Capital

- Golden Equator Ventures

- Golden Gate Ventures

- Grab Ventures

- GSR Ventures

- Her Capital

- Hera Capital

- ICBF

- Iglobe Partners

- IncuVest

- Innosight Ventures

- Investigate

- JAFCO Asia

- Jungle Ventures

- K3 Ventures

- KK Fund

- Koru Partner

- KV Asia Capital

- L Catterton Asia

- Lazada Group

- Leonie Hill Capital

- Life.Sreda

- LionRock Capital

- LuneX Ventures

- MainNet Capital

- Majuven

- Makers Fund

- MassMutal Ventures Southeast Asia

- Mercatus Capital

- Monk's Hill Ventures

- Motion Ventures

- NGC Ventures

- North Base Media

- Northstar Group

- Novo Tellus Capital Partners

- Openspace Ventures

- OWW Capital Partners

- Pix Vine Capital

- Play Ventures

- Protege VC

- Prytek

- QCP Capital

- Qualgro VC

- Quest Ventures

- Quona Capital

- RB Investments Pte. Ltd.

- Reapra

- Red Dot Ventures

- Rekanext

- Rikvin Capital

- Ruvento Ventures

- SBI Ven Capital

- SC Capital

- SC Ventures

- Seavi Advent

- Seed Plus

- SEGNEL Ventures

- Senjo Group

- SGInnovate

- Signal Ventures

- Singapore Angel Network

- Singtel Innov8

- SoGal Ventures

- Southern Capital Group

- SPH Ventures

- Spiral Ventures

- Symphony Asia Holdings Pte. Ltd.

- Temasek (Vertex Venture Holdings)

- Tembusu Partners

- The Origin Capital

- TNB Aura

- TNF Ventures

- Token Advisors

- TRIVE Ventures

- Turing Capital

- TUZ Ventures

- UOB Venture Management

- Velocity Ventures

- Velos Partners

- Vertex Ventures Holdings

- Vertex Ventures

- Vickers Ventures

- Wavemaker Partners

- Xpdite Capital Partners

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Singapore go to Singapore PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team