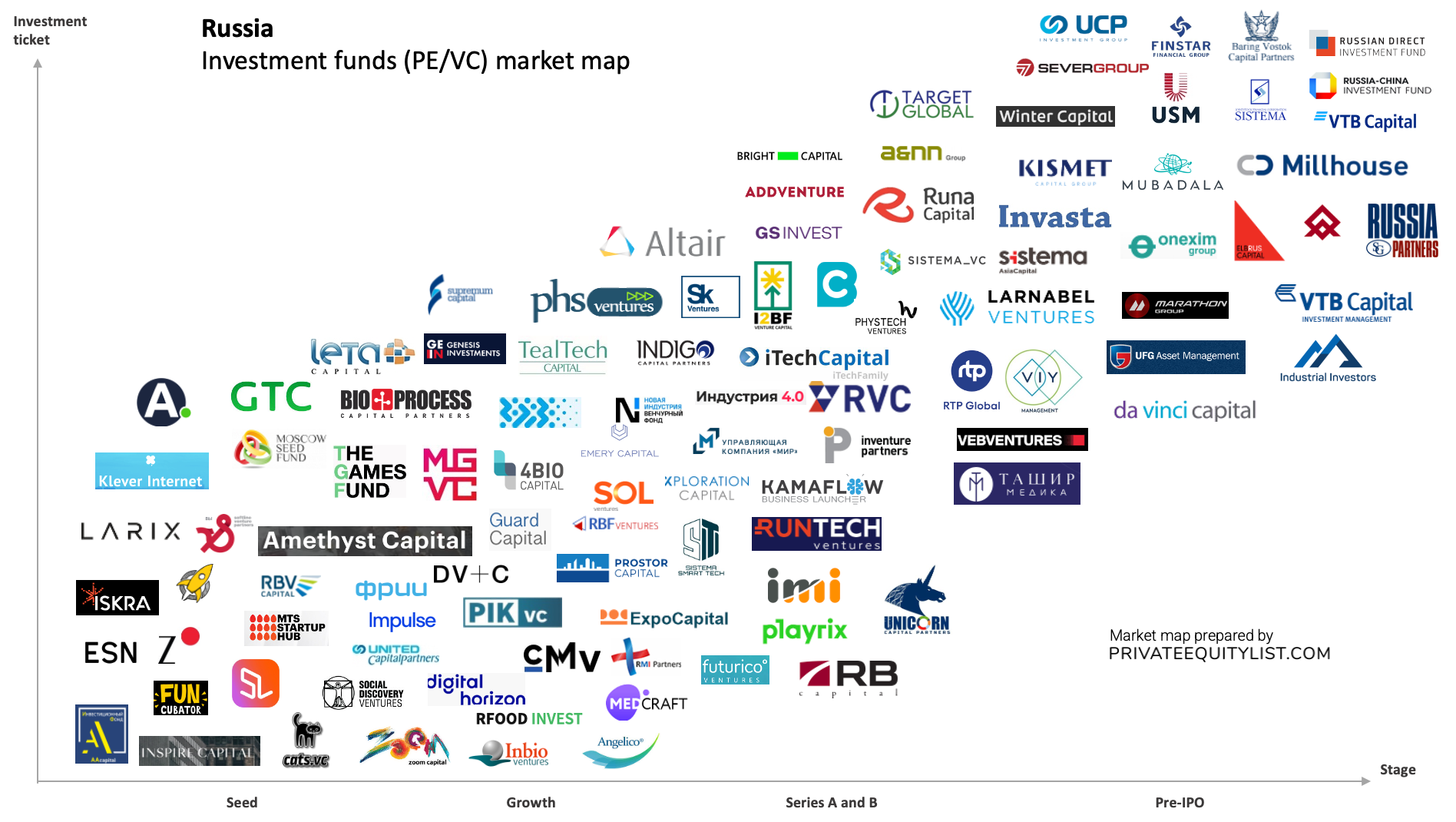

We compiled an extensive Russia investment funds - private equity (PE) and venture capital (VC) market map that shows key Russian investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

For all information on Russian PE/VC investment funds with filters (investment criteria, sector/ticket/region preferences, funds sizes and etc.) please go to Russia PE/VC funds database.

For very attentive readers we give you promocodes:

- BASIC30 for 30% discount to use at privateequitylist.com/pricing for 1st month of usage for BASIC tartiff (Unlimited access to the database of nearly 5000+ PE/VC funds globally with great filters)

- PRO30 for 30% discount to use at privateequitylist.com/pricing for 1st month of usage for PRO tariff (PRO tariff = Basic + investment team contacts)

Russian Private Equity and Venture Capital market is the largest in the Eastern Europe and Former Soviet Union (FSU). While there are some international firms and local firms backed by international institutional investors in Russia, the market is quite local with most of the funds are sourced domestically. Many of the largest local PE/VC firms are controlled by the government or Family Offices of Russian high-net-worth individuals (HNWI), which also act as Angels, including in international unicorns. Russian Internet Leaders, such as Yandex, Mail.Ru Group and Sberbank are very active investors, especially in the VC arena, hunting for the most attractive startups in promising areas of Internet and Technology sectors. All the major PE/VC firms in Russia are concentrated in Moscow. While top-tier global PE/VC investors may have some portfolio companies from Russia, usually they do not have an office there and the country is covered from London and other EMEA offices. With many Russian startups located in Silicon Valley, Europe and Israel, Russian Venture Capitalist also focus more on international markets and may have representative offices in California, London, Berlin, Tel Aviv and other prominent locations. Russian PE/VC/Angels invest in different sectors, such as Consumer Goods and Retail, Financial Institutions, Industrials, Healthcare, Energy, with Internet and Information Technology being the most popular lately. In terms of deal types, early-stage (seed, round A, round B) and growth capital are the most common in Russia.

The funds present on the market maps and in our database are (some of them):

- Altair

- Amethyst Capital

- Angelico Ventures

- Atrani Capital

- Baring Vostok

- Binomial Ventures

- Bioprocess Capital Ventures

- BitPride Fund

- Brayne

- Bright Capital

- Brothers Ventures

- Cabra VC

- CATS.VC

- CM Ventures

- Coinstelegram Fund

- CommIT Capital

- Crypto Bazar

- Crypto Fund

- Da Vinci Capital

- DFJ VTB Capital Aurora

- Digital Horizon

- Direct Group

- Distributed Fund

- DV Capital

- EG Capital (Mints)

- Elbrus Capital

- Emery Capital

- ESN Group

- Far Eastern High Technology Fund

- FASIE

- FINAM Global

- FinSight

- Finstar Financial Group

- Flashpoint Venture Capital

- Foodpro.tech

- Funcubator

- Futurico.vc

- Genezis Technology Capital

- Genome Ventures

- GS Invest

- Guard Capital

- I2BF Global

- IMI.VC

- Impulse VC

- Inbio Ventures

- Indigo Capital Partners

- Industrial Investors Group

- Industry 4.0

- Innotech

- Inspire Capital

- Internet Initiatives Development Fund (IIDF)

- Invasta Capital

- Inventure Partners

- Invest AG (Russia)

- Iskra Ventures

- iTech Capital

- KamaFlow Business Launcher

- Kirovsky Zavod CVC

- Kismet Capital Group

- Klever Internet

- Larix

- Larnabel Ventures (SAFMAR)

- Leader AM

- Leorsa Innovations

- Leta Capital

- Mail.ru Group

- Marathon Group

- Matador Fund

- MedCraft Fund

- Memorandum Capital

- Millhouse

- Mint Capital

- MIR

- Moscow Seed Fund

- MTS CVC

- Mubadala Russia

- MY.GAMES Venture Capital

- New Industry

- Onexim

- Orbita Capital Partners

- Otkritie

- Paradigm Investments

- Parta Group

- Pharmstandard Ventures

- Phystech Ventures

- PIK Ventures

- Playrix

- Primer Capital

- Projector Ventures

- Prostor Capital

- Pulsar Venture Capital

- RB Capital

- RBF Ventures

- RBV Capital

- RFood Invest

- Rider Global

- RMI Partners

- RTP Global

- Runa Capital

- Runtech Ventures

- Rusnano

- Russia-China Investment Fund

- Russian Venture Company (RVC)

- S-Group Capital Management

- S8 Capital

- Sber

- SD Ventures

- Severgroup

- Siguler Guff (Russia Partners)

- Sistema Asia Capital

- Sistema PJSFC

- Sistema SmartTech

- Sistema_VC

- SKL Tech

- Skolkovo (Фонд Сколково)

- Skolkovo Ventures

- Softline Venture Partners

- SOL Ventures

- Target Global

- Tashir Medica

- TealTech Capital

- The Games Fund

- The Russian Direct Investment Fund (RDIF)

- Titanium Investments

- TKB Investments

- Transmashholding Group

- Typhoon Digital Development

- UCP Investment Group

- UFG Private Equity

- Unicorn Capital

- United Capital Partners

- USM Holdings

- VEB Ventures

- Veles Capital

- VIY Management

- VTB Capital Investment Management

- VTB Capital Private Equity

- VTB Capital Private Equity and Special Situations

- Winter Capital

- Xploration Capital

- Yandex

- Yellow Rockets

- Zerno Ventures

- Zoom Capital

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team