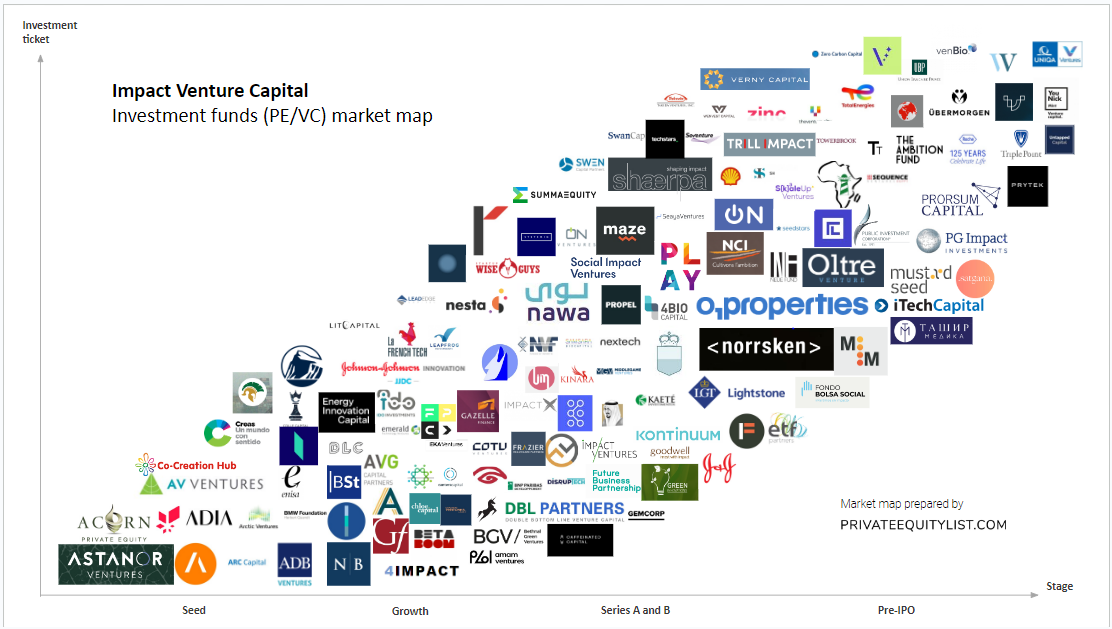

Impact private equity and venture capital (PE & VC) Funds market map with focus on small/mid cap funds

We compiled an extensive Impact private equity (PE) and venture capital (VC) market map that shows key Impact investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

Impact market overview (market map is below it):

Impact investing is a growing trend in the private equity and venture capital space, with more funds being dedicated to companies that prioritize social and environmental impact alongside financial returns. In this blog post, we will explore the key impact market trends in each region for PE/VC funds.

North America:

- Valuation for impact startups is on the rise, with investors willing to pay a premium for companies that demonstrate a clear social or environmental mission.

- Series A funding rounds for impact startups are becoming more common, indicating a growing interest in early-stage companies that prioritize impact.

- Accelerators and incubators focused on impact are popping up across the region, providing resources and support for impact startups to grow and scale.

Europe:

- Impact investing is gaining traction in Europe, with more funds being dedicated to impact-focused companies.

- Series B funding rounds for impact startups are becoming more common, indicating that impact companies are able to scale and attract larger investments.

- Impact investing is being integrated into traditional investment strategies, with more mainstream investors looking to incorporate impact into their portfolios.

Asia:

- Impact investing is still in its early stages in Asia, but there is growing interest from investors and entrepreneurs.

- Valuations for impact startups are lower in Asia compared to North America and Europe, providing opportunities for investors to get in at a lower cost.

- Incubators and accelerators focused on impact are starting to emerge in Asia, providing resources and support for impact startups to grow and scale.

Latin America:

- Impact investing is growing in popularity in Latin America, with more funds being dedicated to impact-focused companies.

- Series A funding rounds for impact startups are becoming more common, indicating a growing interest in early-stage companies that prioritize impact.

- Governments in the region are starting to offer incentives for impact investing, providing a supportive environment for impact-focused funds and startups.

In conclusion, impact investing is a growing trend in the private equity and venture capital space, with more funds being dedicated to companies that prioritize social and environmental impact alongside financial returns. As impact investing continues to gain traction, we can expect to see more opportunities for impact startups to grow and scale, as well as more mainstream investors incorporating impact into their portfolios.

The funds present on the market maps are:

- 4BIO Capital

- 4impact

- Abu Dhabi Investment Authority (ADIA)

- Acorn Private Equity

- ADB Ventures

- Amam Ventures

- Ananda Impact Ventures

- Arc Capital

- Arctic Ventures

- Astanor Ventures

- Asterion Industrial

- AV Ventures

- AVG Capital Partners

- Babylon Ventures

- Bertelsmann Foundation

- Beta Boom

- Bethnal Green Ventures

- Big Society Capital (BSC)

- Bill & Melinda Gates Foundation

- BMW Foundation Herbert Quandt

- BNP Paribas Développement

- BonVenture Management GmbH

- Breakthrough Energy Ventures

- Bridges Fund Management Ltd.

- Caffeinated Capital

- Cantera Capital

- Capacura

- Chalmers Ventures

- Chloe Capital

- Co-Creation Hub

- Colle Capital Partners

- Cotu Ventures

- Creas

- DBL Partners

- Denis Afinco

- Disruptech

- DOEN Participaties B.V.

- Dynamic Loop Capital

- Eka Ventures

- Emerald Technology Ventures

- Energy Innovation Capital

- ENISA

- Equinor Ventures

- ETF Partners

- Fair By Design

- Fondo Bolsa Social

- Foundation Ventures

- Frazier Healthcare Partners

- FSB Capital

- Future Business Partnership

- Future Positive Capital

- Gazelle Finance

- GEMCORP

- Goodwell Investments

- Green Innovations

- Hope Venture

- IDO Investment

- Impact Ventures

- Impact X

- Impact X Capital Partners

- Iron Wolf Capital

- iTech Capital

- Johnson & Johnson

- Kaete Investimentos

- Katapult

- Kinara

- King Khalid Foundation

- Kontinuum Group

- KWAP

- La French Tech

- Lead Edge Capital

- Leapfrog Investment

- LGT Lightstone

- Liechtenstein Group

- Lit Capital

- Lol capital

- London Impact Investing Network (LIIN)

- MAZE - decoding impact

- Middlegame Ventures

- Mustard Seed

- Mustard Seed MAZE

- Nawa

- NCI Gestion

- Nesta

- Neuberger Berman

- Neue Fund

- Nextech Invest

- Norrsken VC

- Novartis Venture Fund

- Nysno

- O1 Properties

- Oltre Venture

- Omidyar Network

- ON Ventures

- Pale Blue Dot

- PG Impact Investments AG

- PGIM Real Estate

- Play Ventures

- Propel Capital Org

- Prorsum AG

- Prytek

- Public Investment Corporation

- Pymwymic

- redseed

- RLC Ventures

- Roche Venture Fund

- Samsara BioCapital

- Satgana

- Seaya Venture

- Secha Capital

- Seedstar Investments

- Seedstars

- SEIF

- Sequence Ventures

- Seventure Partners

- shaerpa

- Shell Ventures

- SHIFT Invest

- SI2 Fund

- SkaleUp Ventures

- Social Impact Ventures NL

- Startup Wise Guys

- Summa Equity

- SwanCap

- SWEN Capital Partners

- Synergies Capital

- SYSTEMIQ Ltd.

- Takeda Ventures

- Tashir Medica

- Techstars

- The Ambition Fund

- TheVenturesCity

- Tony Elumelu Foundation

- Top Tier Impact

- Total Carbon Neutrality Ventures

- TowerBrook Capital

- Trill Impact

- Triple Point Investment Management

- Übermorgen Ventures

- Union Bancaire Privee Dubai

- UNIQA Ventures

- Untapped Capital

- venBio Partners

- Verny Capital

- VitalizeVC

- Voima Ventures

- Wenvest Capital

- Wi Venture

- Younick Mint

- Zerno Ventures

- Zero Carbon Capital

- ZINC

For more information on Impact investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC Impact funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team