Finding investors for your startup or company can be a complex task at any stage, especially if you have no experience in attracting any kind of financing (debt, equity or whatsoever). Creating a long list of investors, contacting the investors, then making a short list can be so time-consuming that founders defocus from startup and lose themselves in capital raising process. A consultant can be hired but not all startups have funds to afford such services plus consultant isn’t a certain guarantee of successful capital raising.

Even professional consultants (working in corporate finance advisory, investment banks, M&A boutiques and etc.) have to spend hours compiling investor lists with investment focus, geographical criteria and investment tickets, sometimes from scratch. As a former consultant (now PE/VC investment manager) I frequently do private consulting for startups in emerging markets and help startups to find potential investors in MENA and ASEAN regions.

Over the course of doing private consulting last year I have found that:

- There is no free consolidated database of investors from Middle East, Africa, Latin America as well as other exotic regions with user-friendly UI/UX, only separate regional databases (most of them aren’t friendly at all)

- Information on more common investment regions such as EU and US also isn’t unified in a clean and clear way

- When you google “Malasyia private equity and venture capital list”, you have to spend endless hours of cherry picking

- A lot of resources lack simple filters and put even basic investor information under the lock of obligatory payments, which can either turn out to be of low quality, so startup and/or founder loses time and money (in the event of scam service)

And so we arrive at a problem.

Problem: Lack of consolidated database of investors with their contact information for startup founders in emerging markets and globally.

I was motivated to create an elegant solution to this problem mainly in order to make my work in private consulting easier in addition to the reasons above (plus I gathered a lot of investor data myself). However, it grew into something more, which became the solution.

Solution: an open user-friendly database privateequitylist.com, which would focus on MENA, Latin America, Asia and other less popular investment regions and help identify investors for any project in 3 clicks.

Private Equity List

Link: privateequitylist.com

Pricing: freemium

Pros: open global database with multiple filters with focus on emerging and exotic markets investors, clean and simple UI, frequent updates, no registration requirements

Cons: small but growing list of angel investors

Users: startup owners looking for financing, investment banking/PE and VC/M&A professionals, investment journalists, research professionals and many others

Current status:

- Over 5800+ PE/VC/Angel investors in an open database with general contact info

- 8 filters to use to sort the investors

- Focus on emerging market regions such as MENA, APAC, CEE and others

- High attention to growing market segments such as AI, CBD, blockchain and etc.

Another reason to create privateequitylist.com was simply becauase other databases are too expensive and are mostly costly corporate solutions (they will be analyzed later on in this post). After analyzing around 30 investor databases (that included several Google Sheets lists, couple of very sophisticated services and half-scam websites), 3 categories of PE/VC investor information services can be identified and sorted out:

- Costly corporate solutions

- Regional/lightweight solutions

- Low quality resources

First 2 categories will be analyzed in the same style as Private Equity List below.

Costly corporate solutions

Overall costly corporate solution platforms have a very broad range of tools including past M&A deals databases, private and public comps, market intelligence/reports and many other useful information. This is all excessive for startups that don’t need any of this. All resources have different UI, registration requirements and information output ranging from average to excellent and super-intuitive.

Pitchbook

Link: pitchbook.com

Pricing: $1500–2000/month

Pros: one of the best corporate services on the market right now

Cons: very expensive for startups, nothing apart from some reports is free

Pitchbook is an unrivaled leader in delivering high-quality information on practically all aspects of PE, VC and M&A industry. However, the service is more for PE, VC, M&A, investment bankers and not for startups or companies due to its high monthly fee.

Tracxn

Link: tracxn.com

Pricing: $1500–2000/month

Pros: 5% of its unlocked information has nice snippets of 4–7 funds practically in every country/city (for example, VC funds in Stockholm)

Cons: very expensive for startups, 95% of information is under subscription lock

Tracxn.com is an Indian tech company backed by several investors such as Accel Partners, Sequoia Partners and several others. Again like Pitchbook it offers a lot of solutions such as CRM systems, reports and a large database of companies, startups and etc. It is a good thing (high-quality analysis) and a bad thing as it makes the database costly (Pitchbook level).

CB Insights

Link: cbinsights.com

Pricing: from $12000/month

Pros: comprehensive intelligence platform with numerous data on VC/PE funds, startups and companies and other industry analytics

Cons: very expensive and excessive for startups, lacks info on MENA, ASEAN and Latin America regions

CB Insights like all costly corporate solutions offers a large variety of tools for its users, but again it is not for startups as monthly fees are enormous.

mergr

Link: mergr.com

Pricing: $150/month

Pros: one of the best US/EU PE and M&A databases on the market with investor contacts

Cons: no VC information at all, severe lack of focus on MENA, Asia and Latin America, information on M&A deals and companies is excessive for startups

mergr.com is close to perfect database, but again it includes some tools that are not needed for startup owners. mergr has investor data on US and EU and several exotic regions, however, large and growing emerging markets have very small representation in the database.

Other resources

Also honorable mentions in this section are Dealroom (very similar to Tracxn), MatterMark and PrivCo (a bit similar to CB Insights).

Regional/lightweight solutions

If corporate costly solutions were more or less on one quality level of data output, regional/lightweight solutions are so different that it certainly can affect the choice of any startup to use the platform.

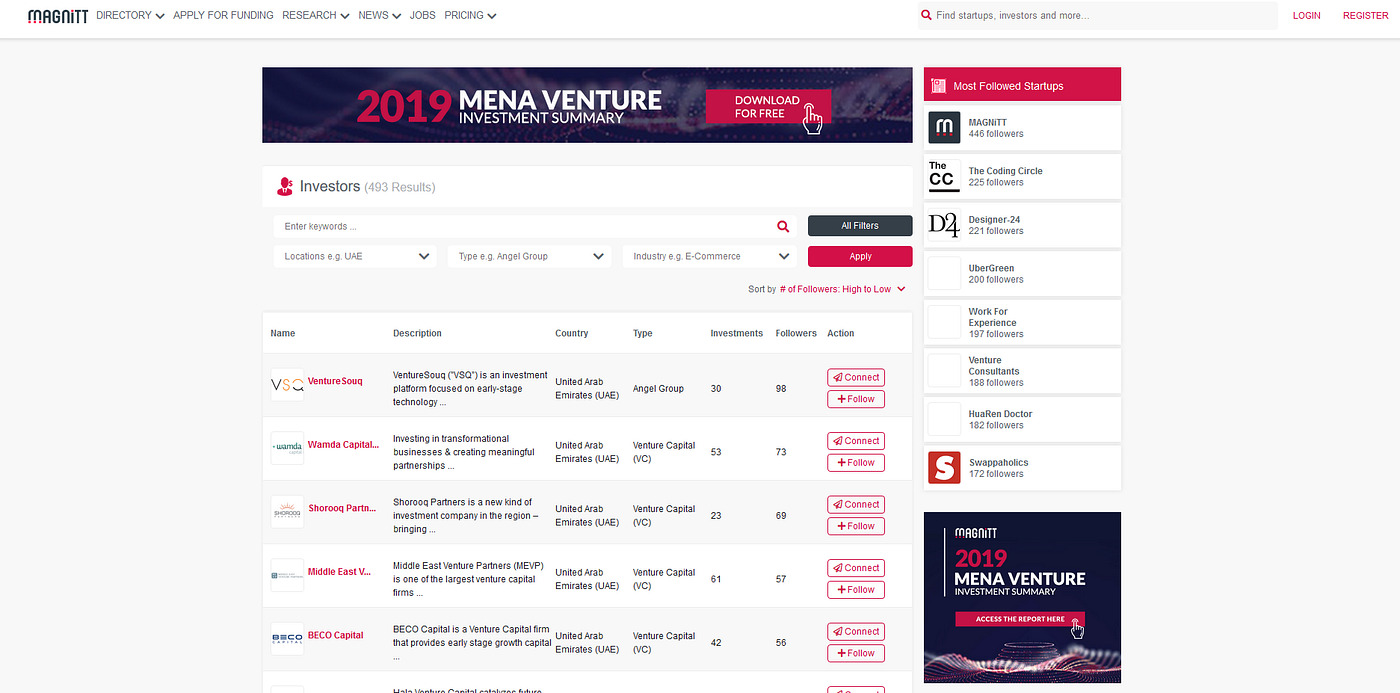

Magnitt

Link: magnitt.com

Pricing: from $399–2499/month

Pros: number one investor-startup platform in Middle East, simple and clean UI, portion of free market research

Cons: too expensive and excessive for startups, investor directory shows only 30 investors

Magnitt is a terrific Middle East investor platform with its investment directory, clean and clear UI. The key feature of Magnitt is that it is a place where both investors and startups connect. And of course Magnitt has practically the best Middle East investment research. But the cost of $399 for a startup seems high to me. Maybe a more direct connection to investor is possible via Magnitt but no guarantees of capital raising. Other than the cost this is the perfect example of how regional startup PE/VC platforms should be done.

Dubaibeat/Sinabeat

Link: dubaibeat.com/sinabeat.com

Pricing: $195

Pros: old resource with many news on Middle East/Chinese M&A deals

Cons: investment directory and contacts may be outdated (based on updates on the website) and they have no filters

Dubaibeat.com/sinabeat.com is an old resource and more a news and press coverage website (though with infrequent updates). It also offers consulting and conference services. Overall this is a service that I would be careful with again only due to outdated website.

Crunchbase

Link: crunchbase.com

Pricing: from $29/month

Pros: largest intelligence resource with PE and M&A databases on the market

Cons: cluttered UI, there is no focus on on MENA, Asia and Latin America as most investors in emerging countries that are shown after filtering are large US/EU investors instead of local/regional investors, no investor contacts

Crunchbase is a great resource overall, but its filtering work better on US region. If we search for non-US investors then the output looks like 700 investors, half of which is incomprehensible individuals from India without even links to LinkedIn profiles.

Aurigin (BankerBay)

Link: aurigininc.com/c/

Pricing: free

Pros: free database based on countries

Cons: very small amount of investors without contacts

Aurigin is a deal origination platform, however, it has an directory, which includes PE/VC funds, consultants, banks, law firms and etc. While investor database is quite small, the other directories are really worth checking.

I believe that easy access to list of investors in these regions will have an immense impact on the global investment climate and will foster the startup financing.

Finding investors in emerging markets is not an easy task, but Private Equity List hopes to change that. Follow us on social media to keep updated.

If you know any other databases, please add them in the comments!

Disclaimer: all pricing information is taken at the date of publication of this article and/or is an estimate based on open sources information (forums, social media and etc.) and may be different from actual pricing.