🚀 Pre-Seed and Seed Funding ecosystem in Latin America: A Comprehensive Guide 🌎

Latin America has emerged as a hotbed for startups and entrepreneurial innovation, attracting significant attention from venture capitalists around the world. In recent years, the region has witnessed a remarkable surge in pre-seed and seed funding, bolstered by its vibrant tech ecosystem and a growing number of innovative ventures.

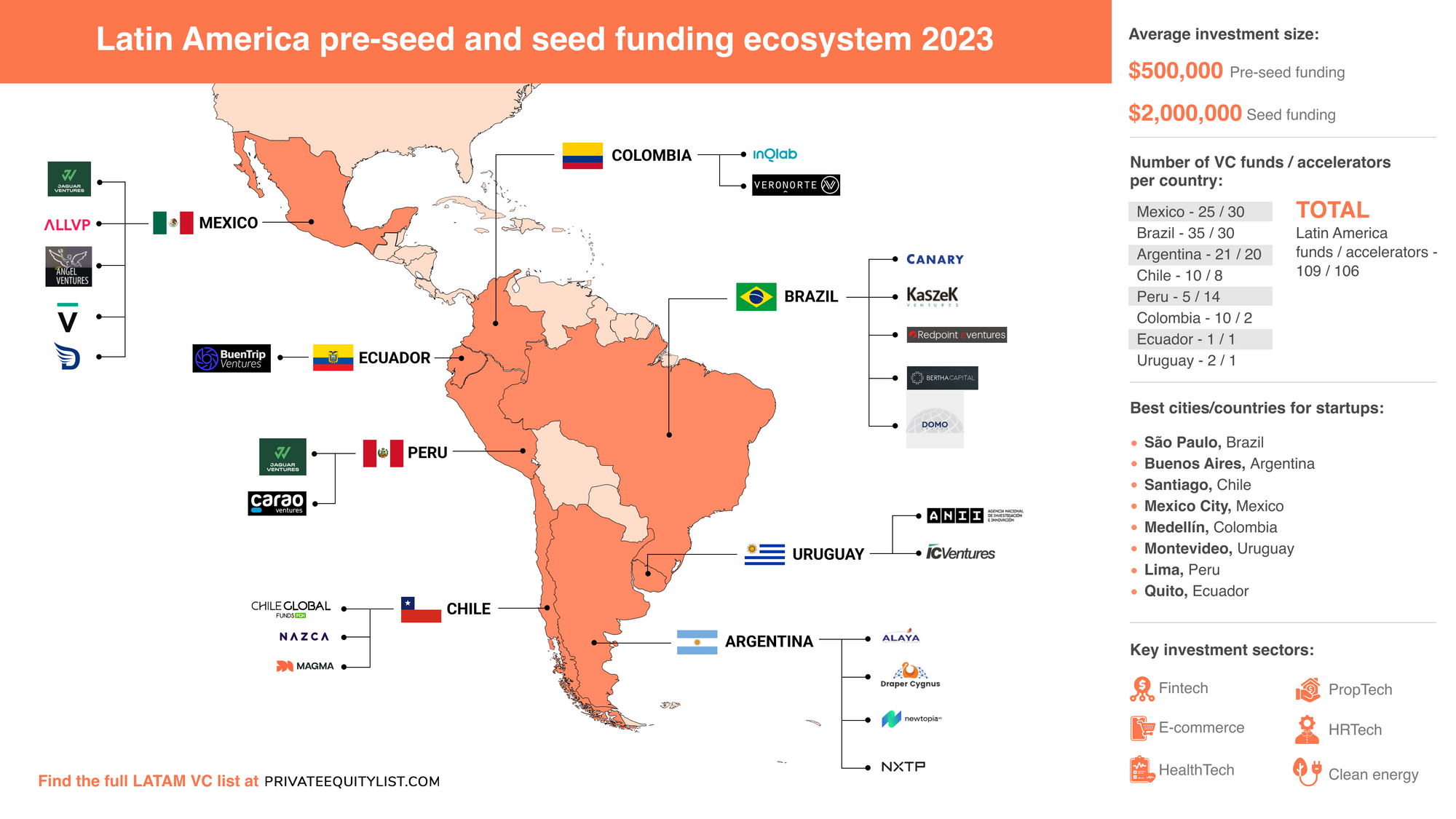

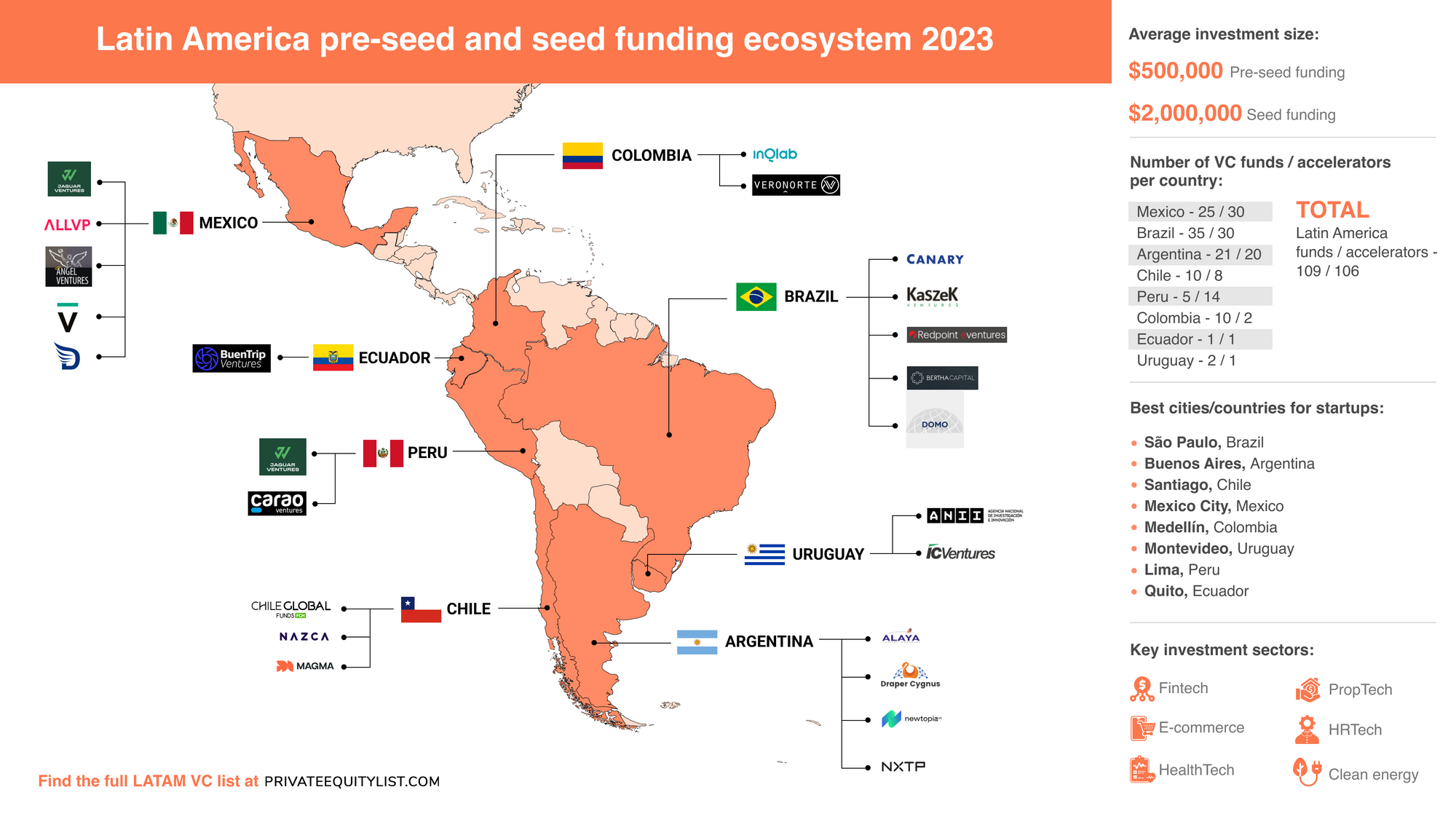

In this blog post, we will delve into the funding statistics, average investment sizes, key investment sectors, and explore the pre-seed and seed funding landscape in nine Latin American countries: Mexico, Brazil, Argentina, Chile, Peru, Colombia, Ecuador, and Uruguay.

Funding Statistics and Investment Size

Over the past few years, the startup ecosystem in Latin America has seen remarkable growth. According to a report by LAVCA, in 2022, venture capital investment in the region reached a record high of $7.8 billion, with a significant portion of it being directed towards early-stage startups. Pre-seed and seed funding rounds have become increasingly popular among investors due to the region's high potential for growth and untapped opportunities amounting to over $1 billion in 2022.

Average funding size

- Pre-seed funding rounds: $100,000 - $500,000 (with some outliers > $1 million)

- Seed funding rounds: from $1 mln to $5 mln, with an average of $1.7 million as per LAVCA report

Key Investment Sectors

Latin America's startup ecosystem is quite diverse, with numerous sectors showing promising growth. Some of the key investment sectors in the region include:

- 💰FinTech: Financial technology is witnessing tremendous growth in Latin America, with companies focusing on mobile payments, lending, and digital banking solutions.

- 🛍️E-commerce: The rise of e-commerce platforms has transformed the retail landscape in the region, making it an attractive sector for investors.

- 💉HealthTech: With an increased focus on healthcare and telemedicine, HealthTech startups have garnered substantial interest from investors.

- 📅HRTech: Use of technology and software solutions to streamline and enhance various human resources processes within organizations

- 🏠PropTech: Application of technology and innovation to transform and optimize the real estate and property industry

- 🍃Clean Energy : Startups focusing on renewable energy and sustainable practices are receiving attention as the region aims to tackle environmental challenges.

Let's now explore the pre-seed and seed funding landscape in each Latin American country.

🇲🇽Mexico (25 VC funds / 30 accelerators)

Mexico's startup scene has experienced remarkable growth in recent years, attracting both local and international investors. Some key pre-seed and seed VC funds in Mexico include:

You can find more funds here.

There are also about 30 accelerators you can apply in Mexico including Orion Startups, COLABORATIVOxSCALE and Venture I Batch 8.

🇧🇷Brazil (35 VC funds / 30 accelerators)

As the largest economy in Latin America, Brazil boasts a thriving startup ecosystem. Notable pre-seed and seed VC funds in Brazil include:

Find other funds via the link.

Brazil has also more than 30 accelerators, for example, Estarte.Me Accelerator, Outsource Brazil Boot Camp and Impactonomy Innovation Labs+.

🇦🇷Argentina (21 VC funds / 20 accelerators)

Argentina's startup ecosystem has seen significant growth, fueled by a pool of talented entrepreneurs. Key pre-seed and seed VC funds in Argentina include:

More funds here.

Here you can apply in 20 accelerators which include NXTP Application Form, Llamado abierto Embarca 2022 and Makers In.

🇨🇱Chile (10 VC funds / 8 accelerators)

Chile has become a regional hub for innovation and entrepreneurship, attracting investors from around the world. Notable pre-seed and seed VC funds in Chile include:

Find more investors in Chile here.

In Chile, there are 8 accelerators you may be interested in: NEXT Chile, Fundación Chile and Open IxDA Santiago are among them.

🇵🇪Peru (5 VC funds / 14 accelerators)

Peru's startup ecosystem is on the rise, with a growing number of ventures making their mark. Key pre-seed and seed VC funds in Peru:

You can search for more funds via the link.

Such accelerators as Toilet Board Coalition - 2024 Latam, 1551 Incubadora UNMSM, City Incubators and 10 more are operating in Peru.

🇨🇴Colombia (10 funds/ 2 accelerators)

Colombia has experienced significant growth in its entrepreneurial landscape, attracting interest from both local and international investors. Notable pre-seed and seed VC funds in Colombia include:

More venture funds in Colombia here.

It's also possible to apply in VelumInverlink and 3DS UNITEC accelerators in this country.

🇪🇨Ecuador (1 fund / 1 accelerator)

Ecuador's startup ecosystem is still relatively new but shows promising signs of growth. One notable VC in Ecuador:

All of Ecuador's venture capital funds are available via the link.

An accelerator named Innobis is open for applicants in Ecuador.

🇺🇾Uruguay (2 funds / 1 accelerator)

Uruguay's startup ecosystem may be small but is gaining momentum with support from the government and investors. Key pre-seed and seed VC funds in Uruguay include:

Find more funds here.

You can also apply to the Incubadora Sinergia accelerator in Uruguay.

Best cities for startups in Latin America

- São Paulo, Brazil: São Paulo is the economic hub of Brazil and offers a vibrant startup ecosystem. It boasts a diverse talent pool, access to venture capital, and a large consumer market.

- Buenos Aires, Argentina: Buenos Aires is known for its rich culture and emerging startup culture. It provides startups with access to funding, accelerators, and a growing network of entrepreneurs.

- Santiago, Chile: Santiago has a well-developed entrepreneurial ecosystem, supported by government initiatives and venture capital investments. The city offers a stable economy and a gateway to Latin American markets.

- Mexico City, Mexico: With a growing tech scene, Mexico City provides startups with a favorable business environment, access to investors, and a strong pool of skilled professionals.

- Montevideo, Uruguay: Montevideo offers a friendly regulatory environment and various incentives for startups, making it an attractive destination for entrepreneurs in the region.

- Lima, Peru: Lima's startup ecosystem is thriving, backed by its strategic location and a growing middle class, providing ample opportunities for startups in various sectors.

- Quito, Ecuador: the growing interest from investors and the availability of co-working spaces and incubators further contribute to the city's appeal. As the entrepreneurial community in Quito continues to evolve, it presents exciting opportunities for startups looking to tap into Ecuador's market and expand their reach in the region.

Key Trends in Latin American Pre-Seed and Seed Funding

The Latin American startup ecosystem is dynamic and ever-evolving, with several key trends shaping the pre-seed and seed funding landscape:

- Cross-Border Collaborations: Startups in the region are increasingly forming cross-border collaborations to expand their markets and reach new audiences.

- Social Impact Focus: Many investors are showing a growing interest in startups that address social and environmental issues, contributing to sustainable development.

- Rise of Female Founders: Latin America has seen a surge in female-led startups, and investors are actively supporting gender diversity in the entrepreneurial ecosystem.

- Government Support: Governments across Latin America are providing support through grants, tax incentives, and programs to foster innovation and entrepreneurship.

- Continued Interest from International Investors: The region's potential for high returns continues to attract international venture capital firms looking to diversify their portfolios.

In conclusion, Latin America is witnessing a remarkable surge in startup funding, with venture capital investment reaching a record $7.8 billion in 2022. Key sectors like FinTech, E-commerce, and HealthTech are attracting significant interest. Countries like Mexico, Brazil, Argentina, Chile, Peru, Colombia, Ecuador, and Uruguay have thriving startup ecosystems. Although ecosystems of some regions are still in their early stages, they show potential with growing investor interest and supportive resources for startups.

_________

If we missed some funds, please add them using the link https://privateequitylist.com/investors/create

Thank you!