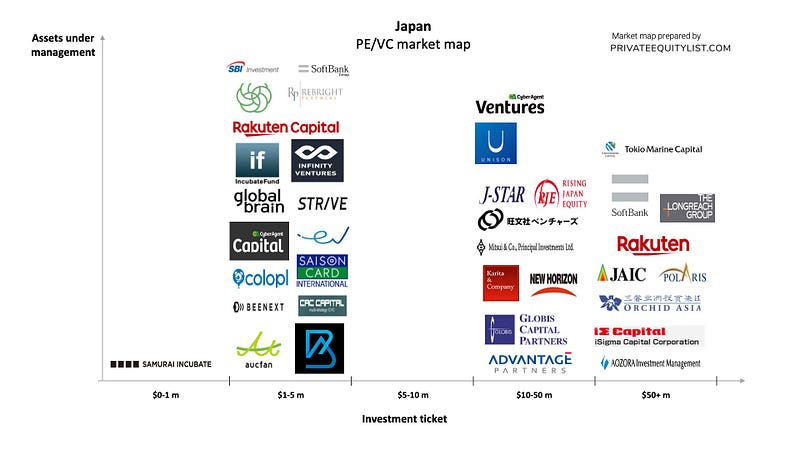

Japan private equity and venture capital (PE & VC) market map

We compiled an extensive Japan private equity (PE) and venture capital (VC) market map that shows key Japan investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Japan has a large tech-savvy domestic market. This is both the luck and the demon for start-ups. Japanese entrepreneurs are too focused on the local market. They can succeed easily but can not grow internationally. Online marketplace Mercari is the first successful unicorn in Japan however they failed to continue their success in the US market. To tackle this Japanese government launched J-startup program to help local startups grow in overseas markets. Japanese Venture Capital funds and Angel Investors are highly risk aversive and usually prefer to invest in domestic-market focused start-ups. In terms of available funds to invest, Japan is a promising market. Japanese start-ups received $3.5 billion investment in 2018 while that amount was $586 million in 2012. Sansan, Japan Taxi, Folio, Freee are among the major start-ups that received venture capital. Fintech, Healthtech and AI are the hottest industries. Softbank and its $100 billion Vision Fund with its massive investments in global start-ups such as Uber, WeWork have changed the investment landscape in Japan. Long established conglomerates like KDDI, Mitsubishi UFJ Financial Group, Tokyu Corporation followed suit and began to invest in tech startups.

The funds present on the market maps are:

- Advantage Partners

- Aozora Investment Management Co., Ltd

- Aucfan

- BAce Capital

- Beenext Capital

- CAC Capital

- Colopl Next

- Credit Saison

- CyberAgent Capital

- CyberAgent Ventures

- East Ventures

- Global Brain

- Globis Capital Partners

- Gree Ventures

- Incubate Fund

- Infinity Venture

- ISigma Capital Corp.

- J-STAR Co. Ltd.

- Japan Asia Investment Co. Ltd.

- Karita and Company, Inc.

- Mistletoe

- Mitsui Principal Investments

- New Horizon Capital Co. Ltd.

- Obunsha Ventures

- Orchid Asia Group

- Polaris Capital Group Co., Ltd.

- Rakuten Capital

- Rakuten Global

- Rebright Partners

- Rising Japan Equity, Inc.

- Samurai Incubate Africa

- SBI Investment

- Softbank

- Softbank Vision Fund

- The Longreach Group Ltd.

- Tokio Marine Capital Co., Ltd.

- Unison Capital, Inc.

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Japan go to Japan PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team