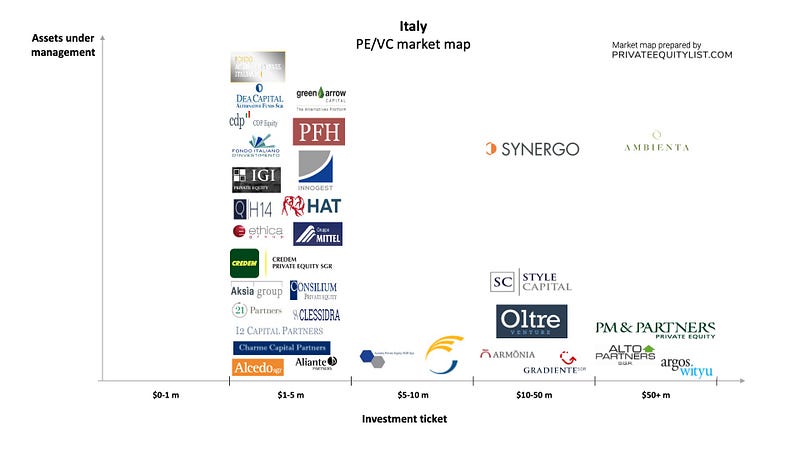

We compiled an extensive Italy private equity (PE) and venture capital (VC) market map that shows key Italy investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Italy lags behind in terms of venture capital-backed startup ecosystem due to its conservative economic structure. However, there is a significant increase in venture capital and angel investments recently. Despite Rome being the capital city, the country’s economic powerhouses Lombardia and Piedmonte regions lead the way both in terms of investment funds and startups. Milan and Turin are the two major hubs in these regions, while the latter pushing hard to become a prominent smart city and a hotbed for tech startups. Italian venture capital industry is nascent compared to its European peers. Innogest Capital, P101, United Ventures, LVenture Group are among the most active players. Italian Angels for Growth is the main angel investor network. Fintech, e-commerce, Biotech, and Medtech are top fields that attract venture capital and angel investors most. Italian Startup Act was launched in 2012 to nurture innovation and attract more entrepreneurs. It has tax incentives for investors. Getting an entrepreneur visa and setting up a new company became easier. National agency to attract foreign investors, Invitalia, provides interest-free loans with innovative startups for projects up to 1.5 million euros. In 2018, startups raised $580 million in funds. The total amount of private equity and venture capital investments was $10.9 billion. Two-thirds of this amount were made through mega deals of CVC Capital Partners, PSP, StepSton3, Alpinvest, GIP and KKR. Bain Capital and Tamburi Investment Partners were among the mid-market investors.

The funds present on the market maps are:

- 21 Partners

- Aksìa Group SGR S.p.A.

- Alcedo SGR S.p.A.

- Aliante Partners

- Alto Partners SGR S.p.A.

- Ambienta SGR

- Argos Soditic

- Armònia SGR

- Assietta Private Equity SGR Spa

- CDP Equity

- Charme Capital Partners

- Charme Capital Partners

- Consilium Sgr

- Credem Private Equity SGR

- DeA Capital Alternative Funds SGR

- Emisys Capital SGRpA

- Ethica Global Investments

- Fondo Agroalimentare Italiano

- Fondo Italiano d’Investimento SGR

- Gradiente SGR S.p.A.

- Green Arrow Capital SGR

- Gruppo Mittel Private Equity

- H14

- HAT Orizzonte SGR SpA

- I2 Capital Partners SGR SpA

- IGI Sgr S.p.a

- Innogest

- Oltre Venture

- PFH Palladio Holding

- PM & Partners SGR SpA

- Style Capital SGR SpA

- Synergo SGR

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Italy go to Italy PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team