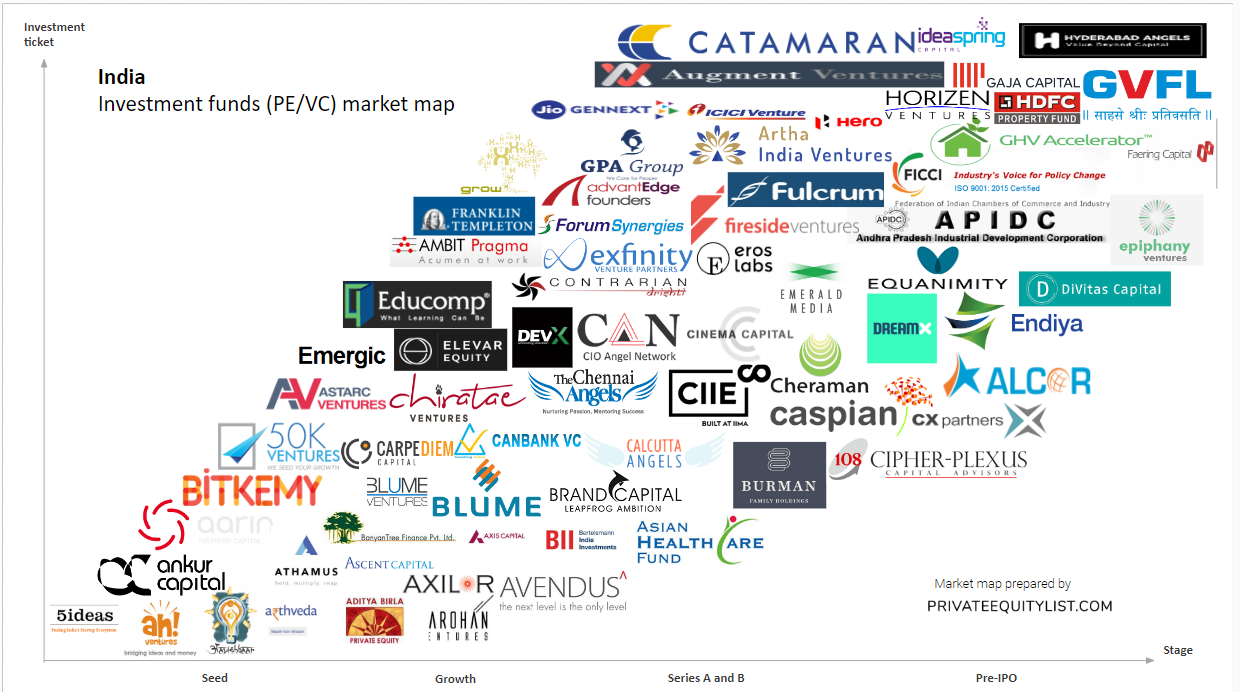

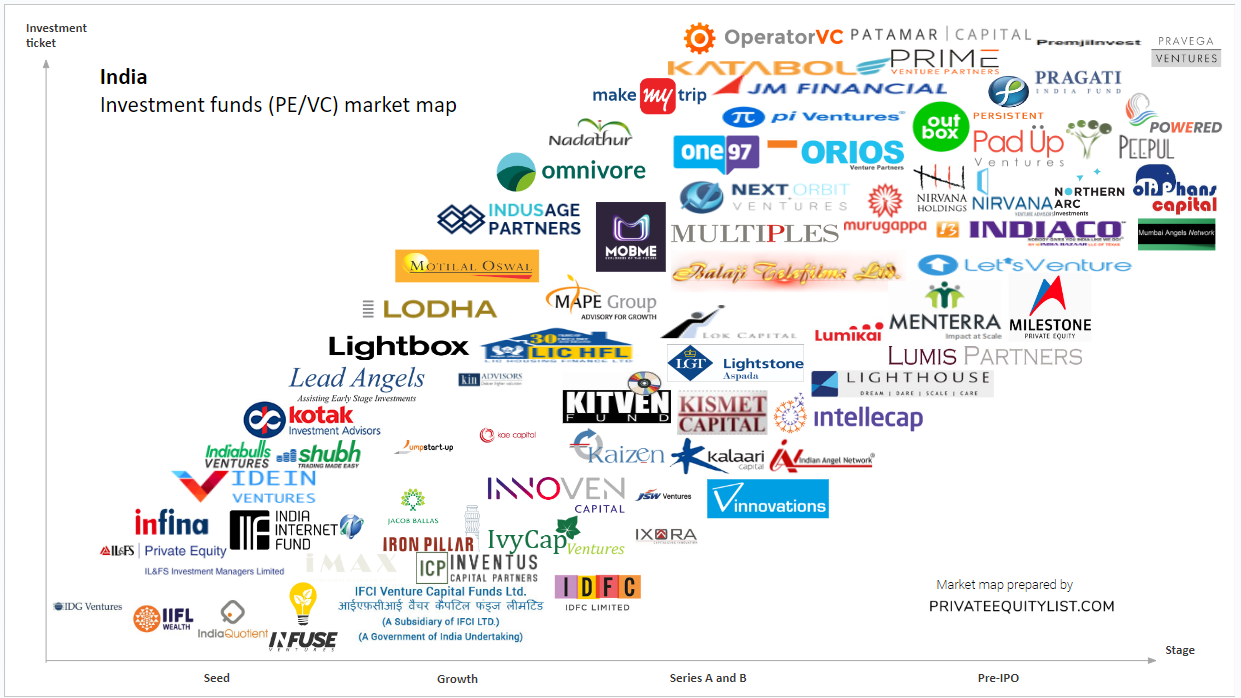

India private equity and venture capital (PE & VC) Funds market map with focus on small/mid cap funds

We compiled an extensive India private equity (PE) and venture capital (VC) market map that shows key India investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

India market overview (market map is below it):

In recent years, India has emerged as a thriving hub for startups and a hotbed for venture capital and private equity investments. With a plethora of promising opportunities, investors are flocking to this vast and diverse market. In this blog post, we'll delve into the exciting world of India's PE/VC funds and highlight key market trends in each region. From valuation to startup growth stages like Series A and Series B, and the vital role of accelerators, let's unravel the secrets to success in the Indian startup ecosystem.

Mumbai - The Financial Capital:

- Mumbai, home to India's bustling financial district, boasts a vibrant startup scene.

- Valuations in Mumbai are among the highest in the country, making it an attractive destination for investors.

- Series A investments in Mumbai-based startups have witnessed tremendous growth, reflecting the city's strong entrepreneurial spirit.

- Prominent accelerators and incubators in Mumbai provide mentorship and resources to nurture early-stage startups.

Bengaluru - The Silicon Valley of India:

- Bengaluru, often referred to as India's Silicon Valley, has a thriving ecosystem fueled by tech innovation.

- Startup valuations in Bengaluru are skyrocketing, reflecting the city's robust tech infrastructure and talent pool.

- Series B investments in Bengaluru-based startups have witnessed remarkable growth, indicating the city's ability to nurture companies beyond the initial stages.

- Accelerators in Bengaluru play a crucial role in providing startups with mentorship, networking opportunities, and access to funding.

Delhi-NCR - The Startup Capital:

- The Delhi-NCR region encompasses Delhi, Gurugram, and Noida, collectively forming the startup capital of India.

- Startups in Delhi-NCR have garnered significant attention from investors due to their diverse range of industries, including e-commerce, fintech, and edtech.

- The region has seen a surge in Series A funding, indicating investor confidence in the growth potential of Delhi-NCR startups.

- Accelerators in Delhi-NCR act as catalysts for startup success, offering structured programs to accelerate growth and expand networks.

Hyderabad - The Emerging Tech Hub:

- Hyderabad has emerged as a thriving destination for tech startups, particularly in areas like biotech, healthtech, and AI.

- Valuations in Hyderabad are on the rise, showcasing the city's technological prowess and innovation.

- Series B investments in Hyderabad-based startups are witnessing steady growth, reflecting investor confidence in the city's ecosystem.

- Accelerators in Hyderabad provide startups with crucial support, mentorship, and access to industry networks.

In conclusion, as India continues to embrace the startup revolution, PE/VC funds have become instrumental in fueling innovation and driving economic growth. Mumbai, Bengaluru, Delhi-NCR, and Hyderabad stand out as key regions where startup ecosystems are flourishing, attracting investments at various growth stages. Valuations, Series A and Series B funding, and the role of accelerators play pivotal roles in shaping India's vibrant startup landscape. By keeping a pulse on these market trends, investors can navigate the Indian market successfully while entrepreneurs can leverage the opportunities presented by these dynamic regions.

The funds present on the market maps are:

- 50k Ventures

- 5ideas Inc.

- Aarin Capital

- Aarohan Ventures

- Aavishkaar Venture Management Services

- Aditya Birla Private Equity

- AdvantEdge

- Ah! Ventures

- ALCOR Fund

- Alteria Capital

- Ambit Pragma Advisors LLP

- Ankur Capital

- APIDC Venture Capital Ltd.

- Artha India Ventures

- ArthVeda Fund Management Pvt. Ltd

- Ascent Capital Advisors

- Asian Healthcare Fund

- Astarc Ventures

- Athamus Ventures

- Augment Ventures (India)

- Avendus PE Investment Advisors

- Axilor Ventures

- Axis Private Equity Ltd.

- Banyan Tree Finance Pvt. Ltd.

- Baring Private Equity Partners India Pvt. Ltd.

- BCP Advisors Pvt. Ltd.

- Bertelsmann India Investments

- Bharti Airtel Ltd

- Bitkemy Ventures

- Blue River Capital India Advisory Services Pvt. Ltd.

- Blume Venture Advisors

- Blume Ventures

- Brand Capital

- Broadbean Capital

- Burman Family Holdings

- Calcutta Angels

- Canbank Venture Capital Ltd.

- Carpediem Advisors

- Caspian Advisors Private Limited

- Catamaran Investment Pvt Ltd

- Catamaran Ventures

- Centre for Innovation Incubation and Entrepreneurship

- Chennai Angels

- Cheraman Financial Services Ltd

- Chiratae Ventures

- Cinema Capital

- CIO Angel Network

- Cipher-Plexus Ventures

- Contrarian Drishti Partners

- CX Partners

- DevX Venture Fund

- Divitas Capital

- DreamX

- Educomp Investment Management Limited

- Elevar Equity LLC

- Emerald Media

- Emergic Ventures

- Endiya Partners

- Epiphany Ventures

- Equanimity Investments

- Eros Labs

- Exfinity Ventures

- Faering Capital

- FICCI Investment Arm

- Fireside Ventures

- Forum Synergies (India) PE Fund

- Franklin Templeton Investments (India)

- Fulcrum Venture India

- Gaja Capital

- Gennext Ventures

- GHV Accelerator

- GPA Group

- GrowX Venture Management

- GVFL Ltd

- HDFC Property Ventures Limited

- Hero MotoCorp Ltd.

- Horizen Ventures Management

- Hyderabad Angels

- ICICI Venture

- Ideaspring Capital

- Idein Ventures

- IDFC

- IDG Ventures

- IFCI Venture Capital Funds

- IIFL

- IL&FS Investment Managers Limited

- Incube Ventures Pvt Ltd

- India Internet Fund

- India Quotient

- Indiabulls Ventures

- Indiaco Ventures Ltd

- Indian Angel Network

- IndiaNivesh Fund

- Indus Balaji

- IndusAge Partners

- Infina Finance

- Infuse Ventures

- Innovations Investment Management India Private Limited

- InnoVen Capital India

- Intellecap Impact Investment Network

- Interfacemax Blockchain Group

- Inventus Capital Partners

- Iron Pillar

- IvyCap Ventures

- Ixora Ventures

- Jacob Ballas Capital India Pvt. Ltd.

- JM Financial Investment Managers Limited

- JSW Ventures

- Jumpstartup Venture Capital

- Kae Capital

- Kaizen Private Equity

- Kalaari Capital

- Karnataka Asset Management Company

- Katabole Technology Venture

- Kin Advisors

- Kismet Capital

- Kotak Private Equity Group

- Lead Angels Network

- LetsVenture

- LGT Lightsone Aspada

- LIC Housing Finance Ltd

- Lightbox Management Ltd

- Lighthouse Advisors India Private Limited

- Lodha Group’s Startup Investment Fund

- Lok Capital Group

- Lumikai Ventures

- Lumis Partners

- MakeMyTrip Limited

- MAPE Advisory Group

- Menterra Venture Advisors

- Milestone Capital Advisors Ltd.

- MobME Wireless Solutions

- Motilal Oswal Private Equity Advisors Pvt. Ltd.

- Multiples Alternate Asset Management Pvt. Ltd.

- Mumbai Angels

- Murugappa Family Group

- Nadathur Estates

- Native Angel Network

- Nazara Technologies

- Next Orbit Ventures Fund

- Nirvana Holdings

- Nirvana Venture Advisors

- Northern Arc Investment Manager

- Oliphans Capital

- Omnivore Partners

- One97 Communications

- OperatorVC

- Orios Venture Partners

- Outbox Ventures

- Padup Ventures

- Patamar Capital

- Peepul Capital LLC

- Persistent Systems

- Pi Ventures

- Powai Lake Ventures

- Powered Accelerator

- Pragati India Fund Pvt. Ltd.

- Pravega Ventures

- PremjiInvest

- Prime Venture Partners

For more information on India investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC India funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team