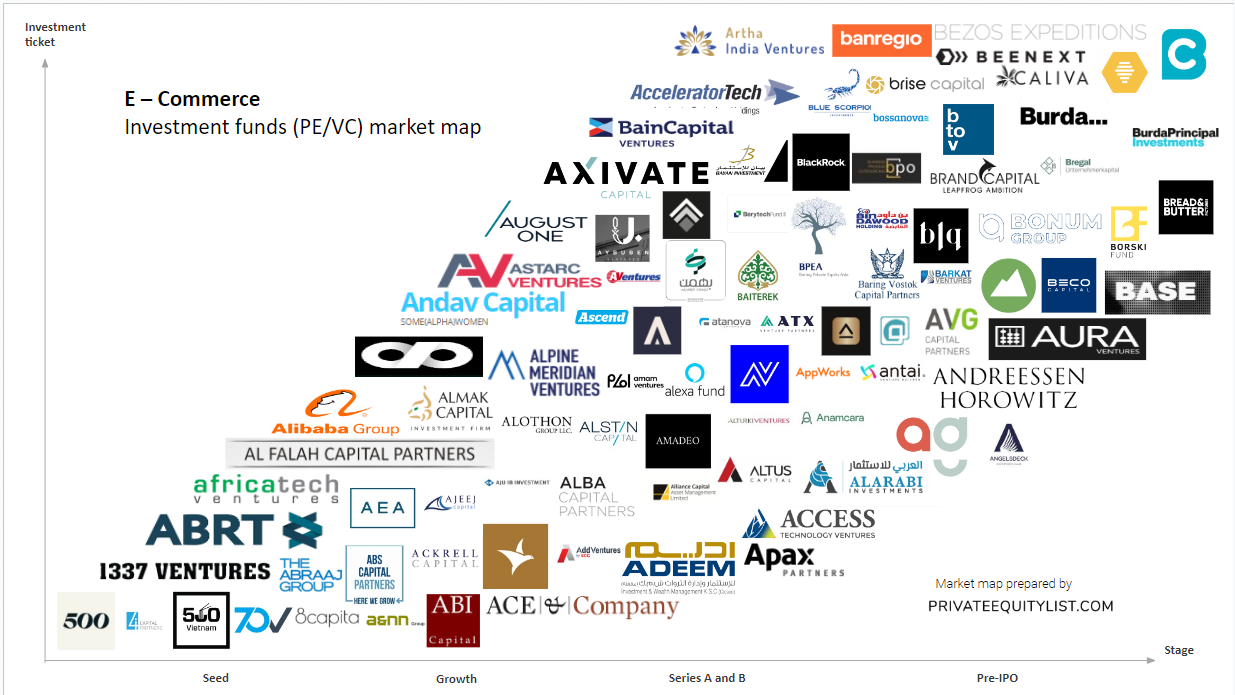

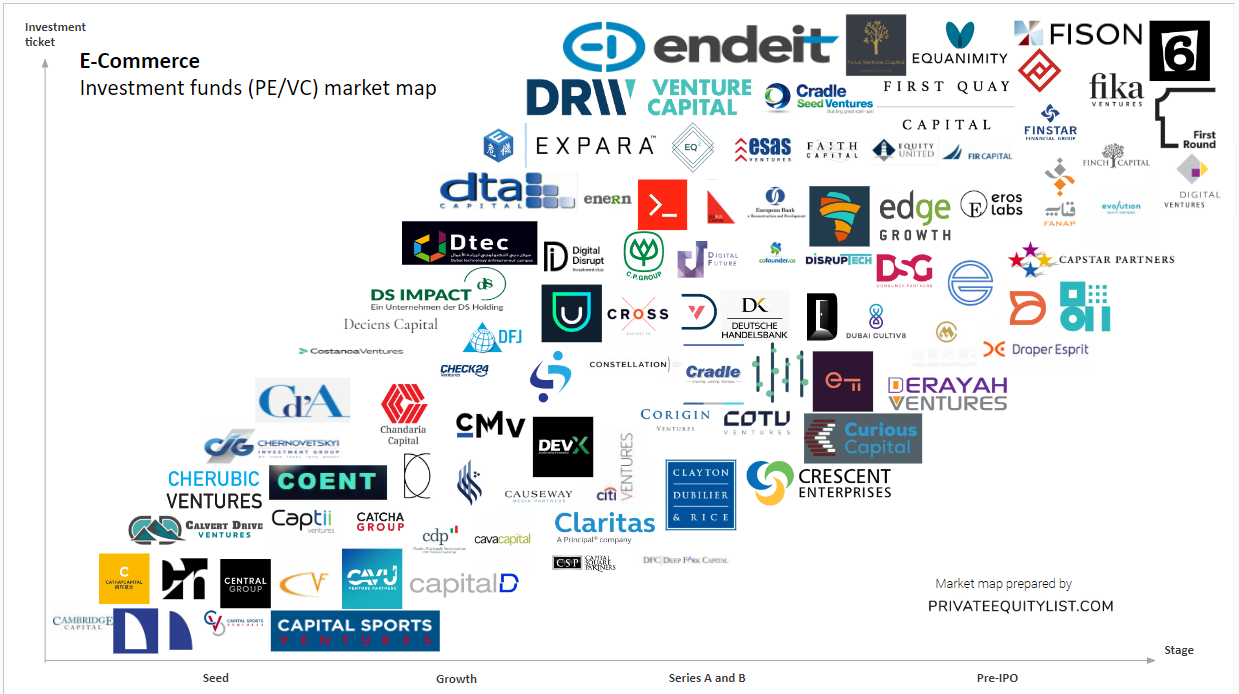

We compiled an extensive E-Commerce private equity (PE) and venture capital (VC) market map that shows key E-Commerce investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

E-Commerce market overview (market map is below it):

In the dynamic world of E-commerce, private equity and venture capital funds play a vital role in fueling the growth of startups. These funds provide financial backing and support to promising ventures, enabling them to thrive and achieve their full potential. In this blog post, we will delve into the exciting realm of E-commerce PE/VC funds, uncovering the key market trends prevalent in various regions across the globe. From valuations to startup accelerators, Series A to Series B investments, we will explore it all. Let's get started!

North America:

- Valuation frenzy: E-commerce startups in North America have been witnessing sky-high valuations as investors vie to secure their share in the rapidly growing market.

- Thriving startup ecosystem: The region boasts a robust ecosystem of accelerators and incubators that nurture E-commerce startups, providing mentorship, resources, and early-stage funding.

- Series A investments: VC funds in North America are actively investing in Series A rounds, recognizing the potential of innovative E-commerce ventures and their ability to disrupt traditional retail models.

- Series B funding surge: Established E-commerce startups in North America are experiencing a surge in Series B funding, allowing them to scale their operations and expand their market reach.

Europe:

- Rise of social commerce: European E-commerce startups are leveraging the power of social media platforms to drive sales and engage with their target audience, revolutionizing the concept of social commerce.

- Cross-border expansion: With the European Union providing a unified market, E-commerce ventures are increasingly focused on expanding their operations across borders, capitalizing on the vast customer base available.

- Growing interest in sustainability: European consumers are placing greater emphasis on sustainability, prompting E-commerce startups to adopt eco-friendly practices and showcase ethically sourced products.

- VC funds backing Series A: European investors are actively participating in Series A funding rounds, identifying promising startups and supporting their growth trajectory.

Asia:

- Mobile-first approach: E-commerce in Asia is predominantly driven by mobile devices, with startups tailoring their strategies to cater to the growing population of smartphone users.

- Rapid adoption of digital wallets: The region's E-commerce landscape is witnessing a surge in digital wallet usage, with startups integrating popular payment platforms to streamline transactions and enhance customer convenience.

- Accelerating in emerging markets: VC funds are increasingly eyeing emerging markets in Asia, recognizing the untapped potential of nascent E-commerce ecosystems and seeking early-stage investment opportunities.

- Series B investments on the rise: Established Asian E-commerce startups are securing significant Series B investments, paving the way for market expansion and technological innovation.

In Conclusion, E-commerce PE/VC funds are instrumental in driving the growth and innovation within the global E-commerce landscape. While North America experiences valuation frenzies and Europe focuses on sustainability and cross-border expansion, Asia takes a mobile-first approach and explores emerging markets. By understanding these key market trends, entrepreneurs and investors can navigate the E-commerce landscape effectively, capitalizing on the opportunities that each region offers. As the E-commerce industry continues to evolve, staying abreast of these trends is crucial for success.

The funds present on the market maps are:

- 1337 Ventures

- 4i Capital Partners

- 500 Istanbul

- 500 Mena

- 500 Startups Vietnam

- 70 Ventures Accel

- 8Capita

- A&NN Investments

- Ab Initio Capital

- Abraaj

- ABRT

- ABS Capital Partners

- Abu Dhabi Investment Office

- Accelerator Technology Holdings

- Access Technology Ventures

- ACE and Company

- Ackrell Capital

- Active Venture Partners

- AddVentures by SCG

- Adeem

- Adfirst.vc

- AEA Investors

- Africa Tech Ventures

- Ajeej Capital

- Aju IB Investment

- Al Falah Capital Partners

- Alarabi Investemnts

- Alba Capital Partners

- Alibaba Group

- All Iron Ventures

- Alliance Capital Asset Management Limited

- Almak Capital

- Alothon Group LLC

- Alpine Meridian Ventures

- Alstin Capital

- Alturki Ventures

- Altus Capital

- Amadeo

- Amam Ventures

- Amazon Alexa Fund

- Amereus

- Anamcara Capital

- Andav Capital

- Andreessen Horowitz

- Angels Deck Investor Club

- Antai Venture Builder

- Apax Digital

- AppWorks

- ArFintech

- Artha India Ventures

- Arx Equity Partners

- Ascend

- Ascension Ventures

- Astarc Ventures

- Asyaf Investment

- Atanova Venture

- Athletic Ventures

- ATX Venture Partners

- August One

- Aura Venture Fund

- AVentures Capital

- AVG Capital Partners

- Axivate Capital

- Aybuben Ventures

- b10.vc

- Bahman Capital

- Bain Capital Ventures

- Baiterek

- Banregio

- Baring Private Equity Asia

- Baring Vostok

- Barkat Venture

- Base Venture Partners, LLC

- Basecamp Fund

- Bayan Investment Company

- Beco Capital

- BEENEXT

- Beenext Capital

- Benson Oak Capital

- Berytech Fund II

- Beyond Capital

- Bezos Expeditions

- BinDawood Holdings

- BlackRock Private Equity Partners

- Blq Invest

- Blue Scorpion Investments

- Bonum Group AMC

- Borski Fund

- Bossanova

- BPO Invest Group

- Brand Capital

- Bread and Butter

- Bregal Unternehmerkapital

- Brise Capital

- btov Partners

- Bumble Fund

- Burda Principal Investments

- Burdadigital

- Cabra VC

- Caliva

- Calvert Drive Ventures

- Cambridge Capital

- Caphorn

- CapHorn Invest

- Capital D

- Capital Indigo

- Capital Sports Ventures

- Capital Sports Ventures

- Capital Square Partners

- Capnamic Ventures

- Capstar Ventures

- Captii Ventures

- Catcha Group

- Cathay Capital Private Equity

- Causeway Media Partners

- Cava Capital

- Cavu Venture Partners

- Cayuga Venture Fund

- CDP Venture Capital

- Central Group of Company

- Centrum Capital

- Chalhoub Group

- Chandaria Capital

- Charoen Pokphand Group

- Check24 Ventures

- Chernovetskyi Investment Group

- Cherubic Ventures

- China Merchants Capital

- Citi Ventures

- Claritas Investimentos

- Clayton Dubilier & Rice

- CM Ventures

- Co-Investor AG

- Coent Venture Partners

- CoFounder

- Communitas Capital

- Community Investment Management

- Compagnie d'Anjou SAS

- Constellation Asset Management Company Limited.

- Corigin Ventures

- Costanoa Ventures

- Cotu Ventures

- Cradle Fund Sdn Bdh

- Cradle Seed Ventures

- Crescent Investments

- Cross Culture Venture Capital

- Curious Capital

- Daal

- Deciens

- Deep Fork Capital

- Defy Ventures

- Denis Afinco

- DEPO Ventures

- Derayah VC

- Deutsche Handelsbank

- DevX Venture Fund

- Digital Disrupt

- Digital Future

- Digital Spring Ventures

- Digital Ventures

- Diligent Capital Partners

- Disruptech

- Draper Espirit

- Draper Fisher Jurvetson International Inc

- DRW Venture Capital

- DS Invest

- DSG Consumer Partners

- DTA Capital

- Dtec Ventures

- Dubai Cultiv8

- Entrepreneur First

- EQ2 Ventures

- Equanimity Investments

- Equity United

- Eros Labs

- Esas Ventures

- Evolution Equity Partners

- Expara Ventures

- Faith Capital

- FANAP

- Faster Capital

- Ficus Venture Capital

- Fika Ventures

- Finch Capital

- Finstar Financial Group

- Finstart Nordic

- FIR Capital

- First Quay Capital

- First Round Capital

- First Track

- FISON

- FitLab

- Flat6labs

For more information on E-Commerce investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC E-Commerce funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team