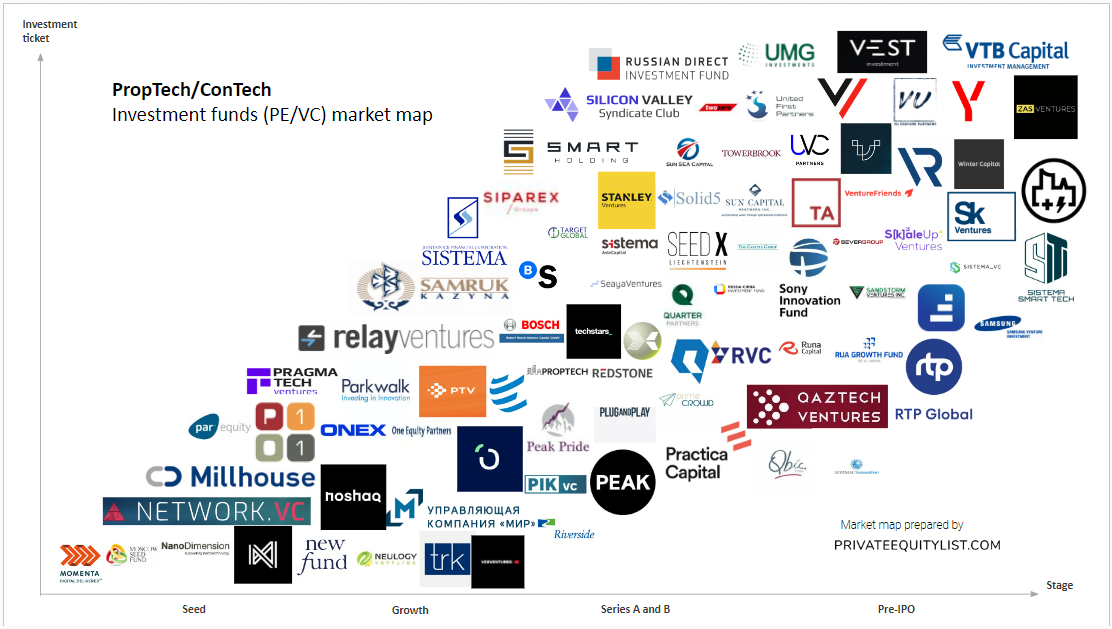

PropTech/ConTech (Property Technology) private equity and venture capital (PE & VC) Funds market map with focus on small/mid cap funds

We compiled an extensive PropTech/ConTech private equity (PE) and venture capital (VC) market map that shows key PropTech/ConTech investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

PropTech/ConTech market overview (market map is below it):

Property Technology (PropTech) and Construction Technology (ConTech) are rapidly growing sectors, attracting significant investments from private equity (PE) and venture capital (VC) funds globally. With the rise of smart cities, the adoption of innovative technologies like the Internet of Things (IoT), and the increasing demand for sustainable buildings, PropTech and ConTech are poised for explosive growth in the coming years. Here are some of the key trends in each region:

North America:

- The PropTech market is expected to reach a valuation of $20 billion by 2020.

- PE and VC funds are investing heavily in startups that offer innovative solutions for real estate management, such as property management software and virtual reality tools for property viewing.

- Accelerators like MetaProp NYC are helping early-stage PropTech startups to secure funding and grow their businesses.

- Series A and Series B funding rounds are becoming increasingly common in the PropTech and ConTech sectors.

Europe:

- The PropTech market in Europe is expected to reach a valuation of €6.5 billion by 2023.

- The UK is a hotbed for PropTech startups, with London-based companies like Nested and Plentific securing significant investments in recent years.

- ConTech startups are also gaining traction in Europe, with companies like Buildots and HoloBuilder offering innovative solutions for construction project management and site inspections.

- The European Investment Fund (EIF) has launched a €700 million fund to support startups in the PropTech and ConTech sectors.

Asia:

- The PropTech market in Asia is expected to reach a valuation of $20 billion by 2023.

- China is leading the way in PropTech investment, with companies like Ke.com and 5i5j securing significant funding rounds.

- ConTech startups are also gaining momentum in Asia, with companies like Bridgetek and Zatpat offering solutions for construction site safety and productivity.

- Singapore's government-backed startup accelerator, JTC LaunchPad, is supporting PropTech and ConTech startups with funding and mentorship programs.

In conclusion, the PropTech and ConTech sectors are rapidly growing and attracting significant investments from PE and VC funds globally. With the adoption of innovative technologies and the increasing demand for sustainable buildings, these sectors are poised for explosive growth in the coming years. Startups in the PropTech and ConTech sectors should focus on securing Series A and Series B funding rounds, leveraging accelerators for support, and offering innovative solutions for real estate and construction management.

The funds present on the market maps are:

- 4i Capital Partners

- 500 Istanbul

- A/O Proptech

- A&M Capital

- ABS Capital Partners

- Abu Dhabi Investment Office

- ACE and Company

- AdamTech Ventures

- AEA Investors

- All Iron Ventures

- Alstin Capital

- Alturki Ventures

- Amazon Alexa Fund

- Amethyst Capital

- Angel CoFund

- Angels Deck Investor Club

- Arkley Brinc VC

- Astrog

- Atanova Venture

- Avenir

- Axeleo

- Bain Capital Ventures

- Beyond Capital

- Bezos Expeditions

- Bitstone Capital

- BlackRock Private Equity Partners

- BPO Invest Group

- Cabra VC

- Calm/Storm Ventures

- Citi Ventures

- Clarendon Fund Managers

- Clave

- Clayton Dubilier & Rice

- Clout Capital

- Club degli Investitori

- Constantia New Business

- Contrarian Ventures

- Corigin Ventures

- Correlation Ventures

- Corten Capital

- Crescent Investments

- Curve Capital

- Delta Partners

- Denis Afinco

- Digital Future

- Earlybird Venture Capital

- Emerald Technology Ventures

- Emkan Capital

- Entrepreneur First

- EquityPitchers Ventures

- Eureka Venture

- Fairpoint Capital

- Faster Capital

- Foundamental

- Franz Haniel & Cie

- Future Energy Ventures

- GB & Partners

- Genome Ventures

- Giant Ventures

- Green Innovations

- HCVC

- Helen Ventures

- Hellman & Friedman

- High-Tech Grunderfonds

- Hiventures

- ICLUB

- ICU

- Iliad Partners

- Impulse VC

- Industry 4.0

- Internet Initiatives Development Fund (IIDF)

- Investissement Quebec

- Irdi Soridec Gestion

- Italian Angels for Growth

- Jet Investment

- JIMCO

- KamaFlow Business Launcher

- Keiretsu Forum

- Kima Ventures

- KK Fund

- Leta Capital

- Levine Leichtman Capital Partners

- LongWall Ventures

- LUMUS Investment Collective

- Lviv Tech Angels

- Maersk Growth

- Marlin Equity Partners

- Martlet Capital

- Mercia Asset Management

- MIG Verwaltungs AG

- Millhouse

- MIR

- Momenta Ventures

- Moscow Seed Fund

- ND Capital

- Network VC

- Neulogy Ventures

- Newfund Capital

- Next47

- Noshaq

- One Equity Partners

- Onex

- Outliers VC

- P101

- Par Equity

- Parkwalk Advisor

- Partech Ventures

- Peak Capital

- Peak Pride

- PIK Ventures

- Plug and Play Tech Center

- Practica Capital

- Pragmatech Ventures

- primeCROWD

- Proptech1 Ventures

- Prospective Technologies PTV

- Q Partners

- QazTech Ventures

- Qbic Fund

- Quantonation

- Redstone

- Relay Ventures

- Robert Bosch Venture Capital

- ROCA X Verified

- RTP Global

- Rua Growth Fund

- Runa Capital

- Russia-China Investment Fund

- Russian Venture Company (RVC)

- Sabadell Venture Capital

- Samruk-Kazyna

- Samsung Venture Investment

- Sandstorm Ventures

- Sber

- Seaya Venture

- Seed X Liechtenstein

- Severgroup

- Siparex Group

- Sistema Asia Capital

- Sistema PJSFC

- Sistema SmartTech

- Sistema_VC

- SkaleUp Ventures

- Skolkovo Ventures

- Smart Infastructure Ventures

- Smart-Holding

- Sofimac Innovation

- Solid5

- Sony Innovation Fund

- Stanley Ventures

- Sun Capital Partners

- Sun SEA Capital

- Surplus Invest

- SVSY Club

- Swiss Immo Lab

- Synergies Capital

- TA Associates

- Target Global

- Techstars

- The Carlyle Group

- The Riverside Company

- The Russian Direct Investment Fund (RDIF)

- TowerBrook Capital

- TRK Group

- twozero Ventures

- UMG Investment

- United First Partners Fintech

- Unternehmertum Venture Capital Partners

- VEB Ventures

- VentureFriends

- Vest Investment

- Vito Ventures

- Voima Ventures

- VR Ventures

- VTB Capital Investment Management

- VTB Capital Private Equity

- VTB Capital Private Equity and Special Situations

- VU Venture Partners

- Winter Capital

- Yandex

- ZAS Ventures

For more information on PropTech/ConTech investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC PropTech/ConTech funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team