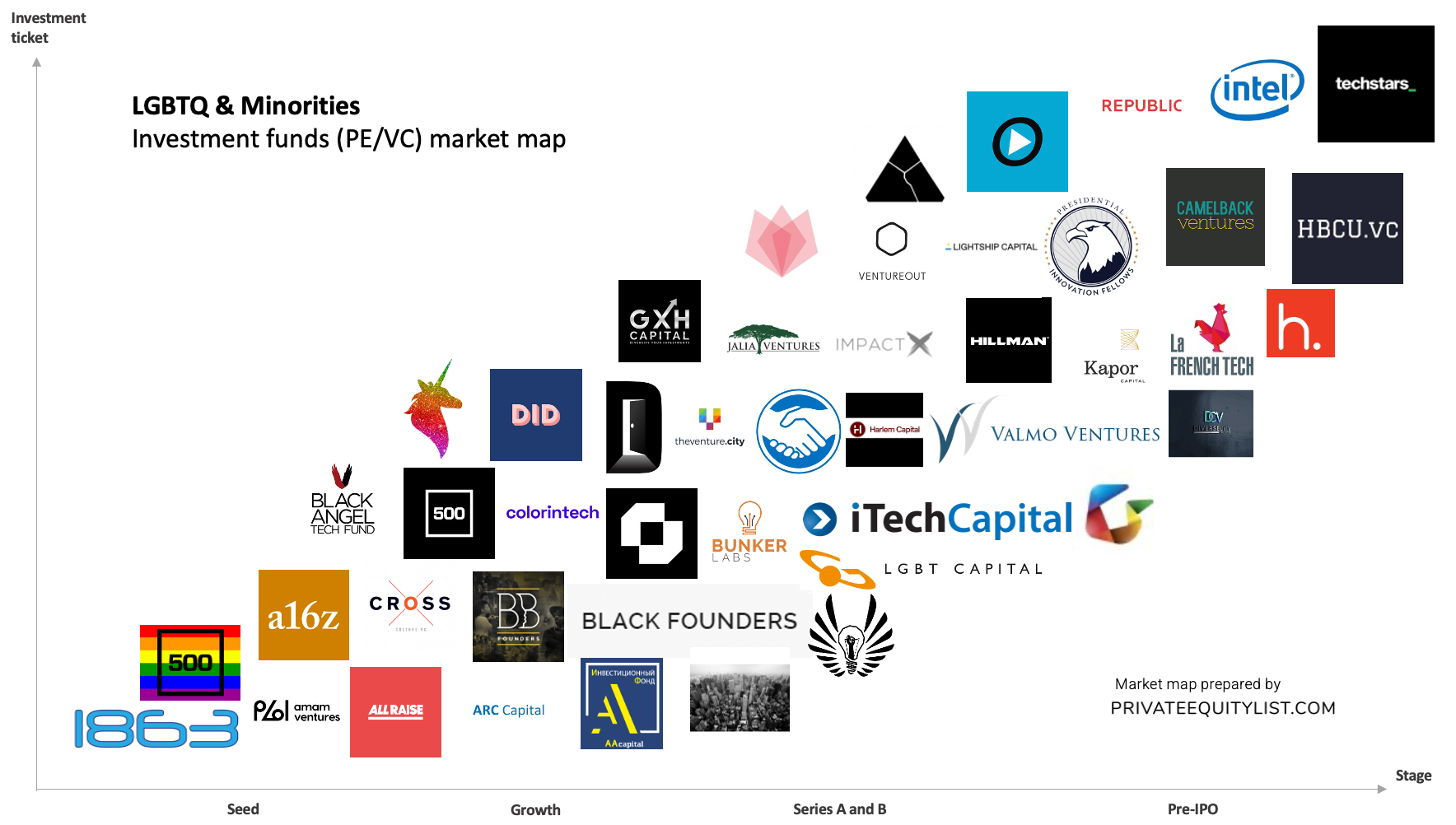

We compiled an extensive LGBTQ & Minorities private equity (PE) and venture capital (VC) market map that shows key LGBTQ & Minorities investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

LGBTQ & Minorities market overview (market map is below it):

In recent years, the world of private equity (PE) and venture capital (VC) has witnessed a remarkable shift towards inclusivity and diversity. One significant area of focus has been the emergence of LGBTQ and minority-focused funds, aiming to support startups belonging to these communities. In this blog post, we will delve into the key market trends of LGBTQ and Minorities PE/VC funds across different regions, shedding light on their impact and growth. Let's embark on this journey of innovation and inclusion!

North America:

- Rising Valuations: LGBTQ and minority-led startups in North America are experiencing a surge in valuations, driven by increased investor interest and recognition of their unique perspectives and market opportunities.

- Series A Support: Numerous LGBTQ and minority-focused funds have been actively investing in early-stage startups, providing vital Series A funding to fuel growth and expansion.

- Accelerator Programs: Accelerators tailored specifically for LGBTQ and minority entrepreneurs have gained popularity, offering mentorship, resources, and networking opportunities to foster success.

- Series B Momentum: LGBTQ and minority-led firms that have successfully secured Series A funding are witnessing a strong momentum in Series B rounds, attracting larger investments and enabling scale.

Europe:

- Diverse Investor Landscape: European PE/VC funds have been actively diversifying their portfolios by investing in LGBTQ and minority-led startups, acknowledging the potential for innovation and market disruption.

- Government Support: Several European countries have introduced initiatives and grants aimed at supporting LGBTQ and minority entrepreneurs, fostering a vibrant ecosystem for startups to thrive.

- Incubation Programs: Incubators catering to the LGBTQ and minority communities have emerged, offering guidance, infrastructure, and access to capital to nurture early-stage ventures.

- Cross-border Collaborations: Partnerships between European and North American LGBTQ and minority-focused funds are on the rise, fostering international connections and enabling access to a broader pool of resources.

Asia:

- Cultural Transformation: In many Asian countries, LGBTQ and minority inclusion in PE/VC funds is gaining traction, signifying a progressive shift towards embracing diversity and fostering innovation.

- Startups with Social Impact: Investors in Asia are increasingly drawn towards LGBTQ and minority-led startups that address pressing social issues, leveraging innovation to drive positive change.

- Series A Investment Surge: LGBTQ and minority-focused funds in Asia are actively funding Series A rounds, recognizing the potential for exponential growth and market disruption in these ventures.

- Technological Innovation: LGBTQ and minority entrepreneurs in Asia are leveraging technology to solve local challenges, attracting interest from PE/VC funds seeking high-potential startups.

In conclusion, the rise of LGBTQ and minority-focused PE/VC funds is an encouraging sign of progress, enabling the untapped potential of underrepresented entrepreneurs to flourish. With increasing valuations, dedicated accelerators, government support, and cross-border collaborations, the ecosystem is evolving to create a more inclusive and diverse entrepreneurial landscape. As these trends continue to shape the global PE/VC space, we can look forward to witnessing groundbreaking innovations and transformative startups that drive social impact while delivering exceptional returns on investment.

The funds present on the market maps are:

- 1863 Ventures

- 500 LGBT Syndicate

- 500 Startups Black and Latino Microfund

- A&A Capital

- a16z

- All Raise

- Amam Ventures

- Arc Capital

- BITKRAFT Esport Ventures

- Black and Brown Founders

- Black Angel Tech Fund

- Black Founders

- Black Girl Ventures

- Bunker Labs

- Camelback Ventures

- Chasing Rainbows

- Colorintech

- Connectivity Capital Partners

- Cross Culture Venture Capital

- Defy Ventures

- Digital Undivided

- DiverseCity Ventures

- Fempire Group (SoGal)

- Founder Gym

- Founders First Capital Partners

- Founders for Change

- FSB Capital

- Gaingels

- GXH Capital

- Harlem Capital Partners

- HBCUVC

- Hillman

- Humble Ventures

- Impact X Capital Partners

- Intel Capital Diversity Fund

- iTech Capital

- Jalia Ventures

- Kapor Capital

- La French Tech

- LDR Ventures

- LGBT Capital

- Lightship Capital

- Lol capital

- Mendoza Ventures

- Morgan Stanley Multicultural Innovation Lab

- NEWME

- Pivotal Ventures

- Presidential Innovation Fellows

- Republic

- Rethink Impact

- Score 3 Ventures

- Seneca VC

- SoGal Foundation

- Southbox Venture Capital

- Spearhead

- StartOut Growth Lab

- Techstars

- The Harriet Fund

- TheVenturesCity

- Valmo Ventures

- Vencapital

- VentureOut Fund

For more information on LGBTQ & Minorities investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC LGBTQ & Minorities funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team