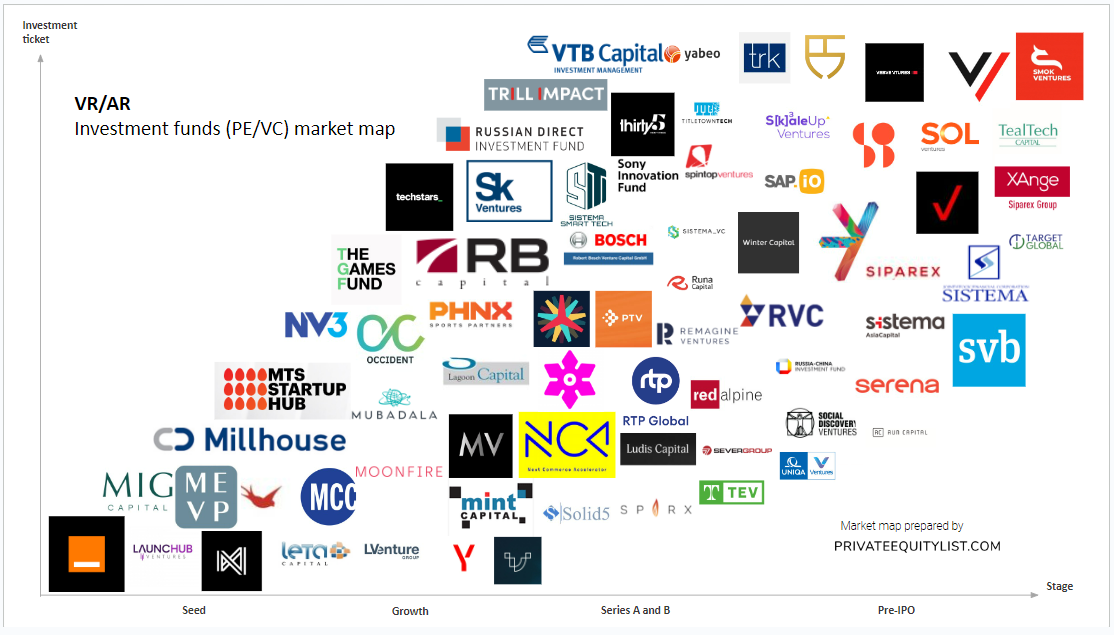

We compiled an extensive VR/AR private equity (PE) and venture capital (VC) market map that shows key VR/AR investors and investment funds. We hope this is useful for your startup fundraising.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

VR/AR market overview (market map is below it):

Virtual Reality (VR) and Augmented Reality (AR) are rapidly growing markets, with a projected global market size of $209.2 billion by 2022. This has led to an increase in investment in VR/AR startups, with PE/VC funds playing a significant role in funding these companies. In this blog post, we will discuss the key VR/AR market trends in each region and how PE/VC funds are investing in these markets.

North America:

- North America is the largest market for VR/AR, with a market size of $38.6 billion in 2020.

- The region has seen a significant increase in investment in VR/AR startups, with over $6.7 billion invested in 2020.

- PE/VC funds such as Andreessen Horowitz, Sequoia Capital, and Accel Partners have invested in VR/AR startups at various stages, from seed to Series B funding rounds.

- Accelerators such as Techstars and Y Combinator have also invested in VR/AR startups, providing them with mentorship and resources to grow their businesses.

Europe:

- Europe is the second-largest market for VR/AR, with a market size of $23.3 billion in 2020.

- The region has seen a steady increase in investment in VR/AR startups, with over $1.6 billion invested in 2020.

- PE/VC funds such as EQT Ventures, Atomico, and Balderton Capital have invested in VR/AR startups at various stages, from seed to Series A funding rounds.

- Accelerators such as Startupbootcamp and Seedcamp have also invested in VR/AR startups, providing them with mentorship and resources to grow their businesses.

Asia Pacific:

- Asia Pacific is the fastest-growing market for VR/AR, with a market size of $34.5 billion in 2020.

- The region has seen a significant increase in investment in VR/AR startups, with over $1.5 billion invested in 2020.

- PE/VC funds such as SoftBank, GGV Capital, and Qiming Venture Partners have invested in VR/AR startups at various stages, from seed to Series B funding rounds.

- Accelerators such as Chinaccelerator and 500 Startups have also invested in VR/AR startups, providing them with mentorship and resources to grow their businesses.

In conclusion, VR/AR is a rapidly growing market, with significant investment from PE/VC funds and accelerators. With the projected global market size set to reach $209.2 billion by 2022, there is ample opportunity for startups to receive funding at various stages, from seed to Series B funding rounds. As the market continues to grow, we can expect to see more investment in VR/AR startups and an increase in their valuation.

Find below the list of investors from the market map and links to their websites.

The funds present on the market maps are:

- 42CAP

- 468 Capital

- 50 Partners

- A.I.M. Ventures

- Abu Dhabi Investment Office

- ADV Group / Launchpad

- Aleph Capital Partners LLP

- All Iron Ventures

- Alma Mundi Fund

- American Express Ventures

- Angels Deck Investor Club

- Apex Ventures

- Astral Capital Partners

- Atlantic Bridge Capital

- AVentures Capital

- Azini Capital Partners

- B4 Sports

- Bezos Expeditions

- BITKRAFT Esport Ventures

- Black Lab Sports

- Bossanova

- Boundary Holding

- Bridgepoint

- Britbots

- Business Growth Fund Ltd. (BGF)

- C4 Ventures

- Cabra VC

- Cambridge Angels

- Capnamic Ventures

- Cassius Family

- Causeway Media Partners

- CDP Venture Capital

- Crescent Investments

- Denis Afinco

- Digital Horizon

- Digital+Partners

- Downing Ventures

- Dream Machine

- DreamersVC

- Droia Oncology Ventures

- Entrepreneur First

- F-Prime Capital

- Faster Capital

- FinSight

- Finstart Nordic

- Fitness Ventures

- Fly Ventures

- Fores Ventures

- FSB Capital

- FunCubator

- Galaxy Interactive

- Game Seer Venture Partners

- GoHub Ventures

- Hiro Capital

- HP Tech Ventures

- HYPE Capital

- ICU

- Impulse VC

- Industry 4.0

- Inspirit Capital

- Insta Ventures

- Internet Initiatives Development Fund (IIDF)

- Inveready

- Jazz Venture Partners

- KamaFlow Business Launcher

- Karma.vc

- KAUST Innovation Fund

- Kima Ventures

- Kismet Capital Group

- KSI Ventures

- Lagoon Capital

- LAUNCHub Ventures

- Leta Capital

- Ludis Capital

- LVenture Group

- Mark Cuban Companies

- Martlet Capital

- MEVP

- MIG Verwaltungs AG

- Millhouse

- Mint Capital

- Moonfire

- Motion Ventures

- MTS CVC

- Mubadala Russia

- Multisig Ventures

- Next Commerce Accelerator

- Next47

- NordicNinja VC

- NV3

- Occident

- Orange Digital Ventures

- Phoenix Sports Partner

- Pollen VC

- Prospective Technologies PTV

- RB Capital

- Redalpine Venture Partners

- Remagine Ventures

- Robert Bosch Venture Capital

- RTP Global

- Run Capital

- Runa Capital

- Russia-China Investment Fund

- Russian Venture Company (RVC)

- SAP.iO Foundry

- Saudi Entertainment Ventures

- Sber

- SD Ventures

- Serena Capital

- Severgroup

- Silicon Valley Bank

- Siparex Group

- Sistema Asia Capital

- Sistema PJSFC

- Sistema SmartTech

- Sistema_VC

- SkaleUp Ventures

- Skolkovo Ventures

- Smok Ventures

- SOL Ventures

- Solid5

- Sony Innovation Fund

- Sparx Ventures

- Spintop Ventures

- Supernode Global

- Synergies Capital

- Target Global

- TealTech Capital

- Techstars

- TEV Ventures

- The Games Fund

- The Russian Direct Investment Fund (RDIF)

- Thirty 5 Ventures

- Titletown Tech

- Trill Impact

- TRK Group

- Trust Esport Ventures

- UNIQA Ventures

- VEB Ventures

- Verizon Ventures

- Vito Ventures

- Voima Ventures

- VTB Capital Investment Management

- VTB Capital Private Equity

- VTB Capital Private Equity and Special Situations

- Winter Capital

- X Ange

- Yabeo Capital

- Yandex

For more information on VR/AR investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC VR/AR funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team