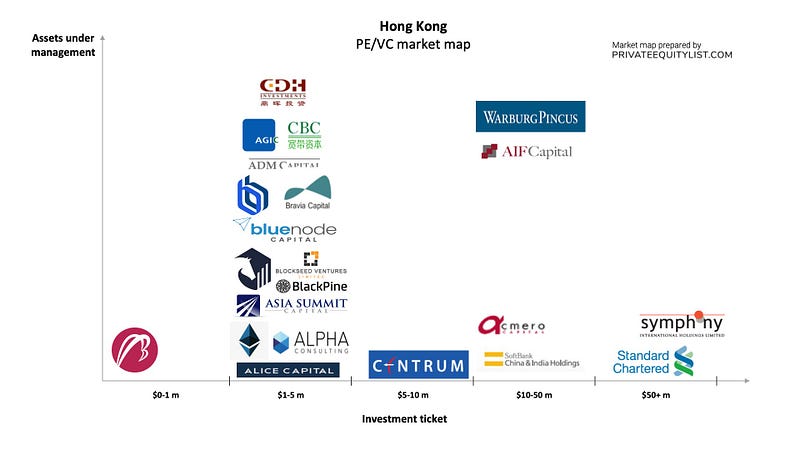

We compiled an extensive Hong Kong private equity (PE) and venture capital (VC) market map that shows key Hong Kong investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Hong Kong is a major trade and financial centre. Its strong capital base and access to the Chinese market provide an attractive hotbed for startups. AI firm SenseTime and smart handsets developer Tink Labs achieved unicorn status in 2018 after logistics on-demand service GoGoVan becoming the first unicorn one year earlier. However, the market is still volatile. Despite being backed by global giants such as SoftBank and Foxconn, Tink Labs shut down its operations within a year after passing a $1 billion valuation benchmark. Total venture capital and technology investments reached $2.3 billion in 2018. Almost 90 percent of the investments made in Technology, media and telecommunication firms. Artificial Intelligence and mobile services are the main attraction points within the technology industry. Hong Kong private equity industry also has a particular interest in technology and fintech along with healthcare and environmental protection due to the high-demand in mainland China. It is the second-largest private equity market in Asia and hosts 19 percent of the total capital pool in Asia. MBK Partners, Affinity Equity Partners, CITIC Capital are among the top private equity firms in Hong Kong.

The funds present on the market maps are:

- Acmero Capital

- ADM Capital

- AGIC Capital

- AIF Capital Limited

- Alice Capital

- All in One Coin

- Alpha Blockchain

- Asia Summit Capital

- Betatron

- BlackHorse Group

- BlackPine Group

- BlockSeed Ventures

- Blue Node Capital

- BlueBlock — blueblock.co

- Bravia Capital

- CBC-Capital

- CDH Private Equity

- Centrum Capital

- Softbank China & India Holdings

- Standard Chartered Private Equity Limited

- Symphony Capital Partners Warburg Pincus LLC

For more information on investment funds (their investment criteria, funds sizes, region preferences and etc.) in Hong Kong go to Hong Kong PE/VC funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com.

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team