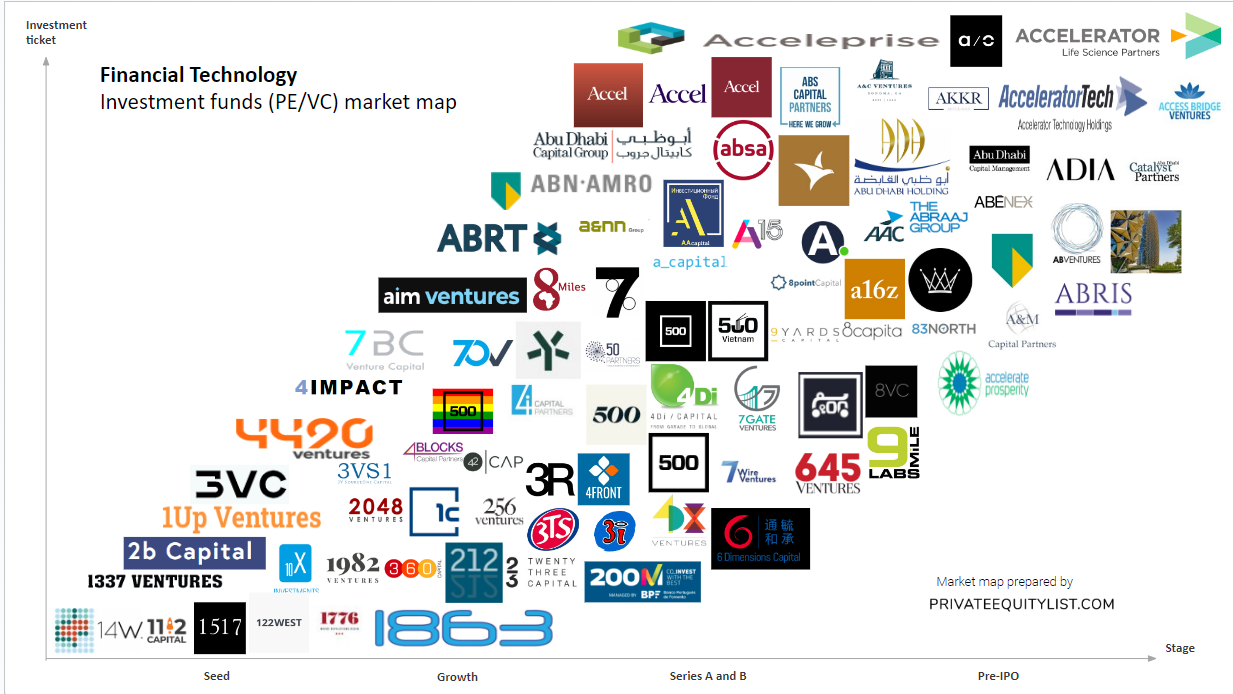

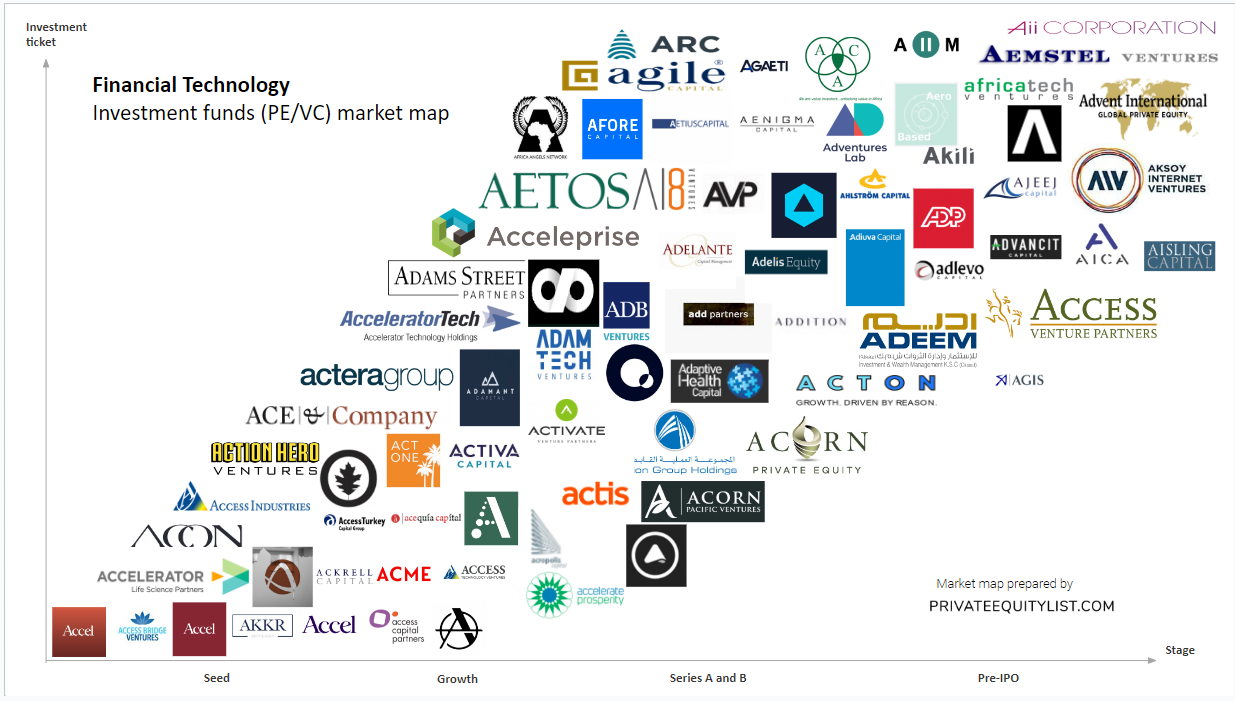

We compiled an extensive FinTech private equity (PE) and venture capital (VC) market map that shows key FinTech investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

Thanks for reading us! Get 50% off your first month of Pro subscription - use PRO50 for Pro Tariff promocode at Pricing page. For more information on all PE/VC investment funds (their investment criteria, funds sizes, region preferences and etc.) go to https://privateequitylist.com/search

FinTech market overview (market map is below it):

As the world continues to embrace digital transformation, financial technology (FinTech) has emerged as a disruptive force revolutionizing the global financial services industry. This blog post explores the key trends in Financial Technology PE/VC funds and highlights the market dynamics across different regions.

North America:

- Valuation Boom: The North American FinTech market has witnessed an exponential increase in valuation, attracting significant investment from PE/VC funds.

- Abundance of Startups: San Francisco's Silicon Valley remains a hub for FinTech startups, with a vibrant ecosystem of accelerators and incubators supporting early-stage companies.

- Series A Funding: Many FinTech startups in North America secure Series A funding to fuel their growth and expand their market presence.

Europe:

- Regulatory Changes: Europe has experienced regulatory reforms like the Revised Payment Services Directive (PSD2), which has opened up opportunities for FinTech innovation and investment.

- London Leading the Pack: London, the financial capital of Europe, has seen a surge in FinTech startups, drawing substantial investments and establishing itself as a global FinTech hub.

- Series B Investments: Established European FinTech players often attract Series B investments to scale their operations and expand across borders.

Asia:

- Unbanked Populations: Many Asian countries, particularly emerging markets, have a large unbanked population. FinTech startups are addressing this market by providing innovative solutions to enhance financial inclusion.

- Growing Government Support: Governments in Asia, especially in countries like Singapore, Hong Kong, and China, are actively encouraging FinTech innovation through regulatory sandboxes and supportive policies.

- Diverse Investment Landscape: Asian FinTech startups receive funding from both local and international PE/VC funds seeking exposure to this high-growth market.

In Conclusion, as the global FinTech ecosystem continues to evolve, PE/VC funds are playing a crucial role in supporting the growth of startups and driving innovation in the industry. With North America leading in valuations, Europe excelling in regulatory reforms, and Asia addressing the unbanked populations, the market trends across these regions demonstrate diverse opportunities for investors.

By staying up-to-date with these key trends, investors can make informed decisions, capitalize on the growth potential of FinTech startups, and contribute to shaping the future of the financial services industry.

The funds present on the market maps are:

- .406 Ventures

- 10X Investments

- 11.2 Capital

- 122-West-Ventures

- 1337 Ventures

- 14W Ventures

- 1517 Fund

- 1776 Ventures

- 1863 Ventures

- 1982 Ventures

- 1Confirmation

- 1Up Ventures

- 200M and Social Innovation Fund

- 2048 Ventures

- 212 Venture

- 23 Capital

- 24Haymarket

- 256 Ventures

- 2b Capital

- 360 Capital Partners

- 3i Group

- 3i Infrastructure plc

- 3Rodeo

- 3TS Capital Partners

- 3V SourceOne Capital

- 3vc

- 4 Blocks Capital Partners

- 42CAP

- 4490 Ventures

- 468 Capital

- 4Di Capital

- 4DX Ventures

- 4Front Ventures

- 4i Capital Partners

- 4impact

- 50 Partners

- 500 Istanbul

- 500 LGBT Syndicate

- 500 Mena

- 500 Startups

- 500 Startups Black and Latino Microfund

- 500 Startups Vietnam

- 500 Tuktuks

- 54 Ventures

- 5Y Capital (Morningside Venture Capital)

- 6 Dimensions Capital

- 645 Ventures

- 7 Gate Ventures

- 7-Wire Ventures

- 70 Ventures Accel

- 7BLOCKCHAIN

- 7percent Ventures

- 8 Miles LLP

- 83North

- 8Capita

- 8point Capital

- 8VC

- 9 Mile Labs

- 9Mile Labs

- 9Yards Capital

- A.Capital

- A.I.M. Ventures

- A.Partners

- A/O Proptech

- A&A Capital

- A&M Capital

- A&NN Investments

- A1

- A15

- a16z

- AAC Capital Partners

- AAF Management

- AB Ventures

- Abénex

- ABN AMRO Participaties BV

- ABN AMRO Ventures

- Abraaj

- Abris Capital Partners

- ABRT

- ABRY Partners

- ABS Capital Partners

- ABSA Capital Private Equity Pty Ltd

- Abu Dhabi Capital Group

- Abu Dhabi Capital Management

- Abu Dhabi Catalyst Partners

- Abu Dhabi Catalyst Partners

- Abu Dhabi Investment Authority (ADIA)

- Abu Dhabi Investment Council

- Abu Dhabi Investment Office

- AC Ventures

- Accel

- Accel London

- Accel Partners

- Accel-KKR

- Acceleprise Ventures

- Accelerate Prosperity Kyrgyzstan

- Accelerator Life Science Partners

- Accelerator Technology Holdings

- Access Bridge Ventures

- Access Capital Partners

- Access Industries

- Access Technology Ventures

- Access Venture Partners

- AccessTurkey Capital Group

- Accomplice

- ACE & Company

- ACE and Company

- Acequia Capital

- Ackrell Capital

- ACME

- Acon

- ACON Investment

- Acorn Innovestments

- Acorn Pacific Ventures

- Acorn Private Equity

- ACrew Capital

- Acrobator Ventures

- Acropolis Capital

- Act One Ventures

- ACT Venture Capital

- Actera Group

- Action Group Holdings

- Action Hero Ventures

- Actis Capital

- Activa Capital

- Activate Venture Partners

- Active Capital

- Acton Capital Partners

- Adage Capital

- Adamant Capital

- Adams Street Partners LLC

- AdamTech Ventures

- Adapt Ventures

- Adaptive Health Capital

- ADB Ventures

- Add Partners

- Addition VC

- Adeem

- Adelante Capital Management

- Adelis Equity Partners

- Adfirst.vc

- Adiuva Capital

- Adlevo Capital

- Adobe Capital

- ADP Invest

- AdTay Ventures

- Advance Capital

- Advance Venture Partners

- Advancit Capital

- Advant Partners

- Advent International Corporation

- Advent Venture Partners

- Adventures Lab

- Aemstel Ventures BV

- Aenigma Capital

- AeroBased

- Aetius Capital

- Aetos Capital

- Afore Capital

- Africa Angels Network

- Africa Tech Ventures

- African Capital Alliance

- African Infrastructure Investment Managers

- African Rainbow Capital

- Agaeti Ventures

- Agga Capital

- Agile Capital

- Agis Investments

- Aglae Ventures

- AHLI FINTECH

- Ahlstrom Capital

- AI Seed Fund

- AI8 Ventures

- AICA

- Aii Capital

- Aisling Capital

- Ajeej Capital

- Aju IB Investment

- Akili VC

- Aksoy Internet Ventures

For more information on FinTech investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC FinTech funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team