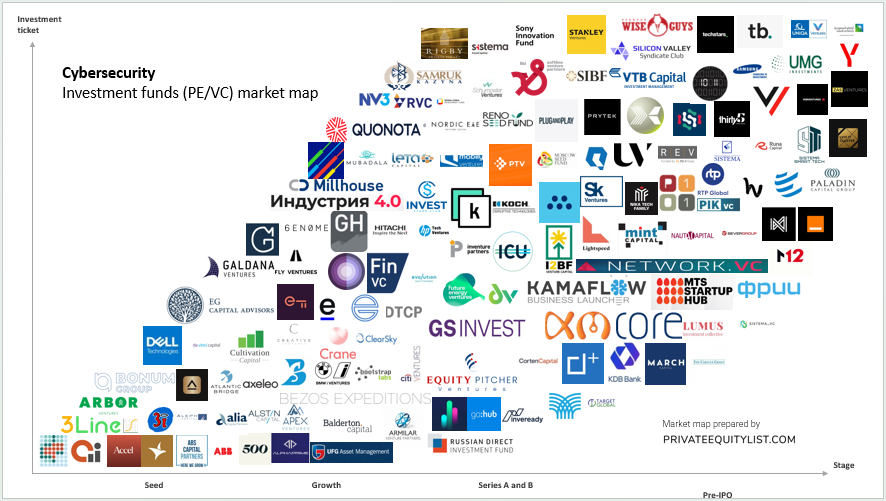

We compiled an extensive Cybersecurity private equity (PE) and venture capital (VC) market map that shows key Cybersecurity investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

The funds present on the market maps are:

- 406 Ventures

- 3i Group

- 3Lines

- 500 Istanbul

- ABB Technology Ventures

- ABRY Partners

- ABS Capital Partners

- Abu Dhabi Investment Office

- Accel London

- AI Capital

- Aleph Capital Partners LLP

- Alia Capital Partners

- Almi Invest

- AlphaPrime

- Alstin Capital

- Apex Ventures

- Arbor Ventures

- Armilar Venture Partners

- Asyaf Investment

- Atlantic Bridge Capital

- Axeleo

- Balderton Capital

- Bezos Expeditions

- Binomial Ventures

- Blossom Capital

- BMW i Ventures

- Bonum Group AMC

- BootstrapLabs

- Citi Ventures

- ClearSky

- Co-Investor AG

- Corten Capital

- Crane Venture Partners

- Creative Ventures

- Crosspoint Capital

- Cultivation Capital

- Da Vinci Capital

- Dell Technologies Capital

- Denis Afinco

- Detonate Ventures

- Differential Ventures

- Digital+Partners

- DTCP

- Early Game Ventures

- eCAPITAL

- EG Capital (Mints)

- Entrepreneur First

- EquityPitchers Ventures

- Evolution Equity Partners

- Fin Venture Capital

- FinSight

- Fly Ventures

- Force Over Mass Capital

- Future Energy Ventures

- Galdana Ventures SL

- GapMinder Venture Partner

- Genome Ventures

- GoHub Ventures

- Granite Hill Capital Partners

- GS Invest

- Hitachi Venture

- HP Tech Ventures

- I2BF Global

- ICU

- Industry 4.0

- Internet Initiatives Development Fund (IIDF)

- Inventure Partners

- Inveready

- InvestStore.Club

- KamaFlow Business Launcher

- Kima Ventures

- KM Core

- Koch Disruptive Technologies

- Korea Development Bank

- LANIT

- Leta Capital

- Lightspeed Venture Partners

- LUMUS Investment Collective

- Lviv Tech Angels

- M12

- March Capital Partners

- March Gaming

- MassMutal Ventures Southeast Asia

- Millhouse

- Mint Capital

- Mobily Ventures

- Moscow Seed Fund

- MTS CVC

- Mubadala Russia

- Nauta Capital

- Network VC

- Next47

- Nika Tech Family

- Nordic Eye Venture Capital

- NV3

- Onexim

- Orange Digital Ventures

- P101

- Paladin Capital Group

- Partech Ventures

- Phystech Ventures

- PIK Ventures

- Plug and Play Tech Center

- Prospective Technologies PTV

- Prytek

- Quantonation

- Quonota

- Reed Elsevier Ventures (REV)

- Reno Seed Fund

- Rigby Private Equity

- ROCA X Verified

- RTP Global

- Runa Capital

- Russia-China Investment Fund

- Russian Venture Company (RVC)

- Samruk-Kazyna

- Samsung Venture Investment

- Sber

- Schumpeter Ventures

- Severgroup

- Sistema Asia Capital

- Sistema PJSFC

- Sistema SmartTech

- Sistema_VC

- Skolkovo Ventures

- Softline Venture Partners

- Sony Innovation Fund

- Southern Israel Bridging Fund

- Stanley Ventures

- Startup Wise Guys

- SVSY Club

- Synaptech Capital

- Synergies Capital

- Target Global

- Techstars

- TenEleven Ventures

- The Carlyle Group

- The Russian Direct Investment Fund (RDIF)

- Think Bigger Capital

- Thirty 5 Ventures

- UFG Private Equity

- UMG Investment

- UNIQA Ventures

- United Ventures

- VEB Ventures

- Vito Ventures

- VTB Capital Investment Management

- VTB Capital Private Equity

- VTB Capital Private Equity and Special Situations

- Wa'ed Ventures

- Yandex

- ZAS Ventures

For more information on Cybersecurity Technology investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC Cybersecurity funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team