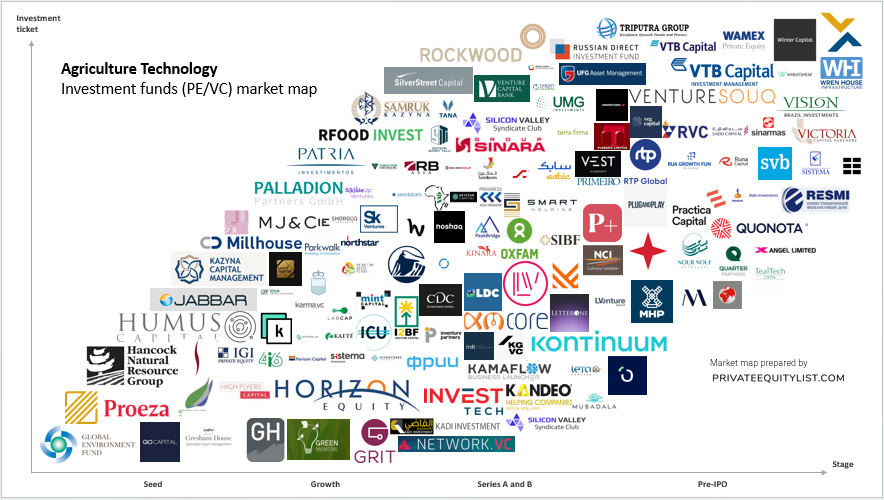

We compiled an extensive Agriculture Technology private equity (PE) and venture capital (VC) market map that shows key Agriculture Technology investors and investment funds. We hope this is useful for your startup fundraising. Find below the list of investors from the market map and links to their websites.

The funds present on the market maps are:

- Global Environment Fund

- GO Capital

- Granite Hill Capital Partners

- Green Innovations

- Green Sage LLC

- Gresham House Asset Management Ltd.

- Grit Ventures (fka Grit Labs)

- Grupo Proeza

- Hancock Timber Resource Group Inc

- High Flyers Capital

- Hiventures

- Horizon Capital

- Horizon Equity Partners

- Humus Capital Partners

- I2BF Global

- ICU

- IDIA Capital Investissement

- IGI Sgr S.p.a

- Illumina Ventures

- Impact46

- Innovation Industries

- Internet Initiatives Development Fund (IIDF)

- Inventure Partners

- Invest tech

- Irdi Soridec Gestion

- Jabbar Internet Group

- Kadi Investment

- Kaete Investimentos

- KamaFlow Business Launcher

- Kandeo Private Equity

- Karma.vc

- KCM Sustainable Development Fund I

- Kima Ventures

- Kinara

- Kirovsky Zavod CVC

- KM Core

- Kontinuum Group

- Kula Fund Ltd.

- Labcap

- LDC

- Leta Capital

- LetterOne

- Liechtenstein Group

- Luminous Ventures

- LVenture Group

- Lviv Tech Angels

- Maslin Capital Limited

- Melitas Ventures

- MHP SE

- Millhouse

- Mint Capital

- MJ&Cie

- Moscow Seed Fund

- Motion Equity Partners

- Mubadala Russia

- NCI Gestion

- Network VC

- Northstar Group

- Noshaq

- Novastar Venture

- Nuor Nuof

- Outliers VC

- Oxfam's Enterprise Development Programme

- Palladion Partners GMBH

- Pampa Start Ventures

- Paraty Capital

- Parkwalk Advisor

- Patria Investimentos Ltda

- PeakBridge Partners

- Pembroke Ventures Capital Trust

- PGIM Real Estate

- Phystech Ventures

- Plug and Play Tech Center

- Practica Capital

- Primeiro Partners

- Progress Tech Transfer Fund

- Q Partners

- Quonota

- Rabo Corporate Investments

- RB ASIA

- Resmi Investment Management Company (IMC)

- RFood Invest

- Rockwood Private Equity (Pty) Limited

- Route Capital Partners S.r.l.

- RTP Global

- Rua Growth Fund

- Runa Capital

- Russia-China Investment Fund

- Russian Venture Company (RVC)

- Sabic Ventures

- Sadu Capital

- Samruk-Kazyna

- Sandstorm Ventures

- Satya Capital

- Sber

- Secha Capital

- Seedstar Investments

- Severgroup

- Shorooq Partners

- Silicon Valley Bank

- SilverStreet Capital LLP

- Sinara Group

- Sinarmas

- Siparex Group

- Sistema Asia Capital

- Sistema PJSFC

- Sistema SmartTech

- Sistema_VC

- SkaleUp Ventures

- Skolkovo Ventures

- Skystar Capital

- Smart-Holding

- Southern Israel Bridging Fund

- SpeedUp Venture Capital Group

- SVSY Club

- Synergies Capital

- Tamkeen

- Tana Africa Capital

- Target Global

- TealTech Capital

- Terra Firma Capital Partners

- The Russian Direct Investment Fund (RDIF)

- Tianguis Limited

- Tony Elumelu Foundation

- Triputra Group

- UFG Private Equity

- UMG Investment

- United Connexion Inc.

- VEB Ventures

- Veg Capital

- Venture Capital Bank

- Venture Souq

- Vest Investment

- Victoria Capital Partners

- Vision Brazil Investments

- VTB Capital Investment Management

- VTB Capital Private Equity

- VTB Capital Private Equity and Special Situations

- WAMEX Private Equity

- Wheatsheaf Group

- Winter Capital

- Wren House Infrastructure Management Ltd.

- X Angel Limited

- Xpdite Capital Partners

For more information on Agriculture Technology investment funds (their investment criteria, funds sizes, region preferences and etc.) go to PE/VC Agriculture Technology funds database on privateequitylist.com

If you are raising capital, we would love to hear about you and help you find the right investors! If you want to be featured on our website as a startup looking for investments or if you want to add a PE/VC to this list, please email at privateequitylist@gmail.com

We hope our platform will help you find the right investors for your startups!

Regards,

Private Equity List team