In the ever-evolving world of technology, the Foodtech sector has emerged as a hotbed for innovation and investment. Venture capitalists (VCs) are increasingly recognizing the potential of startups aiming to disrupt the traditional food industry. In this exploration, we delve into the funding statistics, average investment sizes, key investment sectors, and the prominent VC players across America, the European Union (EU), Asia, and the Middle East and North Africa (MENA).

Global Funding Statistics

Before we embark on our journey across continents, let's take a glance at the overall funding landscape in the Foodtech sector. According to recent data, global Foodtech funding reached a staggering $26.5 billion in 2022, showcasing a robust 65% year-over-year growth. This exponential rise underscores the sector's allure for investors worldwide.

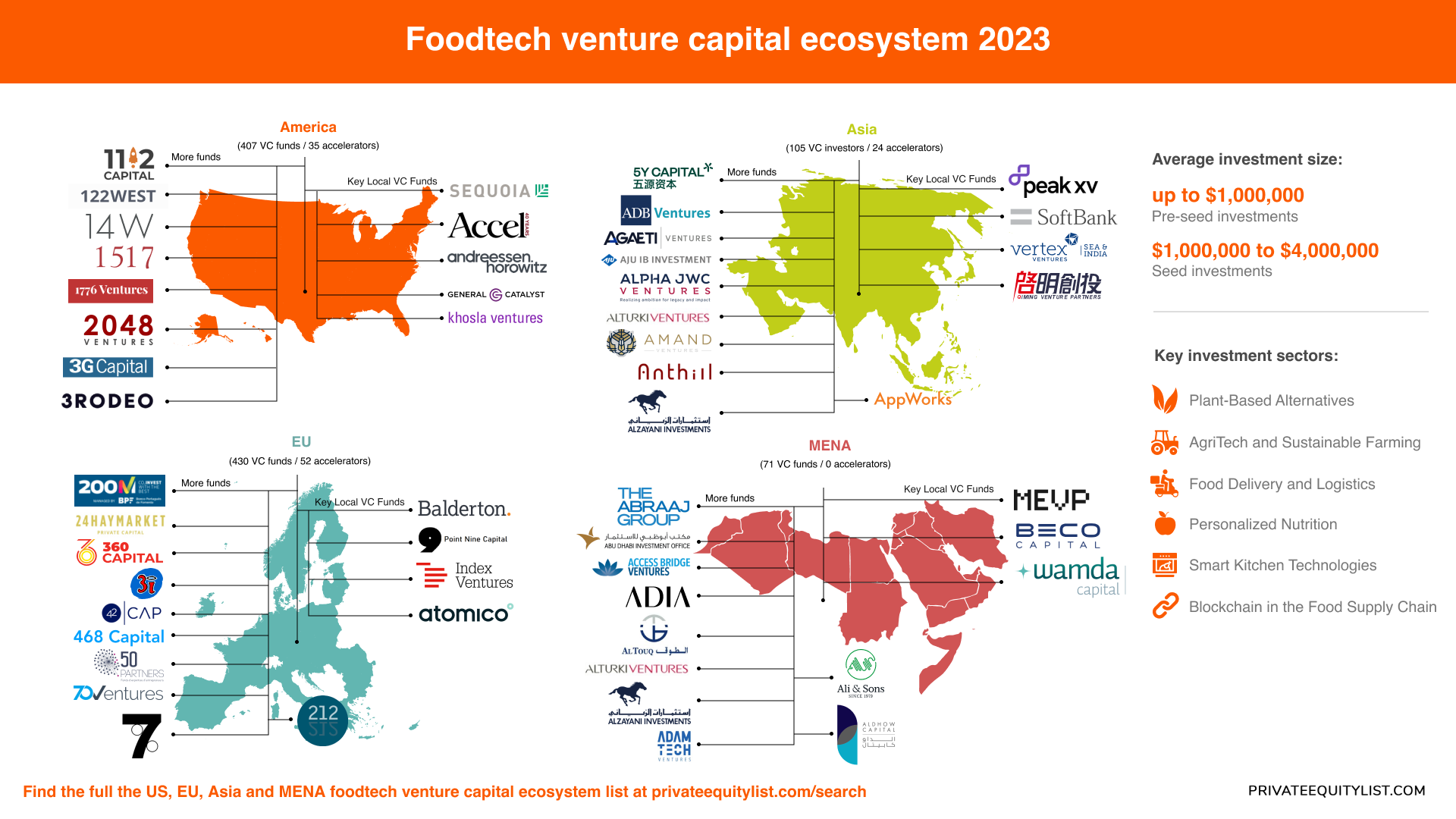

Average investment size in the pre-seed stage: up to $1,000,000

Seed stage: $1,000,000 to $4,000,000

Key Investment Sectors

The Foodtech landscape encompasses various sectors, each ripe with opportunities. Here are the key investment sectors that have been capturing the attention of VC investors:

- Plant-Based Alternatives 🌱

- AgriTech and Sustainable Farming 🚜

- Food Delivery and Logistics 🛵

- Personalized Nutrition 🍏

- Smart Kitchen Technologies 🍳

- Blockchain in the Food Supply Chain ⛓️

Now, let's embark on our journey continent by continent, uncovering the prominent VC players and accelerators.

America (407 VC funds / 35 accelerators)

Key Local VC Funds:

More funds:

Find the full list of funds here. Accelerators that operating in the region are SLP New York 2024, UMSL Anchor Accelerator 4 and Lighthouse Labs Spring 2024.

European Union (430 VC funds / 52 accelerators)

Key Local VC Funds:

More funds:

- 200M and Social Innovation Fund

- 212 Venture

- 24Haymarket

- 360 Capital Partners

- 3i Group

- 42CAP

- 468 Capital

- 50 Partners

- 70 Ventures Accel

- 7percent Ventures

You can find the full list via the link. Local accelerators are DRG4Food|Evaluators Call #1, Womenture Pre-Accelerator and RGU Startup Accelerator 2024.

Asia (105 VC investors / 24 accelerators)

Key Local VC Funds

More funds:

- 5Y Capital (Morningside Venture Capital)

- ADB Ventures

- Agaeti Ventures

- Aju IB Investment

- Al Zayani Investments

- Alpha JWC Ventures

- Alturki Ventures

- Amand Ventures

- Anthill Ventures

- AppWorks

Find the full list here. Local accelerators that are operating in the region are NIDHI-EIR Programme (FiiRE) 2023, Catapult 4.0 by Mahindra Logistics and IIMK LIVE BIP 24 R1.

MENA (71 VC funds / 0 accelerators)

Key Local VC Funds:

More funds:

- Abraaj

- Abu Dhabi Investment Authority (ADIA)

- Abu Dhabi Investment Office

- Access Bridge Ventures

- AdamTech Ventures

- Al Dhow Capital

- Al Zayani Investments

- Ali & Sons Holding LLC

- AlTouq Group

- Alturki Ventures

You can find the full list here.

Key Trends Shaping the Foodtech Investment Landscape

- Rise of Alternative Proteins. Investment in plant-based and lab-grown protein startups is soaring.

- Tech-Driven Supply Chain Solutions. Blockchain and AI applications are enhancing transparency and efficiency.

- Personalization and Health Focus. Startups offering personalized nutrition solutions are gaining traction.

- Sustainability as a Core Value. Investors prioritize environmentally conscious Foodtech ventures.

In conclusion, the Foodtech sector is a dynamic space witnessing remarkable growth and innovation globally. VC investors are playing a pivotal role in nurturing startups that have the potential to revolutionize how we produce, distribute, and consume food. As we move forward, keeping an eye on these trends and key players will be crucial for anyone involved or interested in the ever-evolving world of Foodtech. Buckle up as we embark on a flavorful journey into the future of food! 🍽️