The entrepreneurial landscape in Southern Europe is thriving, with countries like France, Spain, Italy, Portugal, and Cyprus witnessing a surge in startups and innovation. These countries offer a rich tapestry of investment opportunities in the pre-seed and seed stages. In this comprehensive guide, we will delve into the funding statistics, average investment sizes, key investment sectors, and the top players in the venture capital and accelerator scenes across these nations.

Funding Statistics and Average Investment Sizes

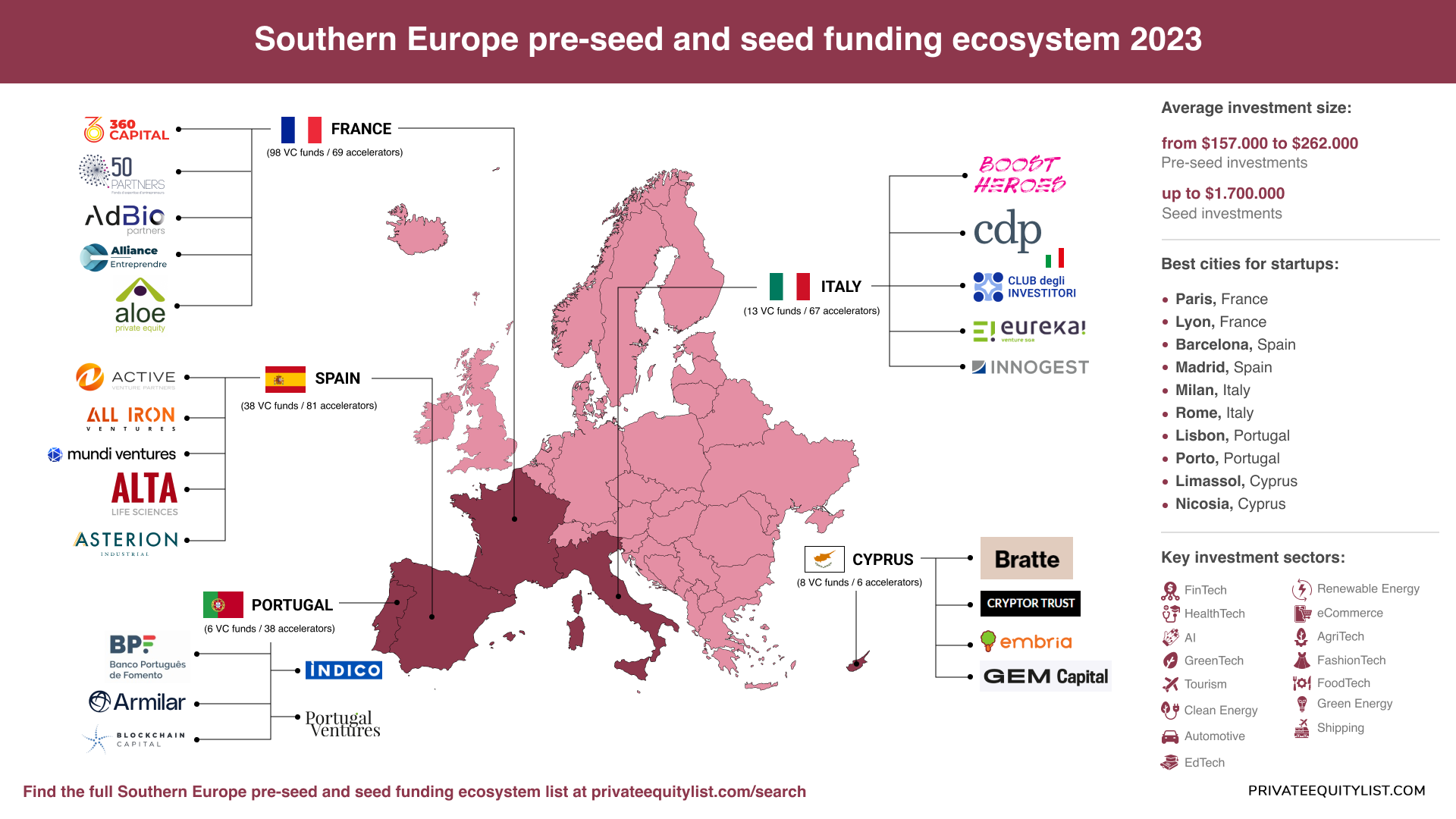

Understanding the funding landscape is crucial for any startup founder. Let's kick off by examining some funding statistics and average investment sizes for pre-seed and seed rounds in Southern Europe.

As EU-Startups says, the typical payout for a pre-seed round falls within the range of $157,000 to $262,000.

According to Statista, the average investment size in seed round was $1,700,000 in Europe in 2022.

Key Investment Sectors

The major sectors differ from country to country, here are the top sectors popular in Southern Europe:

- FinTech

- HealthTech

- AI

- GreenTech

- Tourism

- Renewable Energy

- eCommerce

- AgriTech

- FashionTech

- FoodTech

- Clean Energy

- Automotive

- EdTech

- Shipping

- Green Energy

Now that we have an overview of the funding landscape let's delve into some of the key local venture capital funds that play a pivotal role in shaping the startup ecosystems in these countries.

🇫🇷France (98 VC funds / 69 accelerators)

- 360 Capital Partners

- 50 Partners

- Advent France Biotechnology

- Alliance Entreprendre

- Aloe Private Equity SAS

The full list of French funds is here. Le D3 - Paris&Co, CreativeThinking.Ventures and EuraMaterials are accelerators working in the country.

🇪🇸Spain (38 VC funds / 81 accelerators)

Find more funds via the link. Accelerators that operate here are Stage2 - 2024 cohort, SEK Lab 9th Call and Project Ignite Demo Day Access.

🇮🇹Italy (13 VC funds / 67 accelerators)

For the full list go here. BeLeaf Be The Future - Call 4 Innovation, CTE PRISMA 5G Acceleration Program 2023 and Web 3 Finance Accelerator are operating in Italy.

🇵🇹Portugal (6 VC funds / 38 accelerators)

- 200M and Social Innovation Fund

- Armilar Venture Partners

- BlockChange Capital

- Indico Capital Partners

- Portugal Ventures

Follow the link to find more funds. Discoveries Accelerate the Smart Tourism, Check-in Open Innovation | 3rd Edition and Beta-Start - Tourism Edition |2023 are operating here.

🇨🇾Cyprus (8 VC funds / 6 accelerators)

More funds are available via the link. Diogenes Business Incubator UCY, Gravity Ventures Application and ARIS A Really Inspiring Spac are working here.

Best Cities for Startups

Now, let's explore the best cities for startups in these countries, and understand why they are magnets for entrepreneurial talent.

France:

- Paris - The French capital is a global tech hub, boasting a vast talent pool, numerous co-working spaces, and a thriving startup culture. Its central location in Europe makes it a prime destination for investors and entrepreneurs alike.

- Lyon - Lyon is emerging as a dynamic tech city, thanks to its strong focus on biotech, health innovation, and a growing number of incubators and accelerators.

Spain:

- Barcelona - Known for its vibrant lifestyle and beachfront locale, Barcelona attracts startups with its cosmopolitan atmosphere, tech events, and a supportive local government that encourages entrepreneurship.

- Madrid - The Spanish capital is a hub for fintech and proptech startups, with a bustling ecosystem of co-working spaces and networking events.

Italy:

- Milan - Milan's rich history and modern innovation blend seamlessly, making it a magnet for fashion, design, and finance startups. Its central location within Europe enhances accessibility.

- Rome - Italy's capital city offers a unique blend of ancient charm and tech innovation, attracting startups in various sectors, including cultural heritage and tourism.

Portugal:

- Lisbon - Portugal's capital city offers affordable living costs, a pleasant climate, and a vibrant cultural scene. It has become a European hotspot for digital nomads and tech entrepreneurs.

- Porto - Porto is gaining recognition for its thriving startup ecosystem, driven by a supportive community, access to talent from local universities, and attractive government incentives.

Cyprus:

- Limassol - As Cyprus's financial and shipping hub, Limassol provides an ideal environment for fintech and maritime startups. Its strategic location also facilitates international business connections.

- Nicosia - The island's capital city offers a central location, a growing tech community, and easy access to government support for startups.

Key Trends

As we conclude our journey through the pre-seed and seed funding landscape in Southern Europe, let's take a moment to highlight some key trends that are shaping the region's startup ecosystem:

- Sustainability and GreenTech - Southern European startups are increasingly focusing on sustainable solutions, aligning with global efforts to combat climate change.

- Remote Work and Digital Nomadism - The rise of remote work is attracting digital nomads to cities in Southern Europe, boosting the demand for coworking spaces and innovative solutions.

- Government Support - Many governments in Southern Europe are actively supporting startups through grants, tax incentives, and streamlined regulations.

- Cross-Border Collaboration - Startups in these countries are exploring cross-border collaborations to access larger markets and diverse talent pools.

- HealthTech Innovation - The ongoing global health challenges have spurred innovation in healthcare and telemedicine, with startups leading the way.

In conclusion, Southern Europe's startup ecosystem is vibrant and rapidly evolving. With favorable funding conditions, growing access to resources, and an entrepreneurial spirit, these countries are poised for continued growth and success in the global tech landscape. Whether you're an aspiring founder or an investor seeking opportunities, keep a close eye on this region—it's brimming with potential.