Using ChatGPT and other AI tools to find lists of seed and pre-seed funds can save time for entrepreneurs and startups in complex landscape of early-stage funding. In several minutes ChatGPT can compile a nice selection of well-known private equity and venture capital funds along with their corresponding websites, streamlining what could be a time-consuming manual research process.

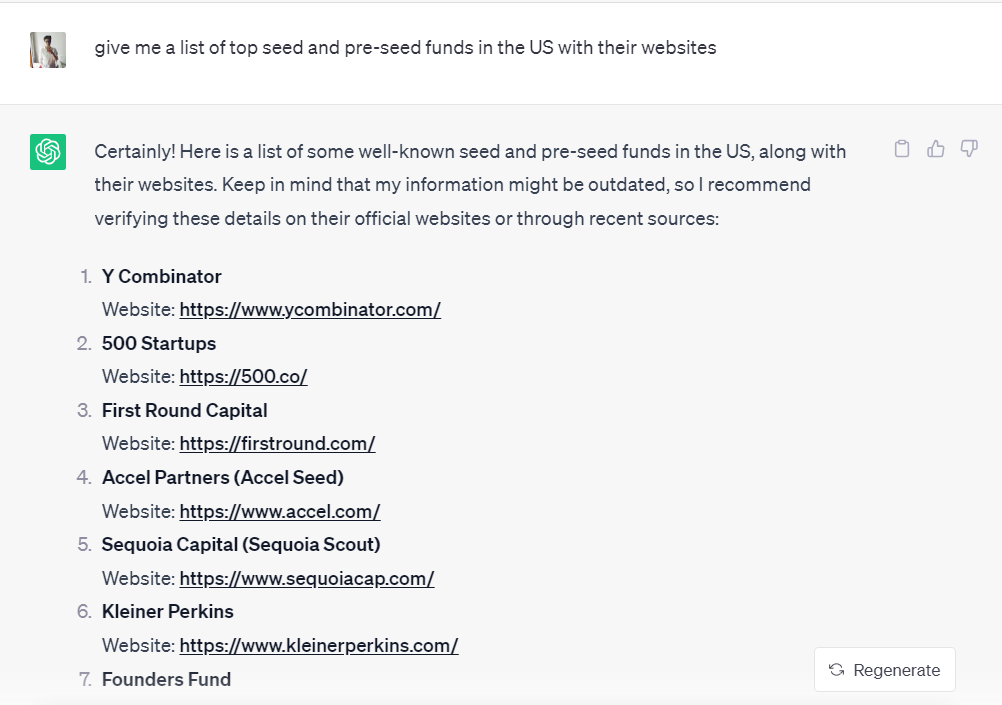

Indeed, for well-known funds in EU/US, it works well. For example, let’s ask it to find popular funds in the US:

These funds really exist and provided websites work.

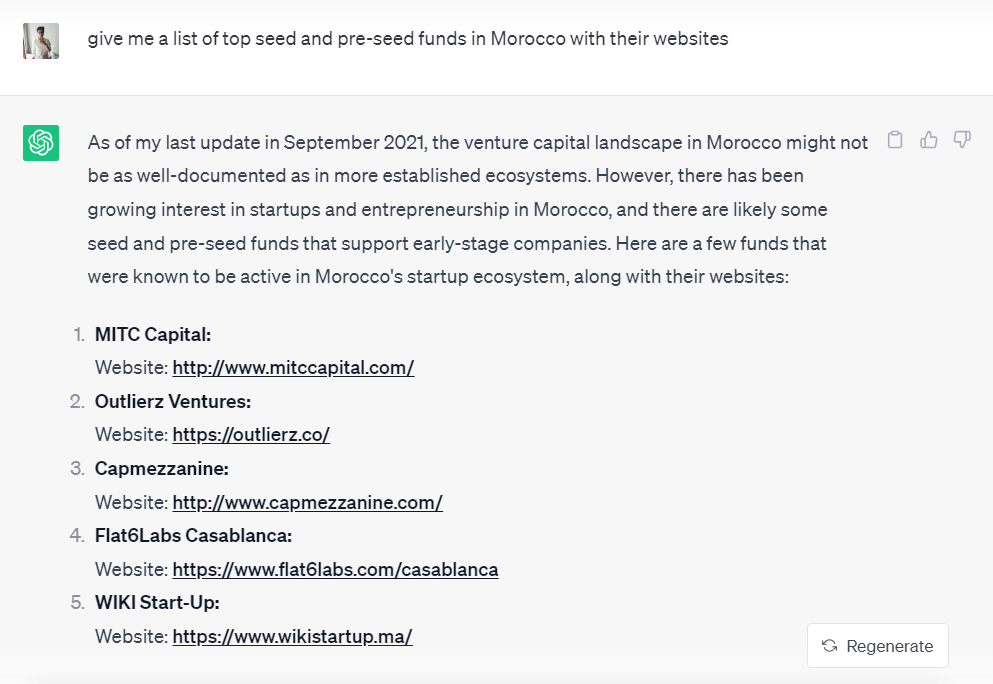

Everything changes once you look for more specific requests, for example, funds in Africa or Asia.

Although there is correct information in this list, Outlierz Ventures is a real fund, other websites don’t work.

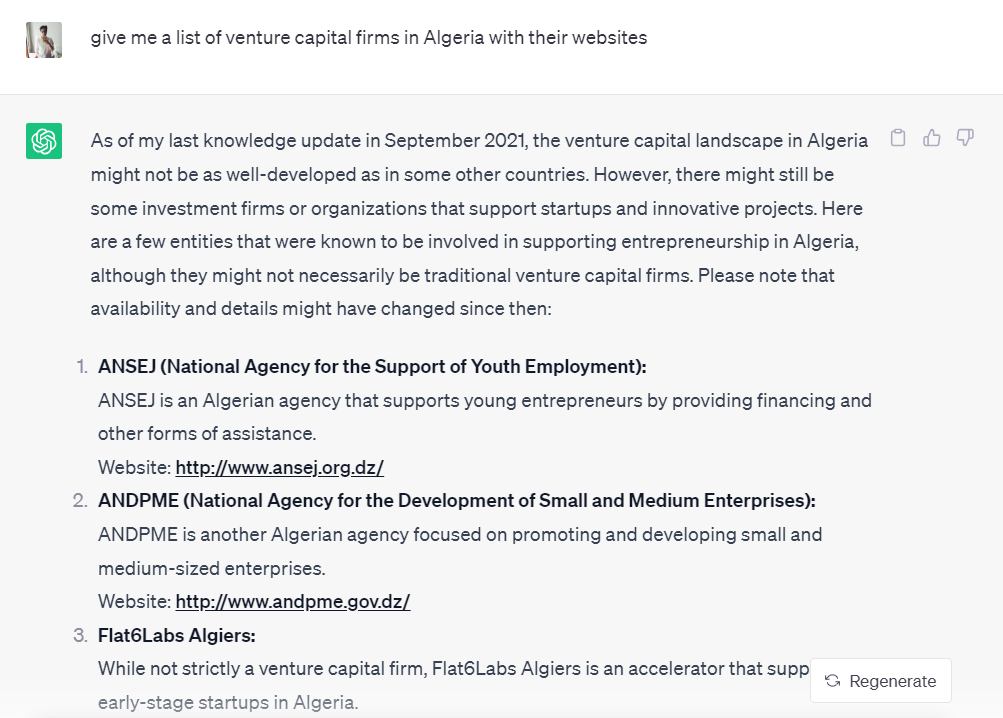

Let’s try another request. For instance, we need to find venture capital firms in Algeria.

Again, only one out of 5 suggested websites works but it’s a website of incubator that can be useful for startups, however, it is not a venture capital firm that was requested. Such outputs repeat for other less known investment regions.

You can ask why someone actually needs to find investments in less known regions or small/mid-cap funds. Finding opportunities for startups in their local regions and small/mid-cap funds can offer several advantages:

- Less Competition: Popular funds have dozens of requests every day, and it’s harder to reach them to show your idea.

- Relevant Expertise: Regional investors and funds often have a deep understanding of local market dynamics, regulations, and cultural nuances. This expertise can be invaluable for startups navigating these complexities.

- Network Opportunities: Local and small/mid-cap investors often have extensive networks within their regions. These networks can connect startups with potential partners, customers, suppliers, and mentors.

- Tailored Support: Regional investors might provide more personalized support, including hands-on guidance and mentorship, based on their familiarity with the local ecosystem.

- Access to Resources: Small/mid-cap funds might provide access to resources that are tailored to the specific needs of startups in a particular region. This could include industry-specific expertise, technical infrastructure, or specialized services.

- Easier Communication: Being in the same region can make communication and collaboration between startups and investors more convenient, facilitating regular interactions and updates.

It is easier to find your next investor in a couple of clicks using Private Equity List. It is fast and accurate compared to AI tools. It has a special focus on small/mid-cap funds and specific regions like Middle East, Asia and Africa. Search using filters such as fund country, ticket size, investor type and more.